Macro momentum is easing but remains positive. Our Global Leading Indicator remains consistent with improving macro momentum, in line with the message from other widely followed high-frequency series like the OECD Leading Indicator, the NY Fed’s Weekly Economic Index and PMIs. Still – and at the risk of sounding like a broken record – we remind our readers that the recent strong upswing in all these indicators should be taken with a grain of salt, as it is partly payback for overstated weakness in April-May. The global manufacturing PMI (51.8 in August), has returned rapidly to levels last seen in 2018 Q4, so it is safe to say that the easy gains in industrial activity – the more cyclically-sensitive side of the economy – are now behind us. Yet given the continued upward trajectory of the new orders vs inventories PMI differential, which tends to lead the headline index, it looks like there is more fuel left in the tank.

World trade is on the mend, too. Something similar can be said about world trade. The latest CPB data show that volumes rose further in July (+4.9% MoM, driven by strength in China and the US), extending the strong gains recorded in June. This translates into a 13% jump from May’s low and a retracement of two-thirds of the Ytd decline. What is more, the IFO export expectations index rose to a two-year high in September, pointing to additional gains ahead for the CPB’s tracker. This is consistent with indicators of Asian trade activity. September data on the dollar value of Korean exports for the first 20 days of the month showed a 29% MoM jump to levels last seen in March. August saw Taiwanese electronics export orders, a barometer of the global tech cycle, gather pace (+28% YoY), while Singapore’s domestic non-oil exports jumped by around 12% MoM and industrial production recorded strong gains for the third month in a row (+4.5% MoM in real terms or up 21% from May).

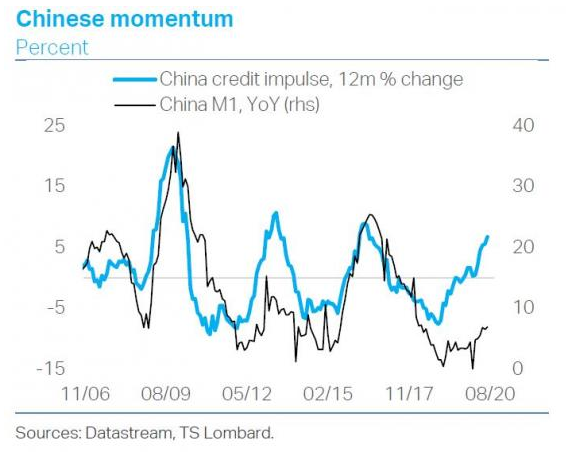

As the chart below shows, China is gathering momentum. Solid momentum in Asian trade is underpinned by positive macro dynamics in China, supported by accelerating money growth and a strengthening credit impulse. Our China team has upgraded its annual real GDP growth estimate for this year to 2.4% and sees the economy’s uneven recovery levelling up. Rebounding exports and infrastructure investment are supporting the labour market, nurturing the recovery in consumer spending.

Client Login

Client Login Contact

Contact