Covid: Omicron variant - first take

26 Nov 2021 - Andrea CicioneThese are our initial thoughts on the new Covid variant: We don’t know enough about the B.1.1.529 variant to draw any specific conclusions at this stage. We know that it has many mutations on the protein spike, which.

#Liquidity #Equities #Covid19 #Stock MarketDelta blues

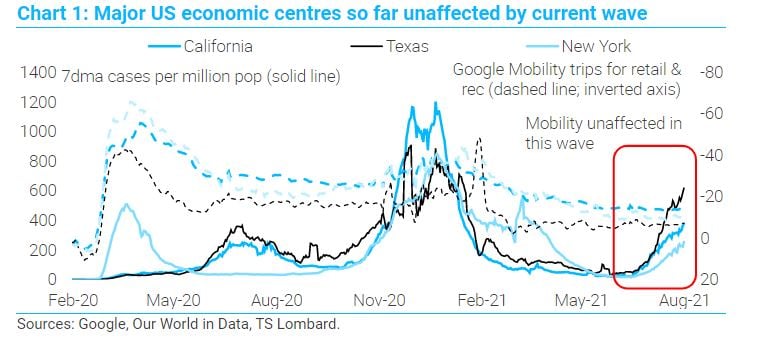

27 Aug 2021 - Oliver BrennanThe US state of Mississippi is in the midst of its worst wave of Covid infections. Ditto Arkansas and Louisiana. But it’s not just the Mississippi Delta feeling the Delta blues. Cases in Florida are second only to.

#China #Covid19 #Recovery #Delta variantWhat is normal anyway? Our clients respond

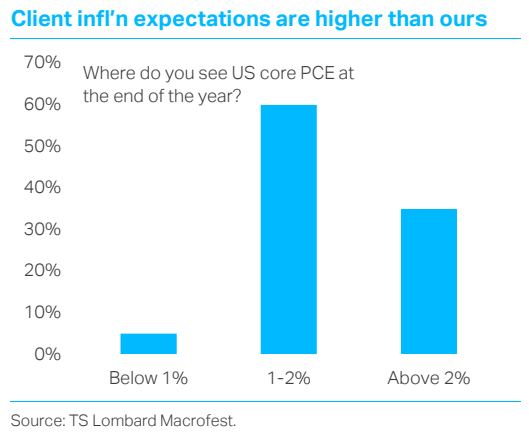

22 Jan 2021 - Oliver BrennanAt our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the.

#Inflation #Eurozone #Emerging Markets #Covid19 #Currencies #USD #VaccineThe 2020 ABC

28 Dec 2020 - Oliver BrennanThere are two types of economist: those who don’t know and those who don’t know they don’t know. That’s why our final blog of the year usually gives “anti-forecasts” – outlandish things that definitely won’t happen. But.

#Brexit #2020 outlook #Covid19 #Recovery Fund #K Recovery #Quantitative Easing #Modern Monetary TheoryDouble-Dip Recession on the way?

24 Nov 2020 - Davide OnegliaA virulent second wave of the Covid-19 pandemic is underway. We do a back-of-the-envelope calculation to estimate relative declines in domestic demand in what we think is a ‘credible’ worst case scenario. We compare the.

