Commodity bull moving into mid-cycle

30 Apr 2021 - Konstantinos VenetisIt has been a little over a year since commodity prices bottomed out, marking the start of a powerful rally that is reminiscent of those in 1993-95, 2005-07 and 2009-10. With the global economic recovery set to gather.

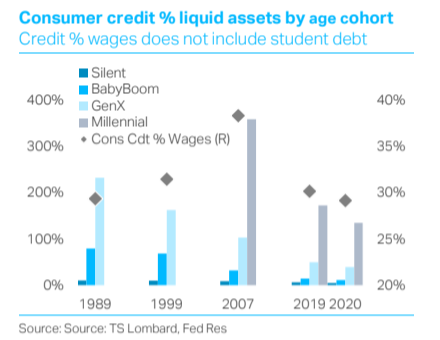

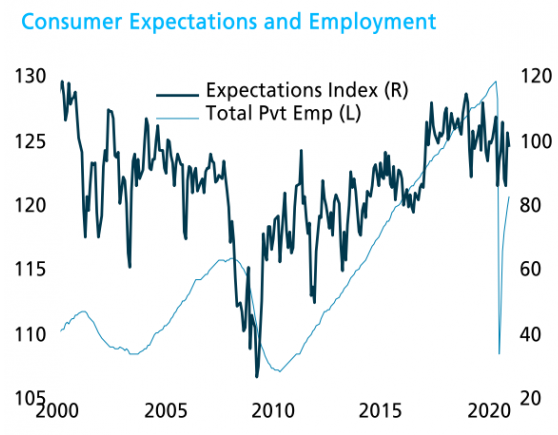

#Federal Reserve #Commodities #OilDo consumers ever borrow again?

13 Apr 2021 - Steven BlitzIf the coming expansion is to be different from the last one, consumers will boost their borrowing relative to income – and there is good reason to believe they will. If they do, real growth gets a lift and so too.

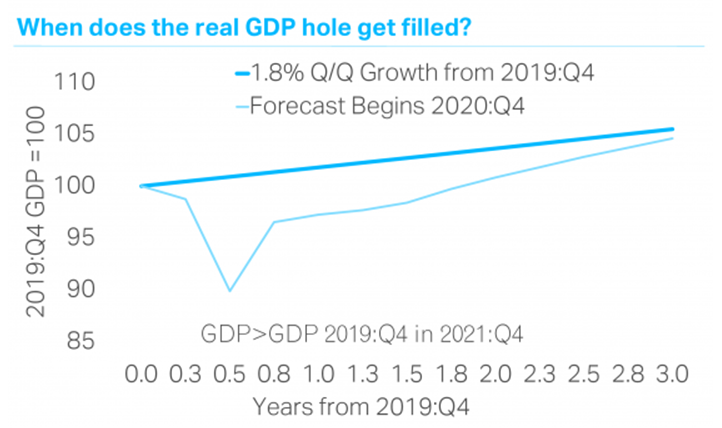

#Federal Reserve #Inflation #US Economy #Debt #UnemploymentUS recession is over - Backwards won't be the way forward

26 Mar 2021 - Steven BlitzThe “non-Covid” recession ended late summer, timed, in part, by the November peak for the number of unemployed not on temporary layoff. What we call the non-Covid recession is simply the downturn that created job losses.

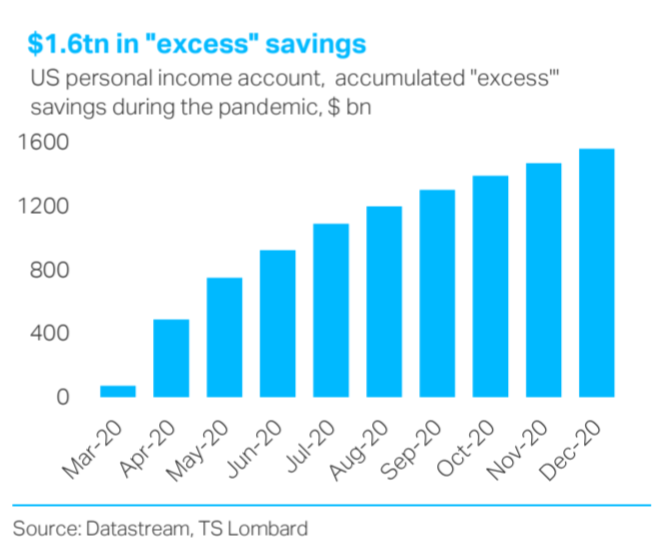

#Federal Reserve #Recession #US Economy #Fiscal Policy #Employment #RecoveryHouseholds $1.6tn in “excess” savings, inflation to take off?

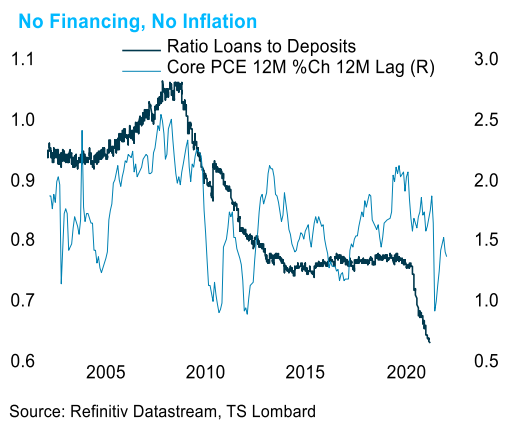

01 Mar 2021 - Shweta SinghHeadline figures overestimate the “excess” savings that households have accumulated since the outbreak of the pandemic. To be sure, the personal saving rate will fall as consumers spend more of their disposable income.

