Despite the recent selloff in bonds, which reflects the pricing-out of near-term recession risk, the experience of the last decade suggests yields are unlikely to rise materially without something "breaking" in global markets. After all, there is a strong degree of hysteresis to low interest rates – “black hole monetary economics”. So what might eventually bring an end to this low-rate equilibrium? Since the current situation is not unprecedented, history can offer some clues. These are generally not very encouraging. Using the Bank of England’s long historical database, we analysed past "secular real-rate depressions", to see what triggered the reversal. The answer - wars, epidemics, famines and more wars - makes even the "Armageddonists" look optimistic. But there is one episode in history, perhaps the period with the closest parallels to today’s situation, which offers a less pessimistic way out: the long depression of the late-1800s.

The Long Depression started with a financial panic, which produced two decades of dismal productivity, deflationary price dynamics, stagnant incomes for the middle classes, a surge in populism and a backlash against globalization. Sound familiar? The panic of 1873 was arguably the first truly international crisis. It began in central Europe with the collapse of the Vienna stock market, then spread to the United States after the failure of the banking house of Cooke and Co. over its investment in the Northern Pacific Railroad. This marked the end of the long railway boom, which revealed serious overcapacity in the sector (by then the largest employer in the United States). The failure of Cooke and Co. was quickly followed by the collapse of several major banking houses in the US, leading to the temporary closure of the New York Stock exchange. Further rounds of panic struck later the same year, with a second wave of financial collapse in Europe. While lots of depressions have their roots in a financial panic, it is the other similarities between the Long Depression and today’s situation that provide the more compelling history lessons for investors. These include:

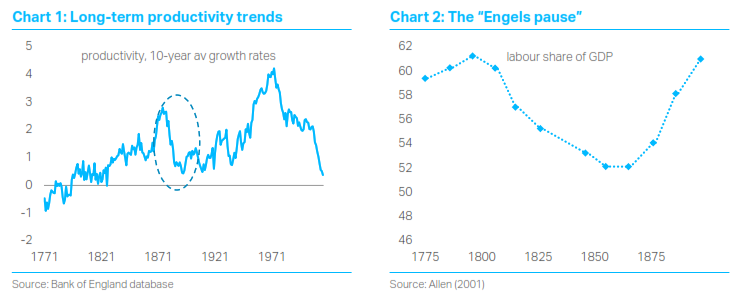

(i) Slump in productivity: British productivity ground to a halt in the late nineteenth century. In fact, this is the only period in the last three hundred years with a downturn comparable to what we see today. Yet, just as there are doubts about the accuracy of modern data, the late 1800s depression seems to contradict widespread evidence for continued rapid innovation. Writing in 1877, the influential economist Robert Giffen declared that the “common impression” of an unprecedented slump “is wrong”.

(ii) Rapid technological change: Even as living standards stagnated, there was no let-up in the Industrial Revolution. Many hugely important inventions occurred during the Long Depression, including the telephone (1876), the lightbulb (1887), the first practical automobile (1885) and the diesel combustion engine (1892). Today, of course, many see the onset of a Second Machine (digital) Age, even if macro data haven’t captured this;

(iii) Globalization: The 1800s had produced a new 'globalized' economy. Britain's 'openness' to trade had increased rapidly from the 1850s onwards, peaking at the start of the twentieth century. Industrialization plus huge advancements in transportation and communication allowed mass production and the shipping of agricultural products and cheap manufactured goods. Imperialism was obviously an important part of the story.

(iv) Persistent deflationary pressures: Today it is widely accepted that the combination of globalization and rapid technological change has been an important ‘structural’ force flattening the Phillips Curve and keeping inflation rates down everywhere. These deflationary pressures were even stronger in the late 1800s, producing a sustained period of falling prices. UK inflation averaged -1.4% between 1873 and 1888.

(v) Jobs polarization: Rapid technological change flattens the Phillips curve and also causes wider income inequality and a ‘hollowing out’ of the labour market. Wages failed to keep pace with productivity, a theme that is all too familiar to economists today. New technologies bring both ‘substitution’ and ‘income’ effects. Machines replace workers but eventually lift real incomes, which creates demand for new goods and services. The Long Depression was a reminder that there can be extended lags in this process.

(vi) Populism and protectionism: Given the other similarities we have identified between the two periods, it is not surprising the late nineteenth century also bought us populism. In fact, the word ‘populist’ first appeared in 1891, as the name for a dynamic movement launched by farmers and workers in the Midwestern and Southern United States. Most socialist parties were also founded in the late 1800s. Some feared a Marxist revolution.

How did the Long Depression end? Productivity reaccelerated in the 1890s because technological diffusion picked up. ‘Income effects’ took over from ‘substitution effects’. This is a reminder that technology can provide a way out of today’s slump, if the gains spread beyond the ‘superstars’. But an acceleration in wages was also important. Populism played a role, especially as it led to the development of the welfare state and the organization of workers into trade unions. There was no Marxist revolution but worries about ‘socialism’ did cause a powerful shift in the distribution of income. So, while many investors struggle to understand the appeal of movements such as Modern Monetary Theory, ‘the left’ might actually have history on its side.

Client Login

Client Login Contact

Contact