Powell lowers the strike price on the Fed's put

27 Jan 2022 - Steven BlitzAIT was the promise that the Fed would chase inflation rather than be pre-emptive and here we are, promise kept. Powell now promises the chase to be executed, using a combination of rate hikes and balance sheet.

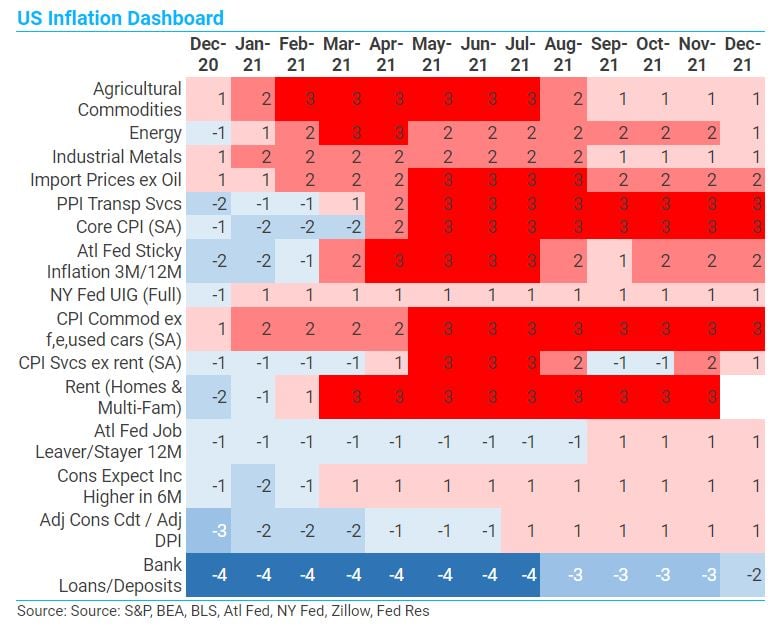

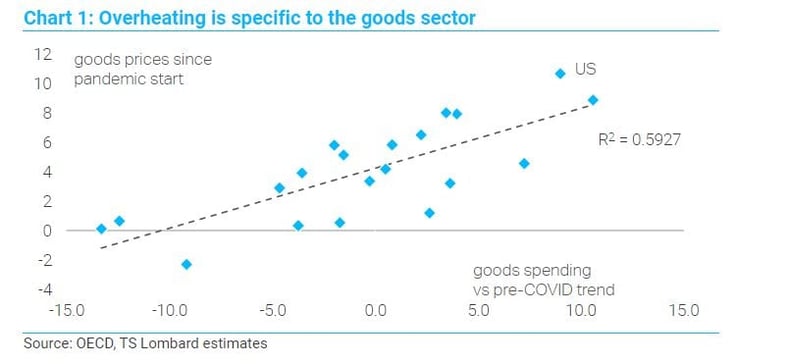

#Federal Reserve #Monetary Policy #Inflation #RecoveryUS inflation - It's not about the rent

18 Jan 2022 - Steven BlitzThe inflation problem for the US is not rent, but the loss of zero inflation in goods prices as an offset, and this offset is unlikely to return in the coming cycle. One can say current goods price inflation is the.

#Federal Reserve #Inflation #RecoveryDon't extrapolate from this fake business cycle

