The prospect of a vaccine will drive a rotation to underperforming EM assets at the expense of outperformers. EM exporters will benefit from rising global growth, while growing inflationary pressures will shift the balance further in favour of equities vs local debt.

Last week’s vaccine news will fuel a rotation to underperforming EM assets. In global equities, we expect the prospect of a Covid vaccine to intensify the rotation from growth to value. In emerging markets, the successful deployment of a vaccine will ultimately put those EM that have so far failed to contain the pandemic in a similar position to those that have brought the virus under control, notably China, South Korea and Taiwan, in which equity markets have outperformed this year.

Last week’s vaccine news will fuel a rotation to underperforming EM assets. In global equities, we expect the prospect of a Covid vaccine to intensify the rotation from growth to value. In emerging markets, the successful deployment of a vaccine will ultimately put those EM that have so far failed to contain the pandemic in a similar position to those that have brought the virus under control, notably China, South Korea and Taiwan, in which equity markets have outperformed this year.

In China specifically, however, there is an additional reason for concern regarding high tech sector valuations. The recent suspension of the Ant IPO underlines the uncertainty of investing in China and will likely lead to a reassessment of valuations as the giant internet companies adjust to the new regulatory environment aimed at reducing alleged abuses of their dominant market position.

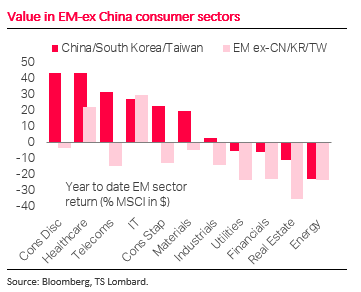

EM ex-China consumer sectors are best placed to recover. Consumer confidence in EM ex-China has plunged to record lows as a consequence of the pandemic and the lockdown restrictions implemented in an effort to contain the virus. The prospect of a vaccine will begin the process of normalization, leading to relative outperformance of consumer strocks in EM ex-China, South Korea and Taiwan.

EM ex-China, South Korea and Taiwan may not be the first countries to successfully deploy a vaccine. The World Health Organisation is tracking more than 170 vaccine developments worldwide. Among major EM, there are vaccine development programs in China, Russia, India and Turkey, while most EM countries are involved in one or more trials of vaccines being developed elsewhere and so will be early recipients of these in the event of the success. In addition to the uncertainty over which vaccine programs will prove successful, and which EM governments will be able to secure supplies, there is the uncertainty around the logistical capacity to deploy the vaccine.

EM economies will benefit even if not first in line for the vaccine. The announcement of an effective vaccine significantly affects our global economic forecasts and should lead to powerful demand growth later in 2021. A more favourable outlook for global growth will ultimately be positive for EM economies, while the gradual recovery of demand in advanced economies will support the continued growth of EM exports.

Client Login

Client Login Contact

Contact