The near-term inflation outlook for the US economy is straightforward – there is none. Demand has collapsed, not supply, and there is no way that inflation will pick up until demand rises at least to meet supply. There is the possibility of supply shortages spiking prices, but that is about individual prices not inflation. Further, the upturn in demand promises to be slow and most likely halting, moving with the ebb and flow of the progression of the virus. Another factor that will weigh on growth for some time is that demand uncertainty keeps business and households from leveraging their balance sheets, state and local government curtailing spending and the federal government deleveraging with the deficit dropping as the economy rebounds, however slowly.

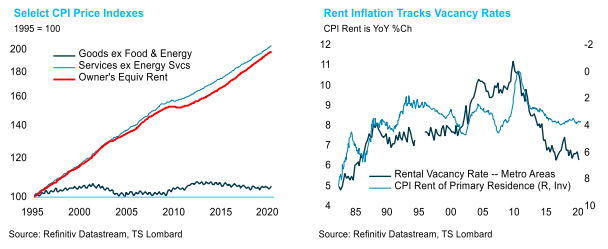

In the US, goods inflation ex oil is globally determined and service inflation domestically determined. Global goods prices are strongly cyclical, moving in line with the industrial cycle and energy prices. Consequently, when energy prices crash and world trade implodes -- such as now – core inflation is similarly impacted. In the US, core goods inflation has been flat in the US since the mid-90s (see chart below), so it is hard to see anything other than deflating goods prices in the US for the next six months at least. And given the lag between the dollar and import prices, it is also hard to see good prices for US consumers accelerating in any meaningful way

for the next 18 months.

for the next 18 months.

Since at least 1995 the driver of US inflation has been service sector inflation, which, in turn, has been driven by rents (see chart above). Over the next 12 to 18 months, rent inflation drop as vacancies rise. Renters typically hold the low-skilled, low-wage service positions that have been lost. In the 2008-09 recession, vacancy rates shot up from 7% to 11% as unemployment rose from 4.5% to 10.0%. In response, rent inflation dropped from 4.5% YoY in April 2007 to -0.06% YoY in May 2010.This time around, the percentage of unemployed looks to top out at more than 20%. Even though many of these job losses promise to be temporary and the CARES Act made unemployment insurance more generous, people are still seeking to lower fixed costs – and so rent inflation will decline. In sum, overall inflation will probably average around 1% for the next two years – inflation lags real growth by about a year.

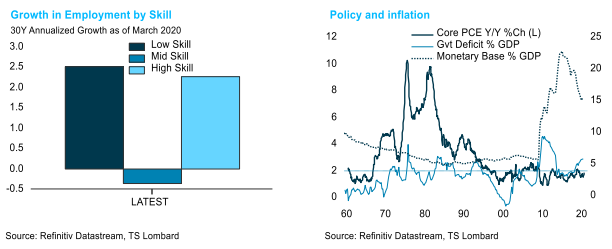

Since at least 1995 the driver of US inflation has been service sector inflation, which, in turn, has been driven by rents (see chart above). Over the next 12 to 18 months, rent inflation drop as vacancies rise. Renters typically hold the low-skilled, low-wage service positions that have been lost. In the 2008-09 recession, vacancy rates shot up from 7% to 11% as unemployment rose from 4.5% to 10.0%. In response, rent inflation dropped from 4.5% YoY in April 2007 to -0.06% YoY in May 2010.This time around, the percentage of unemployed looks to top out at more than 20%. Even though many of these job losses promise to be temporary and the CARES Act made unemployment insurance more generous, people are still seeking to lower fixed costs – and so rent inflation will decline. In sum, overall inflation will probably average around 1% for the next two years – inflation lags real growth by about a year.It is easy to suggest a future inflationary bias for the US, but that call looks suspiciously too easy. The argument for inflation is supply chains moving back to the US or, at the very least, North America combined with fiscal spending in effect underwritten by the Fed. Market triage is not a commitment for the Fed to underwrite future deficits and the political centre has not yet moved to favour government spending over tax cuts. Firms that shift production will try to raise prices to sustain margins -- easier to do in a deglobalized world – because labour will now be more expensive. Higher average hourly earnings should also give firms some pricing power. A shift towards domestic production reshapes the employment growth barbell of the past 30 years – a result of offshoring (see chart below). Mid-skill, mid-wage jobs now grow faster and, as a result, so should average hourly earnings. The pushback is that firms are not going to give up margins or market share so they will accelerate the adoption of processes producing goods and services with as little labour input as possible. Consequently, the reset of supply chains may not be as favourable for mid-skill labour as perceived – although it should help to some degree.

Economists should be humble about pronouncing the Fed balance sheet a trigger for higher inflation in the future – over the past 40 years they have proved to know very little about inflation processes. If inflation were always a monetary phenomenon, it would be rampant by now (see chart below). While the Fed balance sheet will stay high as a percentage of GDP and deglobalization returns some pricing power that will cover higher labour costs, the mammoth disinflationary forces of technology and an aging population will accelerate.

In sum, the longer-run inflationary outlook remains more question than answer but not so the near-term outlook – deflation and very low inflation is the clear call for the next 18 months.

Client Login

Client Login Contact

Contact