Hawkish markets to force global policy response?

04 Nov 2021 - Dario PerkinsA simple narrative is taking over financial markets, especially the short end of the yield curve, where the idea that central banks are “behind the curve” is rapidly gaining traction. Initially, it was just the emerging.

#Central Banks #Monetary Policy #InflationWhy central banks are suddenly sounding hawkish

29 Sep 2021 - Dario PerkinsCentral banks across the world have pivoted to a more hawkish mode in recent weeks. While this is in part acknowledgement that the recovery from COVID is continuing – albeit more hesitantly than officials expected at.

#Central Banks #Monetary Policy #InflationWhen the V starts to fade

17 Sep 2021 - Konstantinos VenetisThe looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the.

#Monetary Policy #Inflation #Equities #Stock Market #VolatilityThe Bank of England’s monetary ‘put’ need not imply static policy

28 Jun 2021 - Konstantinos VenetisJune’s MPC meeting delivered no surprises, but the debate within the Committee is becoming more nuanced. A closer look at the minutes reveals early signs of a rift between 1) those members on alert for imminent signs of.

#Inflation #Interest Rates #Bank Of England #Quantitative EasingBonds are saying the market needs a new catalyst

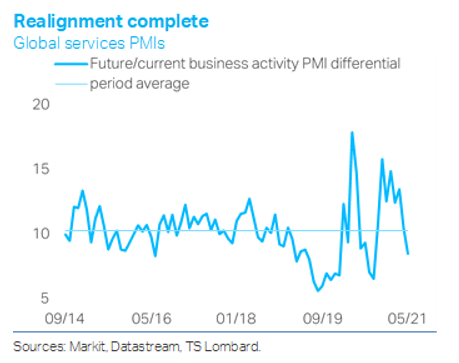

15 Jun 2021 - Konstantinos VenetisThe second quarter of 2021 is set to mark the peak in quarterly GDP growth for most of the major economies, which will give way to a still solid but slower pace of expansion as the transition from an early to a.

#Federal Reserve #Inflation #Bond markets #RecoveryMid-cycle transition means no more low-hanging fruit

11 May 2021 - Konstantinos VenetisThis economic cycle has matured very quickly, courtesy of a strong policy response and the speedy arrival of effective vaccines against Covid-19. Indeed, this has felt more like a bounce-back from a natural disaster.

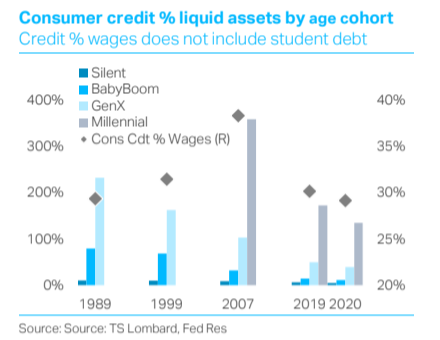

#Federal Reserve #Inflation #Bond marketsDo consumers ever borrow again?

13 Apr 2021 - Steven BlitzIf the coming expansion is to be different from the last one, consumers will boost their borrowing relative to income – and there is good reason to believe they will. If they do, real growth gets a lift and so too.

#Federal Reserve #Inflation #US Economy #Debt #UnemploymentSecular turning point in inflation?

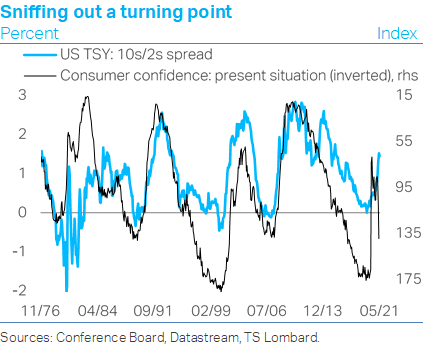

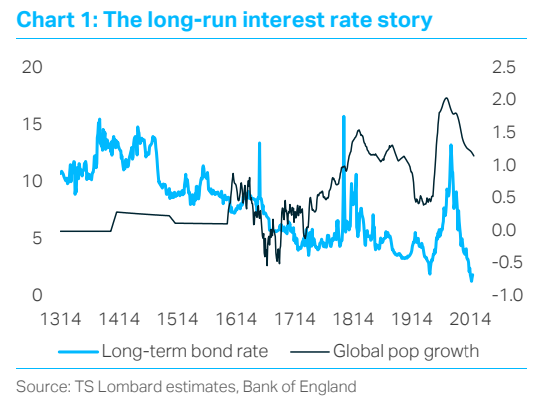

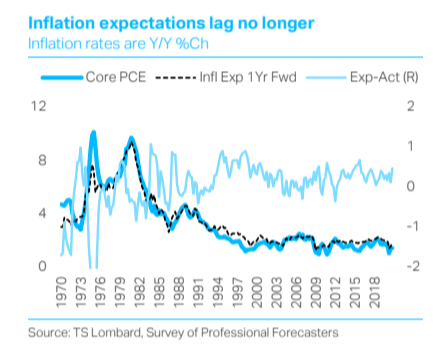

12 Mar 2021 - Dario PerkinsThese days, economists tend to assess monetary policy relative to some deep underlying interest rate (the “equilibrium rate”, or r*) which depends on structural forces and is largely beyond the control of central banks..

#Central Banks #Monetary Policy #InflationU.S. inflation has to wait

12 Mar 2021 - Steven BlitzAny inflationary process must wait for short rates to drift above what the Fed pays for bank reserves, until then its price changes inside a post-recession disinflationary trend. February CPI data underscore the.

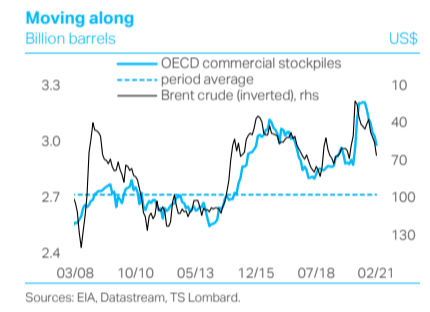

#Inflation #Quantitative Easing #RecoveryOil: new playbook, same old cycle

05 Mar 2021 - Konstantinos VenetisWe have often made the argument that although the nature of the Covid shock makes this macro cycle unique, it is important not to lose sight of the fact that this remains a cycle. The same is true of the oil market..

#Inflation #OPEC #Commodities #Oil Client Login

Client Login Contact

Contact