If the Fed buys stocks? Then sell

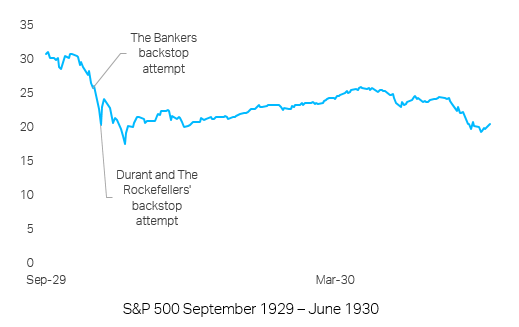

05 Aug 2020 - Charles DumasOctober 1929 – the Wall Street Crash is gathering frightening momentum. Several leading Wall Street bankers get together and decide to backstop the stock market, they come out swinging, placing a bid to purchase a large.

#Federal Reserve #Recession #Stock MarketWill Coronavirus collapse small banks?

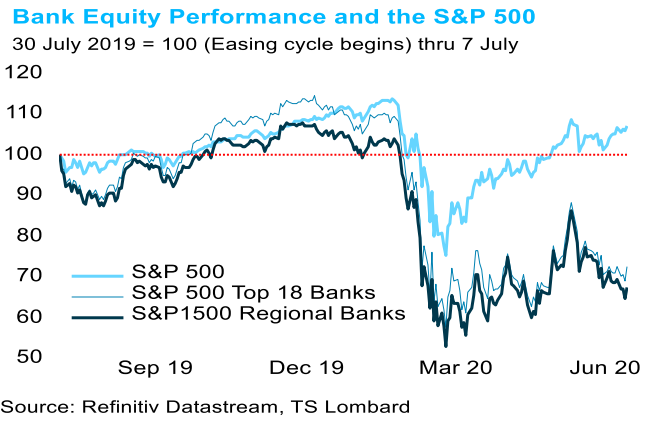

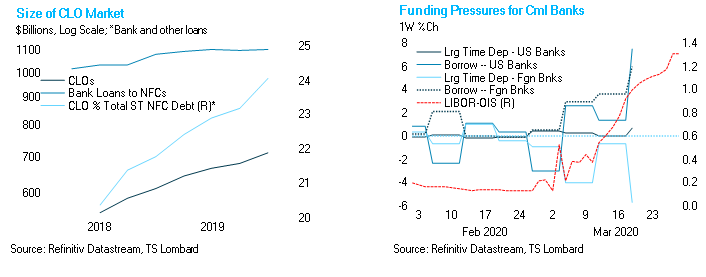

14 Jul 2020 - Steven BlitzEquity market participants are putting banks in the performance penalty box, likely figuring on stressed balance sheets becoming problematic later this year. The equity market has it right, in our view. Comparing the.

#Federal Reserve #Inflation #Equities #Balance SheetPolitics of unemployment to reign

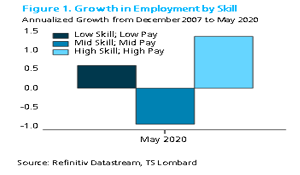

26 Jun 2020 - Steven BlitzAs the economy reopens, the revealed recessionary environment will reflect the imbalance of the expansion just ended – a surplus of service-related workers with no obvious direction in which to go to find re-employment..

#Federal Reserve #Interest Rates #Fiscal Policy #Bear Market #Unemployment #US ElectionInvestors can’t rely on central banks

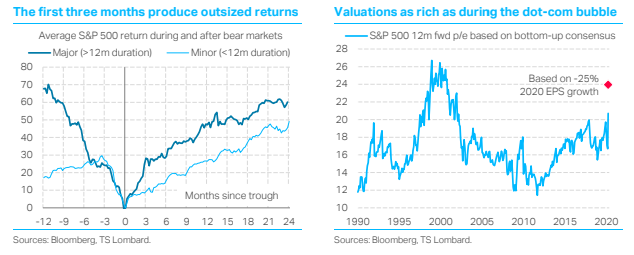

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketCOVID-19 and secular stagnation - the next business cycle

16 Jun 2020 - Dario PerkinsCOVID-19 has resolved our most popular client question of the last five years – “when will this cycle end?’ Even as the number of infections slows and the lockdowns end, most economies will reopen to a serious global.

#Federal Reserve #Monetary Policy #Equities #Bond markets #Covid19Fed policy pivots to the 10 year

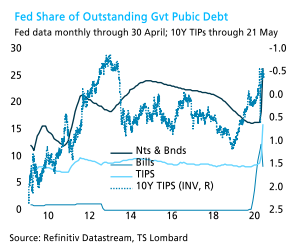

22 May 2020 - Steven BlitzOnce the Fed started buying mass sums to support markets, we began writing that policy was locked into using the balance sheet to manage rates and the yield curve. Reading the April FOMC minutes, we see that this has.

#Federal Reserve #Balance Sheet #FOMC #Yield curve7 reasons the rally won't last

21 Apr 2020 - Andrea CicioneAndrea Cicione, our Head of Strategy, and Steven Blitz, our Chief US Economist, answer the following 7 questions: Equity markets have rallied on the back of unprecedented fiscal and monetary support. Why do we think.

#Federal Reserve #Covid19Fed's new role - Treasury's bank

31 Mar 2020 - Steven BlitzThe Fed ramped up its balance sheet by over $500bn in the past week to $5.3trn (it was $4.2trn a month ago), to support its first line efforts to keep markets liquid and reduce the dollar’s scarcity value through swap.

#Federal Reserve #Balance Sheet Client Login

Client Login Contact

Contact