We’ve been saying for long time that a fiscal boost is necessary to rebalance the EA and to kickstart growth. At first glance, member states’ Draft Budgetary Plans (DBP) for 2020 suggest they’re starting to listen. But don’t read too much into the numbers: fiscal policy probably isn’t about to ride to the rescue.

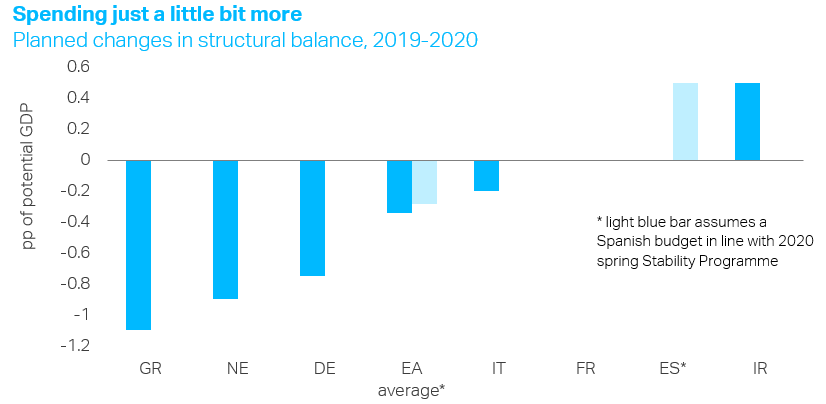

First, the good news. The DBPs suggest that the EA is heading in aggregate for a modest easing in 2020 – by our calculations, of around 0.35% of GDP. More promisingly, the legwork will be done by those who can best afford it: the Dutch and the Germans are respectively pencilling in extra spending of around 0.9% and 0.75%.

Not only does that modest headline figure of 0.35% not look quite so small against the ECB’s projection of 1.2% growth for the EA in 2020, but the extra stimulus will come in the countries with negative output gaps (IT & GR), and in those with most cash to splash and arguably the biggest need to rebalance (NE & DE). Perhaps most significantly, the Dutch and German figures seem to be the latest evidence of a broader, slower shift in attitudes, towards less parsimonious budgeting.

But this small planned stimulus won’t do much for EA growth in 2020. For a start, at an EA level, the stimulus will be no greater than it was in 2019, when growth hovered anaemically around 1%.

And worse still, there is every reason to think that EA member states will collectively end up spending less than the plans suggest. In aggregate, draft budgets often actually overestimate Eurozone governments’ largesse.

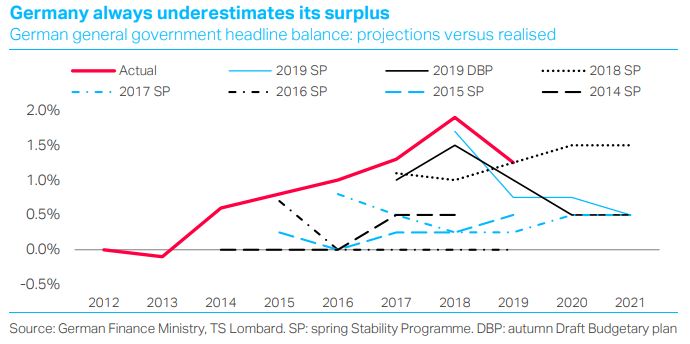

Our calculations suggest that the EA’s structural fiscal stance in 2019 was almost 0.3pp tighter than projected in member states’ budgets. Some of this is due to Italian spending coming in lower than expected. But the big culprit was Berlin, which loosened policy much less than it had planned.

A major contributing factor to Germany’s large surpluses is the systematic pessimism of the federal finance ministry’s budgetary projections. Its spring projections generally underestimate Germany’s headline (and structural) surpluses for the same year by around 0.8pp of GDP, in a way that can’t just be put down to growth surprises. Calculations by the think-tank Bruegel suggest that the error lies in their revenue forecasts. Essentially, every spring, the finance ministry underestimates its revenues for that very year by an amount roughly equal to the entire GDP of Estonia.

If Germany underestimates its revenues again in 2020, as it does every single year, the EA’s projected loosening will virtually disappear and the aggregate fiscal stance for the year will be close to neutral. So it’s good news that Germany and the Netherlands are feeling more spendthrift. But until Berlin can get its numbers right, even that little tailwind won’t materialise.

Client Login

Client Login Contact

Contact