The inflation problem for the US is not rent, but the loss of zero inflation in goods prices as an offset, and this offset is unlikely to return in the coming cycle. One can say current goods price inflation is the unfortunate consequence of high demand meeting constrained supply, but this argument shoves aside the underlying issue that has the Fed itching to tighten – revived middle income wage growth keeping goods prices high and, in turn, overall inflation as well. This group has been lagging in wages for over a decade and many have experienced downward mobility in jobs and pay thanks to a strong dollar teaming with technology to make possible, and profitable, offshore production of goods and services and reduced labour input for domestic production. Better income growth in 2020-21 (wages, stimulus payments, tax credits) helped boost demand to replace goods that have gotten very old (average age of a car on the road is 12.1 years, compared to 10.6 years in 2010, and a record 25% of cars are 16 years old and older). Still strong goods demand will again be in evidence in 2022 because of high wage growth broadening across all categories of employment.

The easing of supply constraints will reduce goods inflation (December CPI data show slowing inflation of everyday items), and some prices will even deflate for a time. Nevertheless, with the economy now transiting to a “normal” expansion, we can see how Covid, and demographics, have left it with a seemingly permanent mix/shift in activity that boosts wages for mid- and low-skill workers. This prospective change in the nation’s inflation dynamics is what has the Fed on edge, not chip shortages or rising rents.

Restoring middle-income jobs and wages became a political imperative once Trump became President, it still is, and this means restoration is the objective of economic policy. The Fed, so far behind on inflation, and understandably unwilling to publicly declare war on rising wages will keep their rhetoric focused on prices. And the only prices they can tame without creating a recession are goods prices, by way of a stronger dollar and the hope that global pressures on goods prices abate (they should) and leave wage increases short of productivity gains. Problem is, goods price inflation, as opposed to the rent inflation of the past generation, is also what can boost productivity and revive wages and jobs in the mid-income mid-skill arena – up to a point (relationships curve, often bend back on themselves – linear is an illusion). In the end, the Fed will tighten, work to keep the curve positive (I will have a US Watch on the balance sheet out tomorrow morning), but end up declaring 3% the new inflation target.

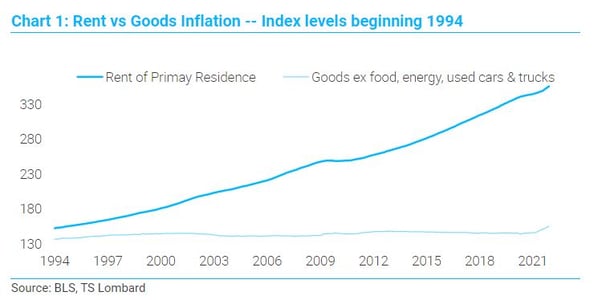

The point about goods inflation versus rent is made clear in Chart 1. Some, including the Fed, might argue that is not their issue, it represents a shift in relative prices and all that – but the fallout from how inflation managed to stay low does matter. Sensitivity to this issue is already in full view through the adoption of AIT and a generally more socially aware take on the impact of monetary policy.

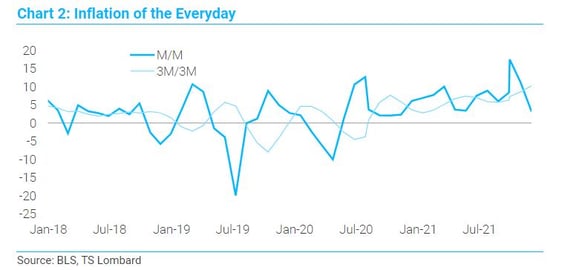

The inflation of what people see every day has dropped off sharply since October on a M/M basis and is now tracking below the 3M/3M rate of change (Chart 2). I created this “inflation of the everyday” by putting together a collection of CPI indexes for products and services that people purchase on a regular basis (food, gas, laundry, car repair, tobacco, alcohol, restaurants, haircuts, cable service, cell phones, childcare services, and the like). The components are weighted based on their weights in the broad index.

The inflation of what people see every day has dropped off sharply since October on a M/M basis and is now tracking below the 3M/3M rate of change (Chart 2). I created this “inflation of the everyday” by putting together a collection of CPI indexes for products and services that people purchase on a regular basis (food, gas, laundry, car repair, tobacco, alcohol, restaurants, haircuts, cable service, cell phones, childcare services, and the like). The components are weighted based on their weights in the broad index.

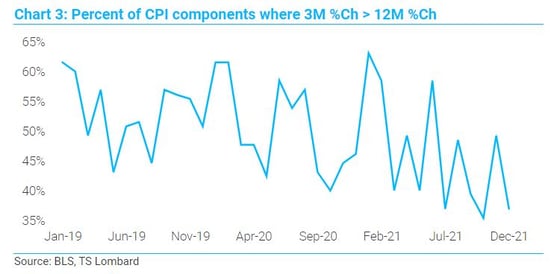

The December CPI also showed a narrowing in the percentage of components whose three-month rate of change is above the 12-month change, a sign inflation is decelerating (Chart 3).

