The Fed ramped up its balance sheet by over $500bn in the past week to $5.3trn (it was $4.2trn a month ago), to support its first line efforts to keep markets liquid and reduce the dollar’s scarcity value through swap lines with various central banks. Important as these efforts are, fiscal and monetary policies are intent on keeping the real economy afloat through forbearance and the extension of credit, knowing that success keeps the financial system solvent. Consequently, efforts by the Fed to date hardly scratch the surface of what is to come, and what they will do will be near impossible to unwind in the years ahead.

To help keep debt defaults from piling up, the Fed is pushing banks to lend their surplus capital, and the Fed is directly lending through its Special Purpose Vehicles (SPVs) capitalized by the Treasury (Section 13(3) of the Federal Reserve Act). For now, these SPVs give the Fed latitude to buy corporates and other credit securities. With the passage of the stimulus package, Treasury sponsored lending could grow the Fed balance sheet by another $4.8 trillion, or about equal to all loans outstanding to businesses, excluding mortgages. Treasury owns the equity stake in the SPVs and takes the hit on the first 10% of losses (allowing the Fed to leverage the equity10-to-1). Treasury also directs the lending, with rules set out in the stimulus package. Treasury now has the Fed’s balance sheet through which to extend up to near $5trn in credit, if it so chooses. This is not going away once the recovery does.

Here, in sum, is what the Fed has done so far.

Here, in sum, is what the Fed has done so far.

- Markets. Buy all the UST and Agency MBS and CMBS needed to keep markets functioning. This mix will likely broaden to include non-Agency CMBS.

- Direct lending. Section 13(3) of the Federal Reserve Act -- $300bn in new financing backed by $30mn in Treasury equity from the exchange stabilization fund.

- TALF (Term Asset-Backed Securities Loan Facility) Lend on a non-recourse basis to holders of certain AAA-rated ABS equal to the market value of the ABS less a haircut and secured at all times by the ABS.

- SMCCF (Secondary Market Corporate Credit Facility) Purchase (a) investment grade corporate bonds in the secondary market and (b) U.S.-listed exchange-traded funds owning U.S. investment grade corporate bonds.

- PMCCF (Primary Market Corporate Credit Facility). Facility is open to investment grade companies and will provide bridge financing of four years.

- Main Street Business Lending Program. To be announced shortly

- Banks. Get banks to lend “surplus” capital to good businesses hurt by the loss of revenue due to Covid-19. Fed has effectively tossed LCR, ended required reserve requirements, and delayed adoption of "current expected credit loss," or CECL.

Still to do:

Mortgage Servicing – GNMA has moved, FNMA and FHLMC are soon to follow, to back up mortgage servicers. Forbearance is a great idea, but servicers still have to make payments to the mortgage pool holders until the Agencies backing the loans replace the payments. Most servicers are far too undercapitalized to handle massive non-payments of mortgages.

CMBS – Fed is buying Agency backed CMBS (multi-family housing), but there is also about $400bn in non-Agency CMBS for commercial properties who are now not getting rent payments. We expect the Fed the step in and add these securities to their balance sheet.

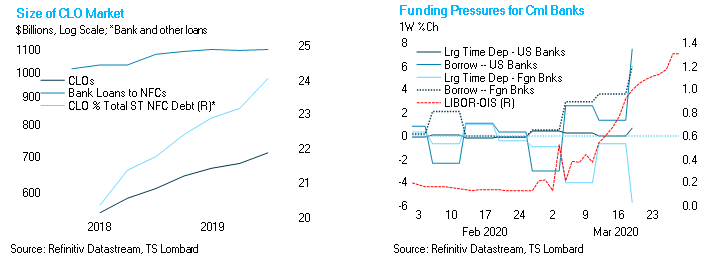

CLOs – Outstandings reached $710bn at the end of Q4, or about 24% of loans to nonfinancial corporations, excluding mortgages (see front page chart). These are high leverage loans, covenant lite and, by some measures, total up to more than high-yield bonds outstanding. The Fed has an obscured view into this market because private firms generated many of these loans and the monies were lent to private firms. The Fed add CLOs to its mix because widespread defaults will damage banks and capital markets.

Bank liabilities – The credit spread banks have to pay for unsecured three-month deposits (LIBOR/OIS spread) widened with banks well capitalized against credit loss. Bank borrowings have, however, jumped in the past week (see front-page chart), and large time deposits at foreign banks dropped almost 6%. LIBOR/OIS reflects bank funding needs not loan loss concerns. Bank deposit flows are simply mirroring sales of UST to raise cash.

Will it all work? If the loans are well directed and offered out soon enough, two big ifs, it helps to hold the economy somewhat in place, a good thing, but it is not stimulus per se. The bigger issue longer run is the Fed’s thumb on the scales of all capital market prices, and they will not let go anytime soon – moral hazard writ large, and inefficient direction of capital. Further, Treasury is unlikely to let go of the Fed’s balance sheet as a vehicle for lending. The recovery will be very different from the one just ended.

Client Login

Client Login Contact

Contact