Steven Blitz

Recent Posts

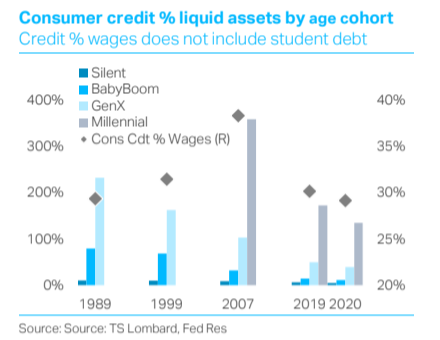

Do consumers ever borrow again?

13 Apr 2021 - Steven BlitzIf the coming expansion is to be different from the last one, consumers will boost their borrowing relative to income – and there is good reason to believe they will. If they do, real growth gets a lift and so too.

#Federal Reserve #Inflation #US Economy #Debt #UnemploymentUS recession is over - Backwards won't be the way forward

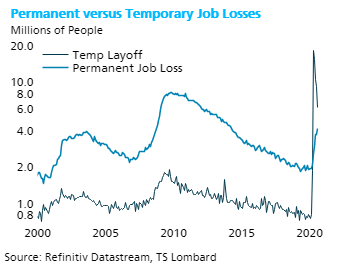

26 Mar 2021 - Steven BlitzThe “non-Covid” recession ended late summer, timed, in part, by the November peak for the number of unemployed not on temporary layoff. What we call the non-Covid recession is simply the downturn that created job losses.

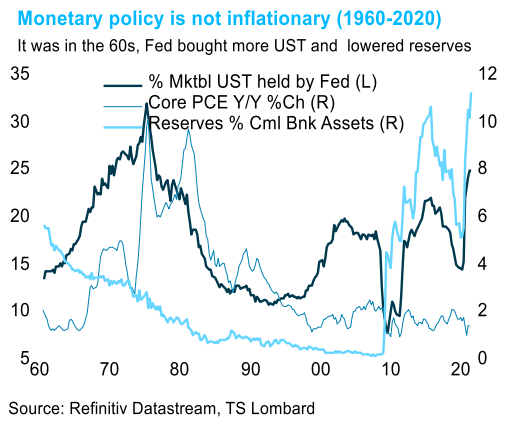

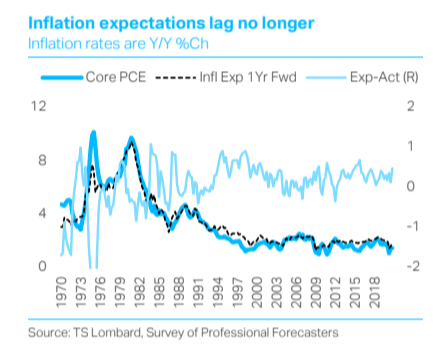

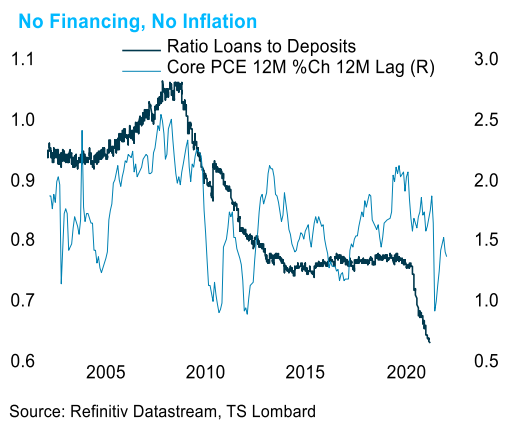

#Federal Reserve #Recession #US Economy #Fiscal Policy #Employment #RecoveryU.S. inflation has to wait

12 Mar 2021 - Steven BlitzAny inflationary process must wait for short rates to drift above what the Fed pays for bank reserves, until then its price changes inside a post-recession disinflationary trend. February CPI data underscore the.

