At Wednesday 16th June’s meeting, the FOMC moved closer to my long-held view that the rate hike first comes at the end of 2022, with two hikes completed by the end of 2023. It was not a unanimous decision, but the widening dispersion of views among FOMC members and Powell’s press conference performance tell us that the Fed no longer denies an outlook for above trend growth and what that means for policy. The Fed promises to maintain an accommodative policy until certain economic goals are met – that does not mean policy is locked-in to become more accommodative as growth roars ahead. In today’s press conference, Powell made clear that there was nothing in the policy framework that keeps them from acting – a point he repeated often in different ways during the Q&A.

With the Fed shifting to more realistic rate hike probabilities given their outlook, the bet shifts from when the Fed acts to whether the outlook materializes. With 39% of FOMC members now seeing a hike in 2022 and 61% seeing two hikes or more by the end of 2023 (72% see at least one hike in 2023), market pricing reflecting Fed rate hike probabilities was reset. The “easy trade”, betting on Fed action before 2024, is now closed. This leaves the harder trade -- guessing whether the economy comes through with strong above trend growth and pushes the Fed to an even steeper trajectory, or not. My view is that the economy will sustain an above trend pace of growth in the coming years aided by government spending and an upsurge in productivity. My suspicion is that whenever the Fed itself becomes convinced of an outlook, chances are good that the opposite comes true.

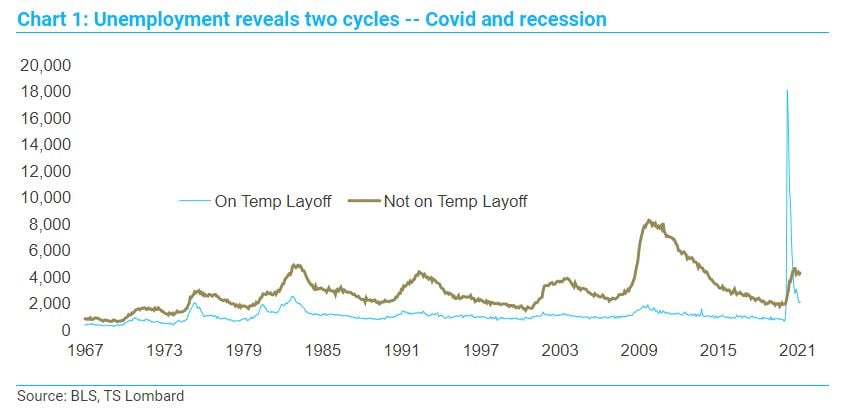

Recent data indicate a deceleration of activity and raises the question of whether the typical “long recovery”, especially for employment, emerges once the economy has reopened. I have long made the point that there are two cycles at play – Covid and a regular recession. The difference is most easily seen when comparing unemployed on temporary layoff and those that are unemployed not on temporary layoff (Chart 1). It takes years for this unemployment measure to return to pre-recession lows and in some cycles (2002-07, for example), it never does. Instead of embracing that perspective, as Powell has in the past, he flipped his narrative today and insisted throughout the press conference that this is “going to be a very strong labour market’.

Powell’s strong belief that a very strong labour market emerges is telling us that that he sees more upside risk in inflation than not. This is an important turn because the Fed’s inflation view, the one they act on, runs through wages not prices. How much of an inflation process can take hold if people have little faith that their wages are going to be higher in the future. Inflation means people willing to borrow against future income to buy today what will be more expensive tomorrow. People do not do that if their wage expectations are low – and they still are. In the May Conference Board Survey, the net percent of consumers seeing income up in six months was 27%, still down from 31.5% when the shutdowns began, Further, there are no signs that firms are leveraging themselves by expanding workers or capital to take advantage of higher prices and low borrowing rates to expand revenue by expanding capacity. The Fed is consequently not the only player in this economy believing current price hikes are passing event. Powell is, however, letting us know that in the coming years, probability of a repeat of high employment and low inflation, tied to weak wage growth, is low – and I think he is right. Powell essentially laid the groundwork today for a tightening cycle more aggressive than what is priced, and that this still fits with the new policy framework - -if the economy comes through as expected.

As for tapering asset purchases, the Fed has a conflict between financial plumbing and their stated economic goals and plumbing will win. By raising IOER five basis points to 0.15% they have shifted this rate to the upper half of their 0-25bp target range for O/N rates. If they are not going to tighten, there is a functional limit to how high IOER can go until they do, and they are 5bp closer to the top inside a 25bp range. That IOER had to be raised is itself an indication that the Fed is buying too many safe assets. All of which means they will taper by year’s end, perhaps in January – they have no other choice regardless of whether there is substantial progress towards their metrics. I still expect an announcement about taper at the July meeting – presuming that the June economy confirms their optimistic forecasts for growth and employment. No one has told them, however, that the taper they announce will not tighten financial conditions – the deficit will drop a lot more than their pace of purchases will decline.

Client Login

Client Login Contact

Contact