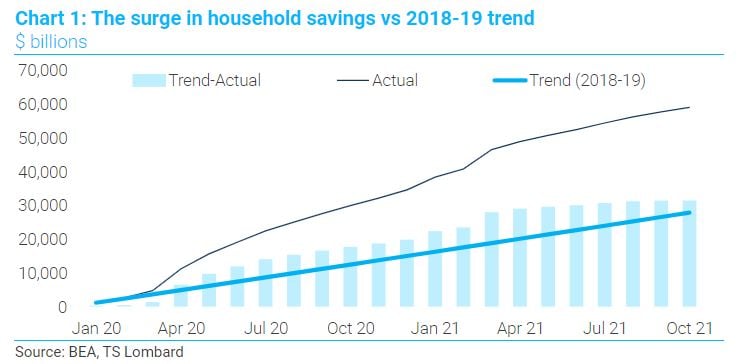

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

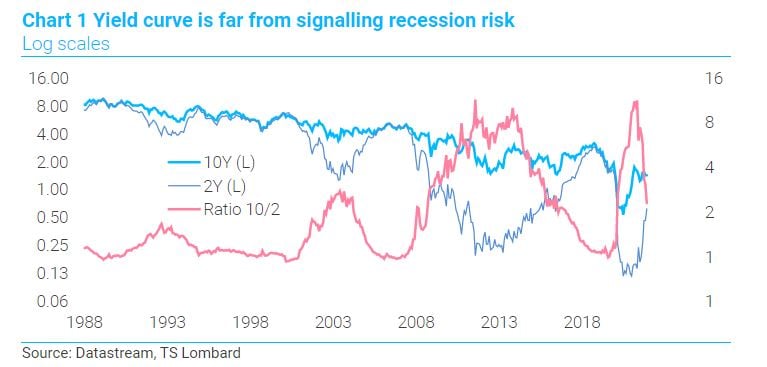

#Central Banks #Monetary Policy #Inflation #Recession #Recovery‘Undecided’ bond market has made up its mind – at least for now

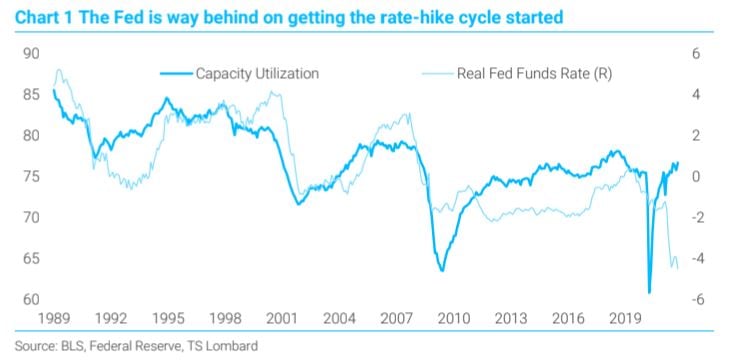

13 Jan 2022 - Konstantinos VenetisTime to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While.

#Central Banks #Federal Reserve #Monetary Policy #Inflation #Bond marketsThe Sellside Guide to Christmas

24 Dec 2021 - Dario PerkinsThe Christmas blockbuster: For economists, Christmas is all about the big “Year Ahead” publication. Even though it’s obvious nobody actually reads these tomes (except, maybe, other sellsiders), they have to be really.

#Central Banks #Bank Of England #FX Market #Cryptocurrency #ChristmasPowell underplays hawkish turn

17 Dec 2021 - Steven BlitzThe march to a March hike is on, assuming, of course, no great downward swerve in growth and/or inflation between now and then. The FOMC sees three hikes in 2022 and this pacing alone tells you March comes first. Powell.

#Central Banks #Federal Reserve #Monetary Policy #InflationFirst Fed hike in March - it's not about current inflation

09 Dec 2021 - Steven BlitzMarch will mark the first Fed rate hike, sooner than the June timing I recently shifted to, and much sooner than the original Q4 call made in November 2020. The timing is being pulled forward because the circumstances.

#Central Banks #Federal Reserve #Monetary Policy #InflationFed's inflation problem is wages in 2022, and no workable answer for it

02 Dec 2021 - Steven BlitzThe Fed’s problem is that current price hikes from shortages of goods and labour will pass, but the coming increase in wages will not. Because the conduit of monetary policy runs through the dollar and the equity.

#Central Banks #Federal Reserve #Monetary Policy #InflationCovid: Omicron variant - first take

26 Nov 2021 - Andrea CicioneThese are our initial thoughts on the new Covid variant: We don’t know enough about the B.1.1.529 variant to draw any specific conclusions at this stage. We know that it has many mutations on the protein spike, which.

#Liquidity #Equities #Covid19 #Stock MarketHawkish markets to force global policy response?

04 Nov 2021 - Dario PerkinsA simple narrative is taking over financial markets, especially the short end of the yield curve, where the idea that central banks are “behind the curve” is rapidly gaining traction. Initially, it was just the emerging.

#Central Banks #Monetary Policy #Inflation Client Login

Client Login Contact

Contact