The nature of the Covid-19 shock makes this macro cycle unique – but this is still a macro cycle. The pattern remains the same. A contraction in GDP is met with counter-cyclical policy measures that aim to get the economy back on track. Sooner or later this leads to signs of “green shoots” in real activity that tend to foreshadow the onset of broader macro re-acceleration. Ultimately this allows policymakers to start thinking about paring back stimulus.

This time round, the sequence has so far played out in steroids. We have witnessed the most violent combination of economic downturn and reflex snapback in recent history, accompanied by massive policy stimulus. What is more, the impact from the pandemic on employment and earnings has been highly bifurcated across the economy, creating winners and losers – and this has been mirrored in stock market returns.

Markets have priced out the fear, giving the illusion of a “return to normal”. Equities, commodities, inflation expectations, PMIs and the dollar have all returned to pre-Covid levels. But the reality is that the world economy is nowhere near out of the woods. Macro visibility is limited, and this means pressure on the authorities to do more is likely to intensify: it is hard to see how policymakers can avoid erring on the side of too much, rather than too little, stimulus for some time to come.

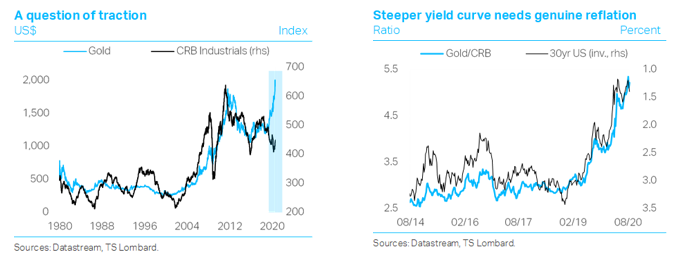

What remains to be seen is if and when the reflationary mix of fiscal and monetary policy easing can gain traction in the real economy, and by how much – commodities are sending a promising signal. The CRB Industrials index bottomed out in late April and has been trending higher, underpinned by the combination of a softer dollar and a stable yuan. Further, looking at the relationship between gold (a proxy for global monetary reflation) and industrial commodities (a proxy for real economic activity) is instructive. The yawning divergence that has developed this year, marked by strong gains in gold prices, is unusual. Gold tends to lead moves in industrial commodities. So, if history is any guide, industrials are more likely to catch up with gold rather than the other way around. This would be consistent with a powerful turnaround in the global cycle, validating expectations for a steeper yield curve.

What remains to be seen is if and when the reflationary mix of fiscal and monetary policy easing can gain traction in the real economy, and by how much – commodities are sending a promising signal. The CRB Industrials index bottomed out in late April and has been trending higher, underpinned by the combination of a softer dollar and a stable yuan. Further, looking at the relationship between gold (a proxy for global monetary reflation) and industrial commodities (a proxy for real economic activity) is instructive. The yawning divergence that has developed this year, marked by strong gains in gold prices, is unusual. Gold tends to lead moves in industrial commodities. So, if history is any guide, industrials are more likely to catch up with gold rather than the other way around. This would be consistent with a powerful turnaround in the global cycle, validating expectations for a steeper yield curve.

Too early to get excited. Our take is that it would be premature to anticipate this kind of move. While the divergence is likely to moderate, it is also likely to persist. The policy measures launched so far are anti-deflationary, not reflationary. The surge in money and credit aggregates has thus far been overwhelmingly precautionary in nature, i.e. it reflects not a bullish resurgence in animal spirits but a private sector that is taking out insurance against future cash flow problems. Households and firms are likely to be reluctant to ramp up spending as long as lingering fears about the pandemic keep confidence levels low. It will take genuine (or, pro-cyclical) acceleration in bank lending, marked by a revival in business capex, to produce “real” reflation, i.e. a mix of faster growth and higher consumer price inflation that translates to material yield curve steepening.

Too early to get excited. Our take is that it would be premature to anticipate this kind of move. While the divergence is likely to moderate, it is also likely to persist. The policy measures launched so far are anti-deflationary, not reflationary. The surge in money and credit aggregates has thus far been overwhelmingly precautionary in nature, i.e. it reflects not a bullish resurgence in animal spirits but a private sector that is taking out insurance against future cash flow problems. Households and firms are likely to be reluctant to ramp up spending as long as lingering fears about the pandemic keep confidence levels low. It will take genuine (or, pro-cyclical) acceleration in bank lending, marked by a revival in business capex, to produce “real” reflation, i.e. a mix of faster growth and higher consumer price inflation that translates to material yield curve steepening.

Gold support. As a reminder, rising high-street price inflation is neither a necessary nor a sufficient condition for elevated gold prices. Looking ahead, gold is likely to stay underpinned by depressed interest rates. Whether right or wrong, at this juncture investors are penciling in very low/negative nominal DM bond yields for as far as the eye can see. With the major central banks communicating a bias towards (de facto) yield curve control, gold – and real assets more broadly – could continue to do well from an asset allocation standpoint even if there is an orderly rise in long real interest rates from current levels. And if inflationary pressures were to gather pace, it will be some time before policymakers show concern. In addition, gold stands to benefit as the dollar loses some of its shine: interest rate support is not what it used to be; and the Fed is minded to alleviate shortages. After all, in nominal trade-weighted terms, the dollar has so far only fallen to where it was in early March.

The message is two-fold. First, while industrial commodities are sending a promising signal for the global macro cycle, it is too early to bet on a powerful re-acceleration – particularly as most EMs remain stuck in a start-stop recovery amid still high levels of virus infections. Second, for those worried that the recent surge in money and credit could soon bring about a regime change in inflation, it would make more sense to pile into industrial commodities than into gold.

In short, industrials are the play for genuine reflation; gold is the play for outcomes closer to stagflation. For the time being, it looks like we are going to be stuck somewhere in the middle.

Client Login

Client Login Contact

Contact