The Covid crisis has triggered secular shifts in tech, but in housing too? Whether Growth really is the new Value or whether we are in the early stages of a tech bubble, secular shifts in use of technology since the crisis may not be unwound: here at TS Lombard, for example, video meetings have unlocked significant productivity gains, not to mention the time no longer used for commuting being put to better use. The relative ease with which white-collar work has adapted to working-from-home has triggered a shift in how people use their homes – and a consequent shift in how people live. Home sales activity has hit a level not seen since the GFC.

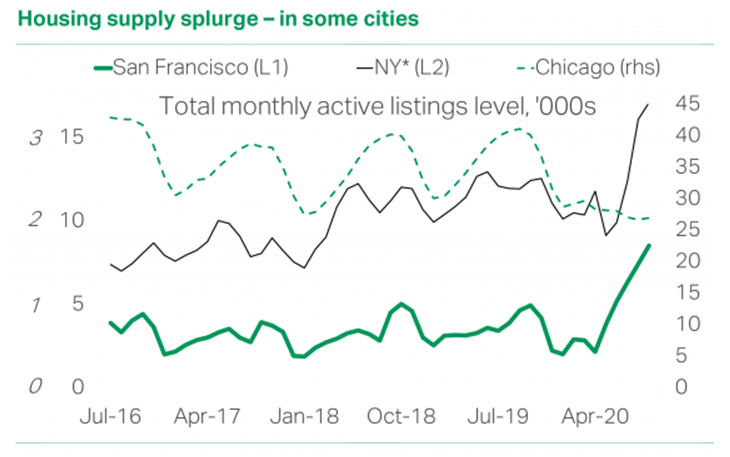

But how long will this pace last? If the recent boom is driven by relocation away from urban centres, then activity in those urban centres will give us a clue about the next stage of the boom. This chart suggests that competition for buyers has already heated up in New York and San Francisco. But listings activity suggests there is no boom in activity in Chicago.

Housing markets are generally driven by new entrants. In the case of the US, these new entrants tend to be in the 25-34yr demographic, where the home ownership rate is currently at a record low. We have been optimistic that home ownership in this demographic would start to rise, as it has historically lagged employment rates by a few years. But since it is this demographic that has been most heavily hit by the COVID crisis in terms of employment, this traditional relationship is in question. There are certainly members of the demographic in a strong position to purchase; but since New York City rents, for example, are now falling close to 2011 levels, there may be no rush to buy.

The current boom in housing activity has brought forward demand; the internals of the market do not support a persistently high level of activity. The K-shaped nature of the economic recovery is evident in housing – strong demand in high value and refinancing but weaker in mortgages for purchases, strong supply in cities where prices have risen already, little change in others. This suggests the boom has brought forward activity rather than signalling a secular shift. While nationwide indicators look strong, the devil is in the detail. For housing to continue to boom the lower leg of the K – new buyers, mortgages for purchases, lower credit score demand – needs to pick up. But, as noted above, it is the 25-34yrdemographic that has been hardest hit by the COVID shock: are first-time buyers now more likely to bring forward the biggest purchase of their lives or wait and see? To be clear, we are not calling a housing crash – far from it: with mortgage rates near record lows and very good affordability, there are no triggers for any such crisis (and with tighter credit conditions than pre-GFC and credit conditions being tightened further recently, there is no chance of another financial crisis). But there can still be a cycle.

Client Login

Client Login Contact

Contact