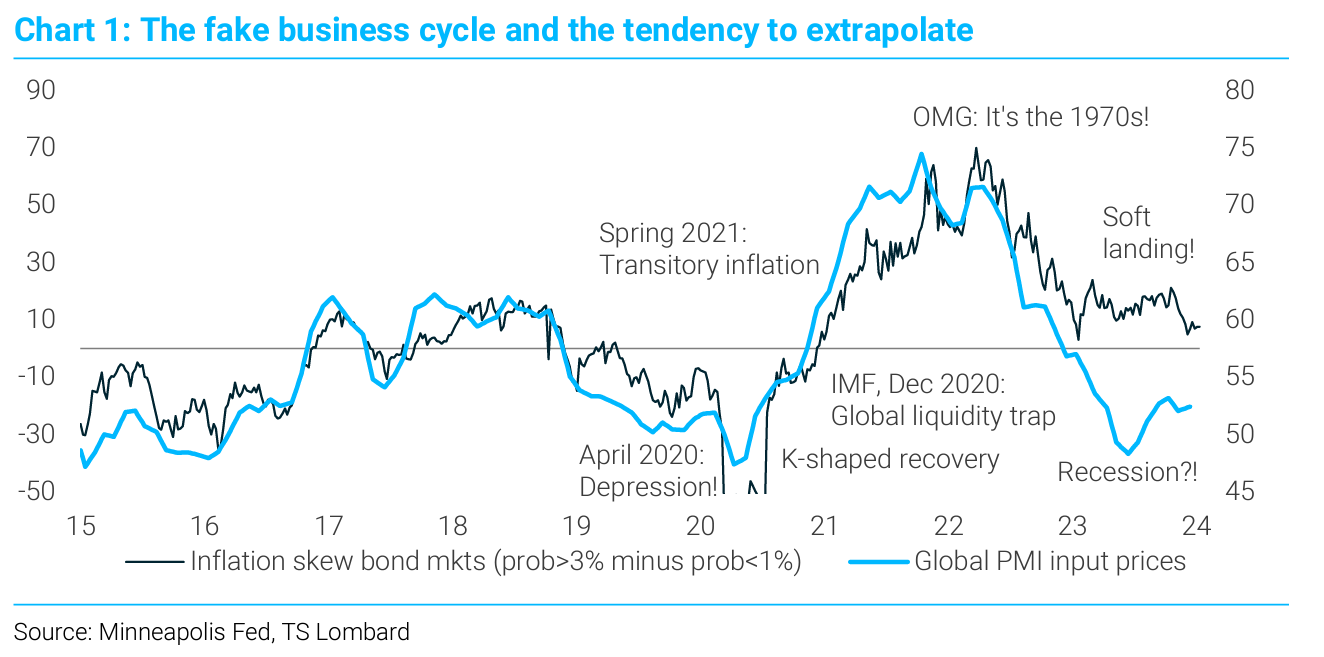

Compared with many of my peers in the financial industry, I’ve been using a very different framework to analyse the evolution of the global economy since its reopening from COVID-19. While most have fruitlessly tried to fit a traditional business cycle to post-pandemic macro trends, I keep reminding investors that we have been living in a distorted “fake cycle”. And the most important conclusion from this analysis was that it could lead to unexpected outcomes, including “immaculate disinflation”, a phony recession scare, and a “soft landing”. Eighteen months ago, most of mainstream economics scoffed at these ideas; today they are the consensus (worryingly, even the IMF has now endorsed the soft landing…). So, it’s time for an update, a review of what went right (since this can tell us what might still go wrong) and, most important, an assessment of whether we are now headed back to pre-COVID norms. I’ll use Q&As to keep it concise (-ish).

Q1: Why wasn’t this a normal business cycle?