#Inflation #Quantitative Easing #RecoveryThe Fed hits a wall

29 Jan 2021 - Steven BlitzThe Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC.

#Federal Reserve #Inflation #US Economy #Yield curve #BubbleBiden's Inaugural to build populism

20 Jan 2021 - Steven BlitzNot being Trump is not enough to successfully govern through the next four years, Biden must turn the base that elected him into a base for him. He will have this political challenge in mind as policies are initiated to.

#Populism #US Election #USDThe Fed's Shortened Timeline

12 Nov 2020 - Steven BlitzThe vaccine arrives early 2021, so our growth forecast accelerates as a result, beginning in 2021 Q3, and the timeline for when the Fed first “tightens” shortens. It may seem odd to relay this view just when the.

#Federal Reserve #Monetary Policy #US Economy #Vaccine #Quantitative EasingThe Equity Market is now in charge

09 Nov 2020 - Steven BlitzBiden won, Trump lost, but lots of Republicans also won, and the October employment data help explain why – the population does not see the economy in crisis. The ongoing recovery in the labour market (906,000 private.

#Federal Reserve #Monetary Policy #Equities #Bond markets #US Economy #US ElectionConsumer Confidence Rebound Confounds the Economic Narrative

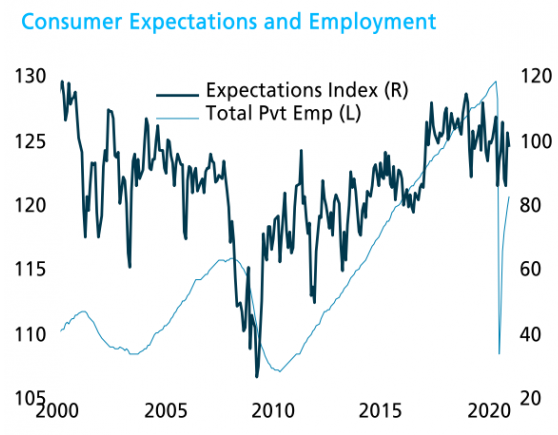

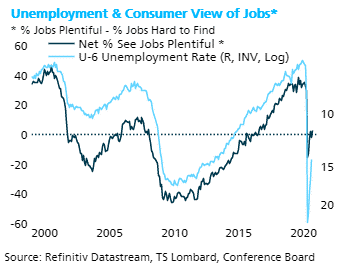

30 Sep 2020 - Steven BlitzThe rebound in consumer confidence is just one more indication that the usual narrative from high unemployment fails. To be sure, the confidence levels from the summer still project a loss for Trump (as it would for any.

#Equities #Recession #US Economy #Unemployment #Labour MarketAugust Unemployment – The Recession Begins to Emerge

04 Sep 2020 - Steven BlitzNot that one could tell that from the strong headline job gains, but remember the critical aspect of understanding the economy’s dynamics is that there is the mandated shutdown and reopening overwhelming the data – and.

#Recession #US Economy #UnemploymentRepublicans set to party like its 1968

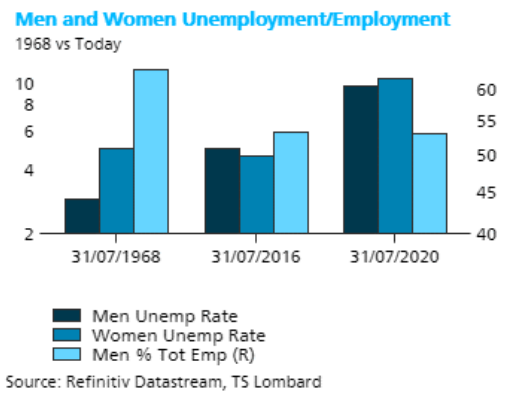

27 Aug 2020 - Steven BlitzMarkets focus on comparative tax policies, but this election is about raising fear among the electorate in order to drive voter turnout – fear will determine the outcome. The ability to convert voters is so small.

#US Election Client Login

Client Login Contact

Contact