#Eurozone #GDP #Recession #Covid19Covid Scarring. Impact in 12 charts

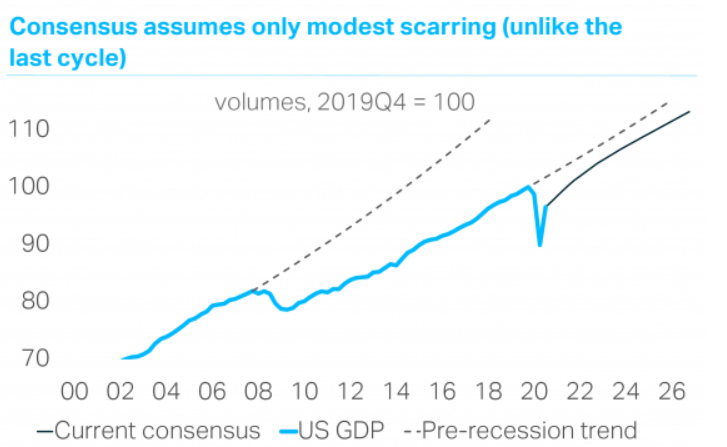

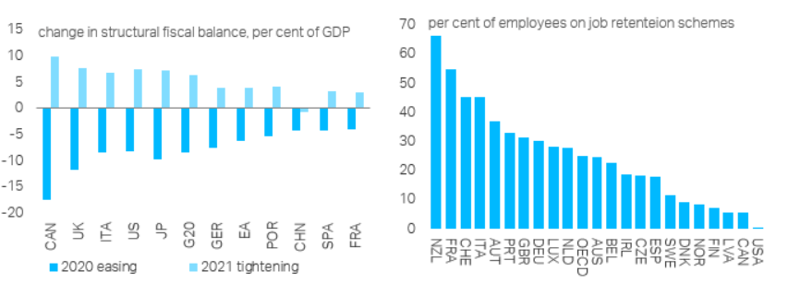

09 Nov 2020 - Dario PerkinsCovid economic scarring is not inevitable, but it is becoming likelier with a second wave of the virus and “fiscal fatigue” setting in. Central banks are determined to ensure scarring does not materialise, but fiscal.

#Fiscal Policy #Covid19Long covid

06 Nov 2020 - Dario PerkinsThe authorities’ attempt to reopen their economies has caused a sharp acceleration in COVID cases across Europe and the US, the (entirely predictable) “second wave” of the pandemic. While the health authorities are.

#Recession #Fiscal Policy #Covid19The Covid-19 recession: L comes after K?

17 Sep 2020 - Dario PerkinsIt is a cliché to say everyone’s experience of the COVID-19 recession has been different, but no sell-side economist ever shies away from using cliché to construct a narrative. For some people – especially those on the.

#Recession #Fiscal Policy #Covid19 #Unemployment #Macro PictureCan the world rebound from the Covid-19 recession?

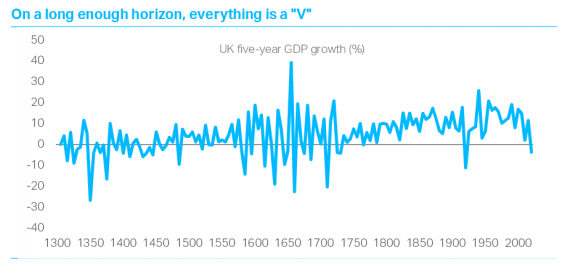

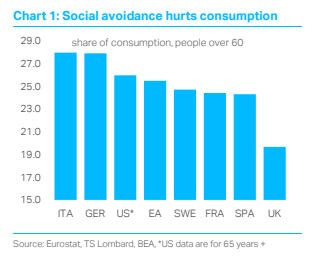

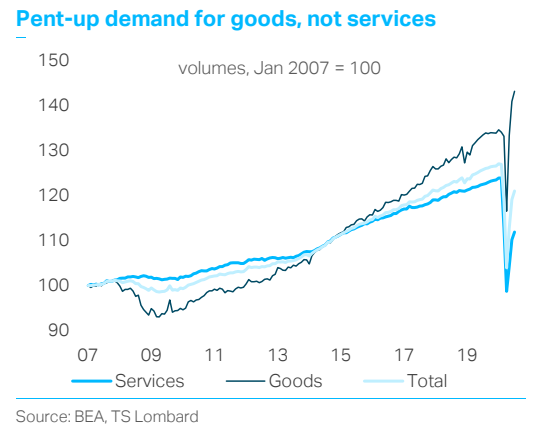

01 Sep 2020 - Dario PerkinsThe COVID-19 economic collapse was unlike anything we have seen before. This was not your classic recession. Yet it was actually easy to forecast. Given the nature of the shock – especially lockdowns and social.

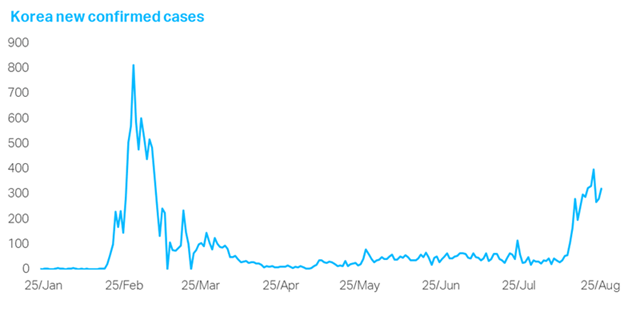

#Recession #Covid19 #Unemployment #Retail SalesLooking through Korea’s second wave

28 Aug 2020 - Rory GreenSecond wave does not change our positive Korean economy, equity, or FX position. Since April, we picked Korea as a relative outperformer due to three core factors: Virus containment success Tech heavy exports profiting.

#Covid19 #South Korea Client Login

Client Login Contact

Contact