Simple: 2020 was not a normal recession. The downturn was not the result of any organic macro process or a response to some underlying financial imbalance. Instead, governments shut down their economies and eventually reopened them, while using massive (but largely one-off) fiscal stimulus to support private-sector incomes and put the credit cycle into a deep policy-induced hibernation. Since then, we have seen huge macro distortions from a variety of sources, including:

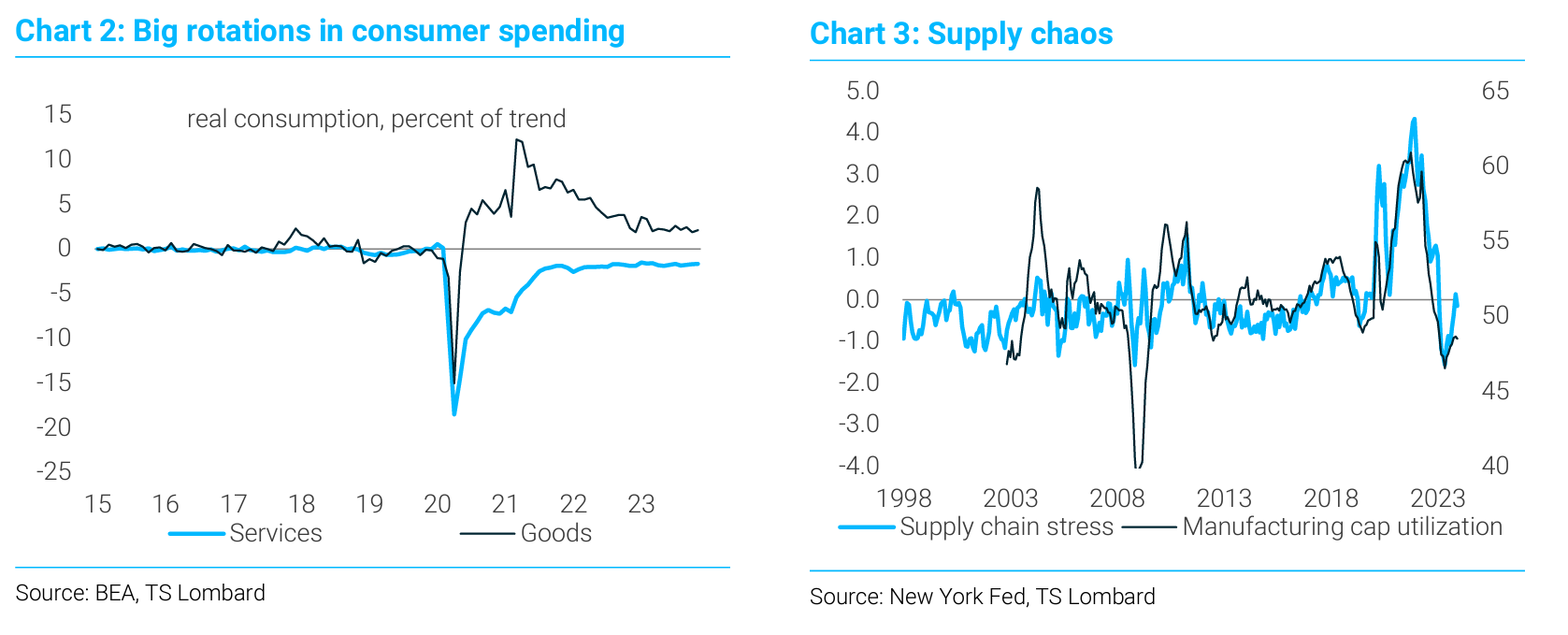

- Massive rotations in consumer spending (first into goods, then into services)

- Logistical chaos during reopening, which sent a powerful bullwhip through supply chains

- Further supply shocks from the war in Ukraine (and potentially the crisis in the Red Sea)

- Pent-up demand and “revenge spending” from excess saving and a fiscal overhang

- Demand-supply mismatches in jobs markets, particularly where the labour force shrunk

- “Volume destruction” from very high inflation (rising prices reduced real spending power)

- Confusing signals out of China, thanks to acute policy trade-offs amid a structural slump

Q2: What did mainstream economics get wrong?

Petty much everything. But to be specific, the main errors were:

- Allured by faulty leading indicators: Finance pundits put too much weight on erroneous "leading indicators". Weighted towards the manufacturing and industrial sectors, these were always going to exaggerate the danger of recession, as consumer spending swung from goods to services. The bullwhip cycle made a deep global manufacturing recession inevitable after reopening. But services – and therefore labour markets – stayed resilient.

