Hawkish markets to force global policy response?

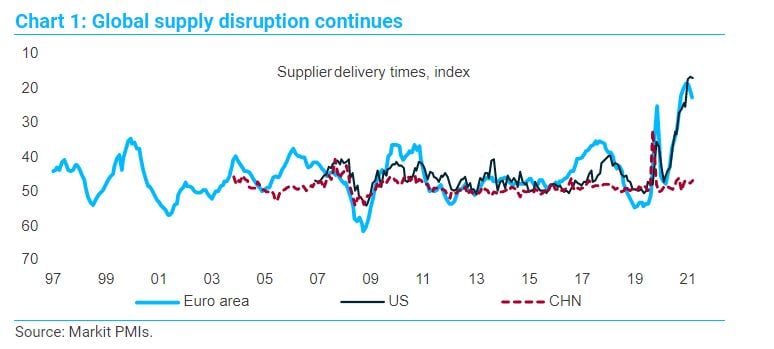

04 Nov 2021 - Dario PerkinsA simple narrative is taking over financial markets, especially the short end of the yield curve, where the idea that central banks are “behind the curve” is rapidly gaining traction. Initially, it was just the emerging.

#Central Banks #Monetary Policy #InflationWhy central banks are suddenly sounding hawkish

29 Sep 2021 - Dario PerkinsCentral banks across the world have pivoted to a more hawkish mode in recent weeks. While this is in part acknowledgement that the recovery from COVID is continuing – albeit more hesitantly than officials expected at.

#Central Banks #Monetary Policy #InflationSecular turning point in inflation?

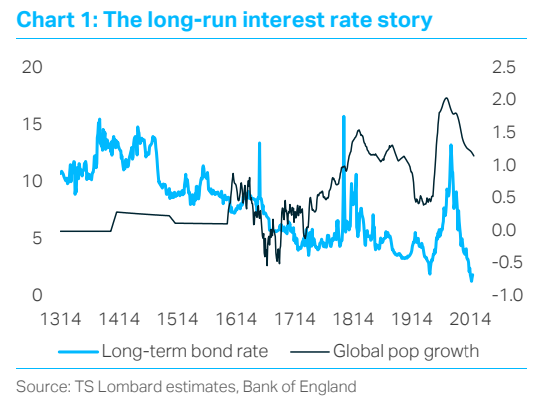

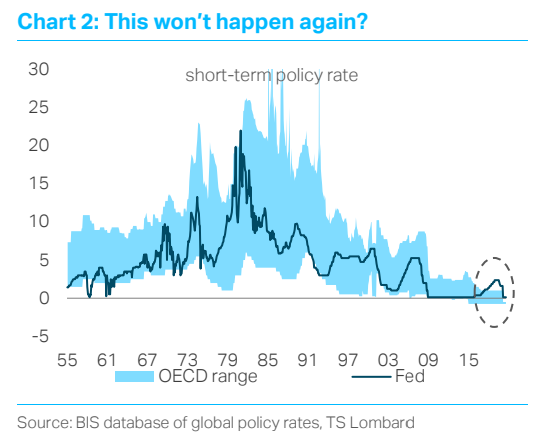

12 Mar 2021 - Dario PerkinsThese days, economists tend to assess monetary policy relative to some deep underlying interest rate (the “equilibrium rate”, or r*) which depends on structural forces and is largely beyond the control of central banks..

#Central Banks #Monetary Policy #InflationEconomists’ guide to Christmas (redux)

23 Dec 2020 - Dario PerkinsThis was something we published back in 2013 – the Economists’ guide to Christmas. But we made a serious omission, by leaving out Modern Monetary Theory. So here’s an update, incl. MMT: ‘If you put two economists in a.

#Central Banks #Federal Reserve #European Central Bank #Bank Of England #Bank of Japan #Modern Monetary TheoryQE Nuclear Options

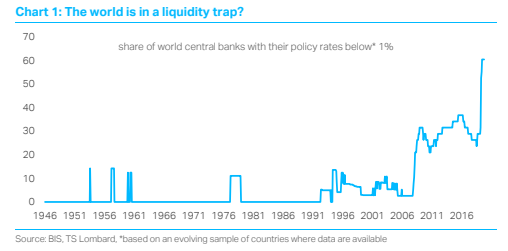

19 Nov 2020 - Dario PerkinsAn effective COVID-19 vaccine is great news because it will save lives and means we might still escape from the current economic crisis with minimal long-term scarring. Yet, the global economy faces a difficult winter,.

#Central Banks #Liquidity #International Monetary Fund #Macro PicturePerma-frosts and fiery endgames

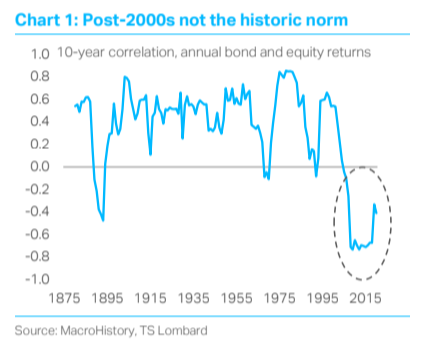

06 Nov 2020 - Dario PerkinsThe bond-equity correlation has gone mainstream in 2020, thanks in part to what happened in March when yields spiked even as equities crumbled (i.e. there was a POSITIVE correlation in returns). While this was.

#Central Banks #Equities #Bond marketsCentral Banks are changing

30 Sep 2020 - Dario PerkinsOnce upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of.

#Central Banks #Federal Reserve #Monetary Policy #European Central Bank #InflationRoad to inflation

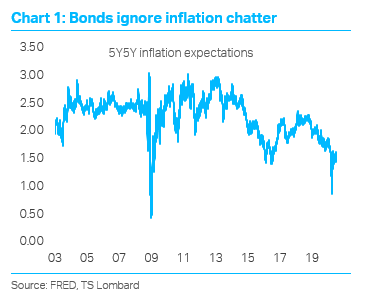

27 Jul 2020 - Dario PerkinsInflation remains an important theme for our clients. Perhaps this reflects supreme confidence in the policies governments and central banks have introduced to support their economies during the COVID-19 pandemic. With.

#Central Banks #Inflation #Equities #Covid19 #UnemploymentInvestors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketMacro policy vs Covid-19 - Has policy done enough?

26 May 2020 - Dario PerkinsThe recovery in investor sentiment since March has been impressive (even puzzling...). Back then, as the global economy entered lockdown, a “flight-to-safety” rapidly became disorderly, leading to an outright.

#Central Banks #Balance Sheet #Fiscal Policy #Covid19 Client Login

Client Login Contact

Contact