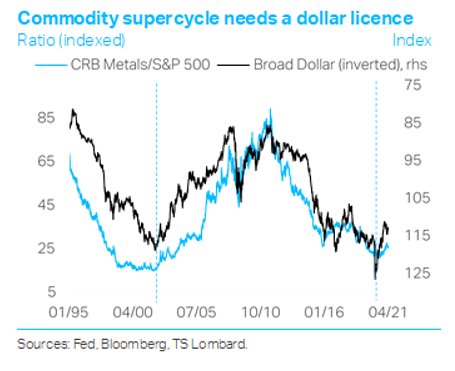

#Federal Reserve #Inflation #US EconomyCommodity Supercycle now on? Potential is there

01 Mar 2021 - Konstantinos VenetisThere are two questions that the current debate on the commodity cycle tends to conflate. Does the rally that kicked off in spring 2020 have further to go? And are we in the early stages of a so-called “supercycle”,.

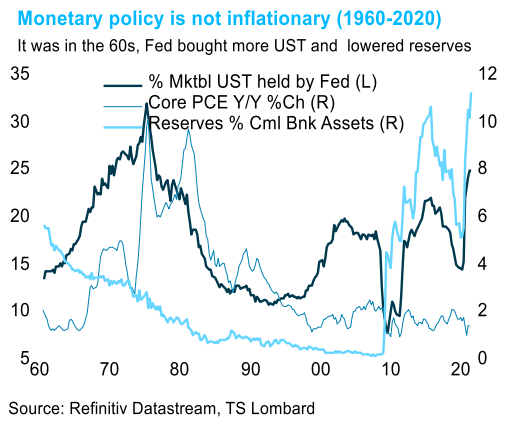

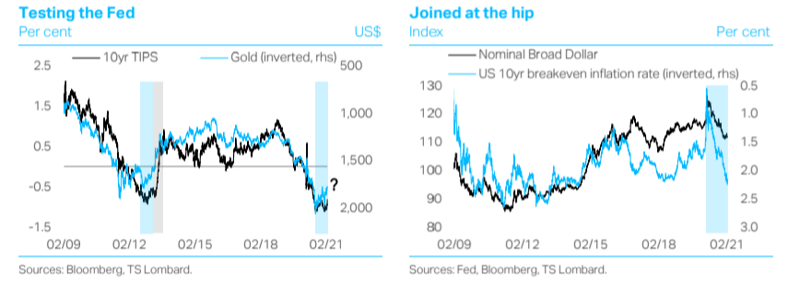

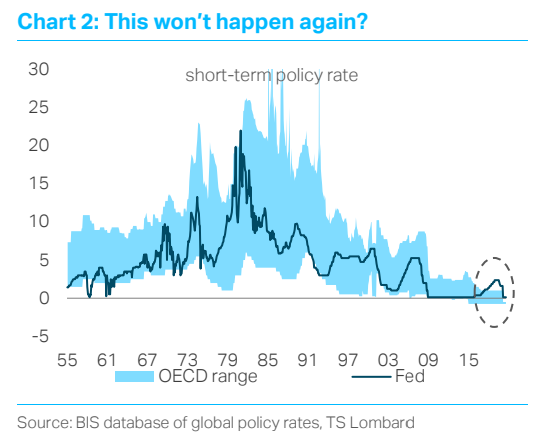

#Federal Reserve #Stimulus #Commodities #OilThe Fed hits a wall

29 Jan 2021 - Steven BlitzThe Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC.

#Federal Reserve #Inflation #US Economy #Yield curve #BubbleEconomists’ guide to Christmas (redux)

23 Dec 2020 - Dario PerkinsThis was something we published back in 2013 – the Economists’ guide to Christmas. But we made a serious omission, by leaving out Modern Monetary Theory. So here’s an update, incl. MMT: ‘If you put two economists in a.

#Central Banks #Federal Reserve #European Central Bank #Bank Of England #Bank of Japan #Modern Monetary TheoryThe Fed's Shortened Timeline

12 Nov 2020 - Steven BlitzThe vaccine arrives early 2021, so our growth forecast accelerates as a result, beginning in 2021 Q3, and the timeline for when the Fed first “tightens” shortens. It may seem odd to relay this view just when the.

#Federal Reserve #Monetary Policy #US Economy #Vaccine #Quantitative EasingThe Equity Market is now in charge

09 Nov 2020 - Steven BlitzBiden won, Trump lost, but lots of Republicans also won, and the October employment data help explain why – the population does not see the economy in crisis. The ongoing recovery in the labour market (906,000 private.

#Federal Reserve #Monetary Policy #Equities #Bond markets #US Economy #US ElectionCentral Banks are changing

30 Sep 2020 - Dario PerkinsOnce upon a time, it was my job to advise the UK government on the Bank of England’s policy remit, which the Chancellor has the option of adjusting every year. I’m sure whoever is in that role today is spending much of.

#Central Banks #Federal Reserve #Monetary Policy #European Central Bank #Inflation Client Login

Client Login Contact

Contact