- Mislead (again) by the Phillips curve: Economists looked at the combination of high inflation and low unemployment and assumed it was symptomatic of "overheating". Worse, according to the logic of the Phillips curve, this meant it would inevitably take economic "pain" to get inflation back down. Phillips curve "sacrifice ratios" implied a deep recession (with a large rise in unemployment) was needed to restore price stability.

- Confused by levels effects: Many confused a one-off shift in the price level with the start of an inflationary spiral. Just because the price pressures became broad-based didn’t mean they would persist. The correct historical template was the 1940s, especially the transition period after WW2, not the 1970s. There would be no “wage-price spiral”. Inflation is about power, and you couldn’t reverse half a century of neoliberalism (which totally crushed the bargaining power of labour) with a one-off fiscal stimulus.

- Getting causal relationships wrong: Economists tend to think of a line of causation that runs from output to inflation. Run the economy too hot and you get inflation. But the link worked in reverse after the pandemic, as very high inflation squeezed real incomes. If inflation was transitory, the weakness in the real economy would fade as inflation fell.

- Misreading yield curves: Yield curve inversion was a sign that monetary policy was tight, not necessarily a signal that recession was inevitable. There was always a possibility of non recessionary rate cuts, especially when pragmaticism returned to policymaking.

Q3: How have we avoided a recession (so far)?

Services-sector demand is essentially demand for labour. Buoyancy in that sector has kept jobs markets resilient. Since the recessionary process is all about the reflexivity that kicks in as employment declines, we have not seen a genuine recessionary dynamic anywhere in the developed world. “Technical” recessions do not count. The focus on quarterly GDP is rather silly.

Facing acute staff shortages after the pandemic, companies have hoarded labour. Unusually fat profit margins provided a cushion that at the same time discouraged reductions in headcount.

Fiscal policy has remained highly supportive. There was an overhang from COVID bailout programmes (in the form of “excess savings”) and governments added new fiscal packages, including energy bailouts in Europe and Bidenomics (strategic industrial policies) in the US.

As inflation has come down, real income growth has recovered. This has allowed consumers to keep spending even when they are no longer willing or able to reduce their saving rates. Recent signs of a reacceleration in the US economy are testimony to the benefits of falling inflation – we should expect to see similar dynamics in Europe, especially if policymakers end their squeeze.

Companies and households have “termed out” their debt. This, together with strong nominal income growth, has insulated the economy – to some degree – from higher interest rates. Much of the anxiety about the impact of policy tightening was too “static” because it ignored income.

4. Have we definitely soft-landed? What happens next?

We are on course for a soft landing, but tight monetary policy is still a threat. Central banks overreacted to the post-pandemic inflation outbreak and policy remains extremely restrictive by all pre-COVID standards (despite what popular – but faulty – “financial conditions indices” say). The recession threat was always about the potential for a monetary-policy whipsaw. Bank officials, by overreacting to supply shocks and one-off fiscal stimulus, have become a source of macro instability over the past three years (moving away from the “efficient Taylor frontier”). While the business cycle has been “fake”, the impact of monetary tightening has been very “real”. So far, policymakers have got away with their mistakes, but their luck may eventually run out:

- To the extent there was policy-induced "demand destruction" in labour markets, it happened through job openings (vacancies) rather than employment. The authorities were helped by a "divine coincidence" whereby the most rate-sensitive sectors of the economy - which saw the biggest reductions in vacancies –were also the sectors with the most severe labour shortages. To the extent open vacancies constitute unrealized demand, firms were able to close those positions rather than lay off existing members of staff. But the divine coincidence could break down, especially now that job vacancies are back to pre-COVID levels and profit margins have normalized. If there is further demand destruction from tight monetary policy, we are perhaps more likely to see aggregate (net) job losses. In the extreme, this could set off a true recessionary dynamic.

- We see the potential for further pain in areas that have not yet adjusted to current interest rates – namely, residential property, CRE (which has not “marked to market”) and SME funding. A lot of smaller companies face a maturity wall, which will squeeze profits.

