Once upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of their time scrutinising the Federal Reserve’s recent strategy review, to figure out if there is anything the UK should replicate. No doubt officials in other countries are involved in a similar exercise. Since any change to monetary-policy remits has the potential to influence markets, we need to think about what these other institutions might come up with. After all, the Fed’s review is deeply significant, a symbolic moment in the history of central banking. To cut to the conclusion, I suspect we will see policymakers in most countries adjust their targets after COVID-19. But without dual mandates, they will struggle to match the full extent of the Fed’s dovish “pivot”.

First some context. The Fed’s new emphasis on full employment and a desire for inflation to “overshoot” is a radical departure from the policy era that began in the early 1980s, when central banks were prepared to cause mass unemployment in an effort to “break the back of inflation”. But this transition has happened gradually, in response slowly moving fundamentals, namely:

- equilibrium interest rates converging on zero:

- a broken Phillips curve;

- hopelessly misleading NAIRU estimates, and

- inflation expectations that have become uncomfortably low.

Other central banks are in a similar – if not worse – position. Even before the pandemic, it was clear the US authorities were desperate to see inflation rise above their target and were prepared to probe historically low levels of unemployment to get there. The Fed’s new strategy makes this approach “official”: by mid-2019, policy was already conducted along these lines.

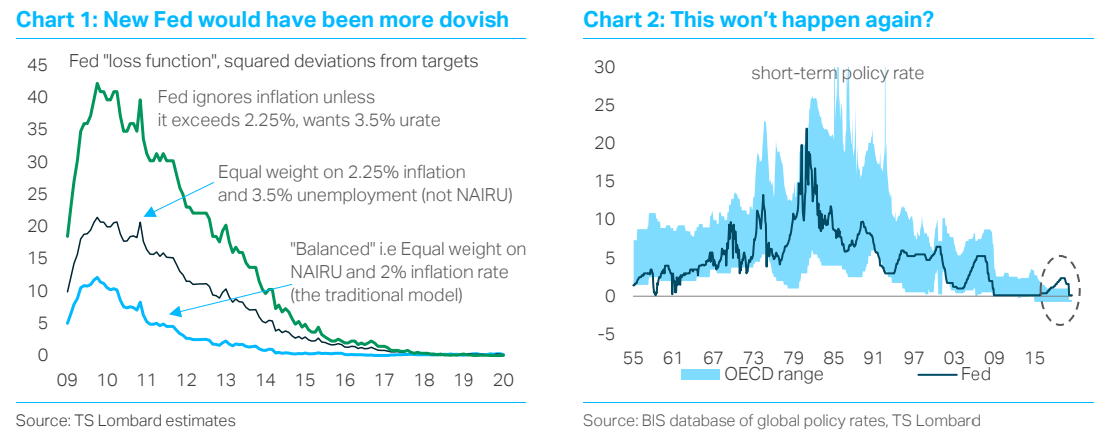

The most radical part of the Fed’s strategy is that it will take an asymmetric approach to the labour market. In the current context, where unemployment is high, this upgrades its importance relative to inflation. Because Fed staff do not feel comfortable estimating the NAIRU, low levels of unemployment are no longer a sufficient reason to tighten policy (in the absence of inflation). They will try to achieve full employment when unemployment is high, but not lean against the jobs market when unemployment is low. The downgrading of NAIRU estimates is important because these have provided a useless steer for policy over the past decade. After the 2008-09 recession, for example, Fed staff erroneously raised their NAIRU estimates because inflation had been sticky. There is also an “inclusive” consideration behind this shift – officials feel they must respond to growing criticism, particularly from MMT-types, who believe they show a political bias to keep unemployment “artificially high” as part of some pro-capitalist/anti-labour ideology.

The Fed’s new strategy also adjusts the way it interprets price stability, adopting an “average inflation” framework. For over 20 years, the Fed – like other central banks – has missed its target in only one direction, undershooting the desired 2% rate. Officials think this undershoot has contributed to the trend decline in inflation expectations, which could eventually lead to deflation (as in Japan). So they will now aim to hit 2% on average, which means inflation must rise above 2% late in the cycle if they undershoot the target during a recession. This is a “make up” strategy, similar to a temporary price-level target. Yet the precise details are fuzzy. The FOMC has not specified the time period over which the average applies, or the degree of overshoot they will allow. But speaking at the September FOMC press conference, Powell said the Fed would not raise interest rates until the economy was at full employment and inflation was both at 2% and likely to “moderately” overshoot this level going forwards. Officials hope this commitment will stop inflation expectations sliding further, keeping real interest rates negative.

Japan introduced an average-inflation target back in 2016 and it is likely other central banks will follow. The ECB definitely needs to clarify its definition of price stability, which in principle leans towards inflation below 2%, even if officials continually stress its “symmetry”. The UK could make similar adjustments, having already introduced some flexibility into its CPI remit back in 2013. In effect, I think we could see most central banks raise their inflation targets in response to COVID. While this will naturally make them even more dovish, they will not be able to match the Fed’s emphasis on the labour market because most of these central banks do not have explicit employment objectives (dual mandates). This matters in a situation where inflation remains sticky despite high levels of unemployment – which is what happened after the last recession. Relative to the Fed, other central banks will feel less “mandate pain”, making them more inclined to write-off the weak labour market as a sign of deteriorating supply capacity. And we probably won’t hear the likes of the ECB complain about the “inclusive” costs of high unemployment.

Sure, central banks fiddling with their objectives isn’t going to solve “lowflation”. The monetary authorities desperately need help from fiscal policy if they are to have any chance of getting inflation back to where they want it. MMT has convinced IceCube but it is yet to win the political battle over fiscal policy. Still, the failure of other central banks to fully match the Fed’s dovish shift could have important implications for the dollar exchange rate. While the currency will still rally in “risk off” episodes – as we have seen recently – the right hand side of the “dollar smile” is likely to behave quite differently. The unprecedented policy divergence of the 2010s (see chart) is unlikely to be a feature of the next economic cycle, which is excellent news for USD debtors.

Read more blogs by Dario Perkins, Managing Director, Global Macro at TS Lombard

Client Login

Client Login Contact

Contact