The December CPI also showed a narrowing in the percentage of components whose three-month rate of change is above the 12-month change, a sign inflation is decelerating (Chart 3).

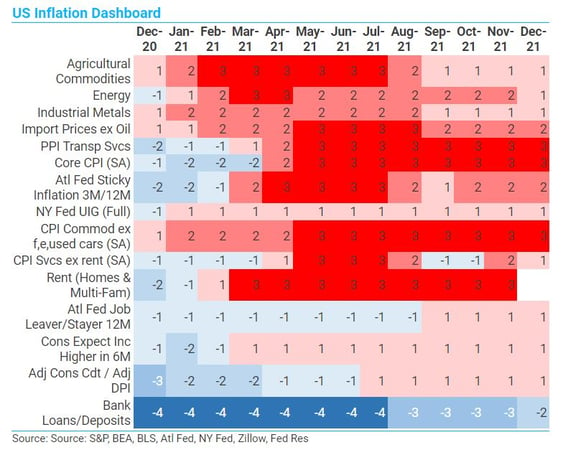

Below is our US Inflation dashboard, the hue is modestly less red than it was last month, thanks to energy prices and services excluding rent. Looking forward, the ratio of loans to deposits continuing to be less “cool” is a worrisome inflation indicator. Once consumer surveys begin to show high confidence in future wage growth, the inflation process can truly get underway as consumers return to leveraging their balance sheets – they did the opposite for the past 10 years despite higher wealth.

Below is our US Inflation dashboard, the hue is modestly less red than it was last month, thanks to energy prices and services excluding rent. Looking forward, the ratio of loans to deposits continuing to be less “cool” is a worrisome inflation indicator. Once consumer surveys begin to show high confidence in future wage growth, the inflation process can truly get underway as consumers return to leveraging their balance sheets – they did the opposite for the past 10 years despite higher wealth.

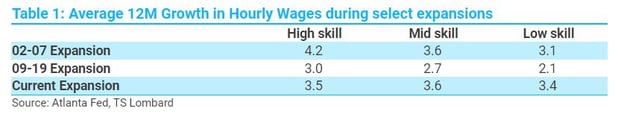

There are a lot of ways to look at the difference in the plight of high, mid-, and low skill workers, wages alone do not tell the whole story of downward mobility. Keeping it simple for this note, Table 1 just shows the average 12M growth rates for hourly wages by job-skill, as calculated by the Atlanta Fed, for different expansions in this century. What is striking is that in the current expansion, mid-skill wage growth is ahead of high skill wages. This likely changes in the coming year as wage growth broadens, but mid-skill compensation will still be stronger than it has been – and the same holds true for low-skill workers.

There are a lot of ways to look at the difference in the plight of high, mid-, and low skill workers, wages alone do not tell the whole story of downward mobility. Keeping it simple for this note, Table 1 just shows the average 12M growth rates for hourly wages by job-skill, as calculated by the Atlanta Fed, for different expansions in this century. What is striking is that in the current expansion, mid-skill wage growth is ahead of high skill wages. This likely changes in the coming year as wage growth broadens, but mid-skill compensation will still be stronger than it has been – and the same holds true for low-skill workers.

In sum, the mix/shift in activity will continue to revive mid-skill employment and wages and this, in turn, will keep goods inflation from returning to its flat trend pre-Covid. The loss of zero goods inflation is what will keep overall core inflation higher in this cycle – not rent. Leaning against this inflation is politically problematic for the Fed, a task made more difficult by their limited options. This is not, to date, a credit inflation but an inflation rooted in large scale income transfers that the Fed financed, and the changes in the organization of economic activity created by Covid. Given the politics involved, the Fed will likely declare 3% the inflation target and leave it at that – all the while still hoping for a deflationary wave from China and the rest of the world.

In sum, the mix/shift in activity will continue to revive mid-skill employment and wages and this, in turn, will keep goods inflation from returning to its flat trend pre-Covid. The loss of zero goods inflation is what will keep overall core inflation higher in this cycle – not rent. Leaning against this inflation is politically problematic for the Fed, a task made more difficult by their limited options. This is not, to date, a credit inflation but an inflation rooted in large scale income transfers that the Fed financed, and the changes in the organization of economic activity created by Covid. Given the politics involved, the Fed will likely declare 3% the inflation target and leave it at that – all the while still hoping for a deflationary wave from China and the rest of the world.

Client Login

Client Login Contact

Contact