To secure the soft landing, central banks might need to cut interest rates soon to head off these problems. The good news is that, with inflation back to acceptable levels, they have the option of reducing interest rates: they could cut rates 100-200bps and still have policy that is “restrictive” by the standards of the pre-COVID economy. What are they waiting for?

As a reminder, there were always three conditions for a soft landing:

1. Inflation back at tolerable levels – ACHIEVED2. Demand/supply imbalances in labour markets gone – LARGELY ACHIEVED

3. Resilience to higher rates/policy reversal before something breaks – IN PROGRESS

5. Let’s assume a soft landing. Has anything really changed since 2019?

Since this has been a fake cycle, caused by massive temporary distortions, it is tempting to think everything will go back to the way it was in 2019. But that would be a mistake, because:

- If they dodge a recession, policymakers will be locking in inflation close to their targets and labour markets as tight as they were doing after a decade of expansion in the wake of the global financing crisis. Any recovery from here is likely to generate sustained (but perhaps gentle) reflation. This changes the “prevailing tendency” of inflation: 2% becomes the new floor rather than the old ceiling. The bias in monetary policy shifts. No more QE, ZIRP, NIRP etc.

- COVID, the war in Ukraine and now the crisis in the Red Sea have intensified structural geopolitical tensions that were emerging long before the pandemic. Deglobalization is real and likely to gain further traction in the years ahead (see here for more).

- The penchant for expansionary fiscal policy (which pre-dates the pandemic) is not going away. We see a world of more activist government interventions. Strategic industrial policy is here to stay. The neoliberalism of the post-1980s is firmly in retreat. There will be no return to austerity, even in Europe. (see here for more)

- We are likely to see further negative supply shocks, from both the physical effects of climate change and the impact of the green transition (see here for more).

- Recent developments in new digital technologies, specifically AI, have confirmed the prospect of an acceleration in productivity (see here for more).

- The pandemic showed that ageing demographics are not inherently deflationary (contrary to the prevailing myth). When older people drop out of the labour force, the bargaining position of younger workers improves. At the same time, savings decline.

6. What does this mean for the global economy in the 2020s?

- The Great Moderation is over. Periodic supply shocks will create additional volatility in inflation, which, in turn, will produce larger short-term gyrations in real GDP.

- Inflation will be somewhat higher, but this will be due mostly to upside volatility. It is hard to say exactly how much average inflation will rise, but an extra 100bps is reasonable. The more important point is about the “prevailing tendency” of inflation: we see a world where it is always threatening to break out to the upside rather than sink to the downside.

- Real GDP growth is likely to be higher, too, thanks to tighter labour markets (faster wage growth), a more expansionary fiscal-monetary mix and more rapid investment (in areas such as AI, decarbonomics, defence and the reconfiguration of global supply chains).

- Productivity probably improves in a higher-pressure economy, where companies are forced to work existing resources harder (rather than rely on cheap borrowing and low wages). We are already seeing signs of this in the US. Over time, technological diffusion, which was remarkably poor in the perma-lukewarm economy of the 2010s, should also accelerate, ending the so-called “productivity puzzle” of the post-GFC era.

7. What would these mild secular shifts mean for financial markets over the longer term?

- We see a secular bear market in bonds. Given that a large part of this move is already behind us, it is better to think from here in terms of higher lows and higher highs in yields.

- The bond-equity correlation, while still negative on average, is likely to weaken owing to more frequent supply shocks, which will produce episodes (like 2021-23) where the correlation switches to positive. This should raise term premia and dilute 60:40 returns.

- Rising macro volatility and higher interest rates should cap overall stock-market valuations. But rather than a secular derating, there is room for a rotation, both within US sectors (from “growth” to “value”) and from the US to the rest of the world. The investment opportunities of the 2020s are about themes, not continuous “rerating”.

- To end on an optimistic note, it is possible that greater short-term macro vol could, in fact, enhance longer-term financial stability. Think Hyman Minsky in reverse (after all, the Great Moderation was a misnomer because it concealed deep underlying problems.)

For more from Dario please request a trial to our research, (certified investment professionals only, please)

Client Login

Client Login Contact

Contact