Dario Perkins

Recent Posts

CENTRAL BANKS – BETTER LUCKY THAN SMART

11 Jul 2024 - Dario PerkinsSummary Though most people are unhappy about the state of the global economy, from the perspective of the average central banker, it is not clear how things could have gone any better. Inflation has returned to.

10 popular questions about monetary policy

15 Apr 2024 - Dario PerkinsSummary Since the start of the year, global investors have been particularly keen to understand global monetary policy – in terms of both the impact interest rates are having on the macro economy, and the prospects for.

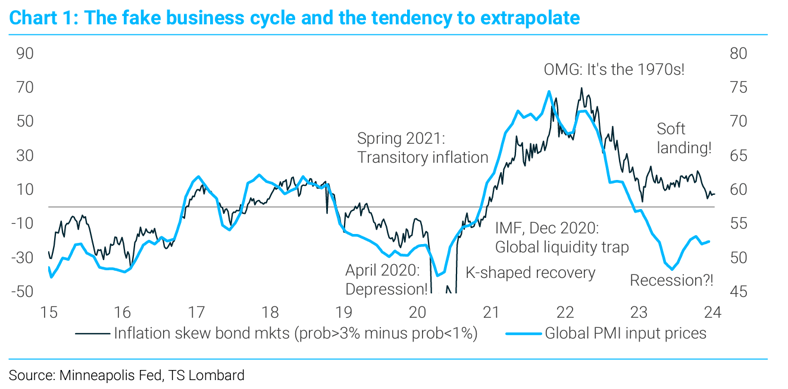

Where are we in the cycle?

07 Feb 2024 - Dario PerkinsCompared with many of my peers in the financial industry, I’ve been using a very different framework to analyse the evolution of the global economy since its reopening from COVID-19. While most have fruitlessly tried to.

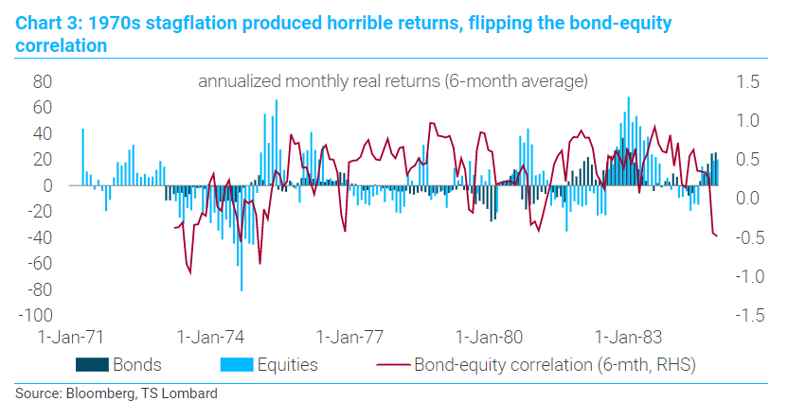

2008 PTSD VS THE GHOSTS OF THE 1970S

31 Mar 2023 - Dario PerkinsCentral banks have been raising interest rates aggressively for just over a year. During that period – the fastest and broadest monetary tightening episode in history – investors have been anxiously waiting for.

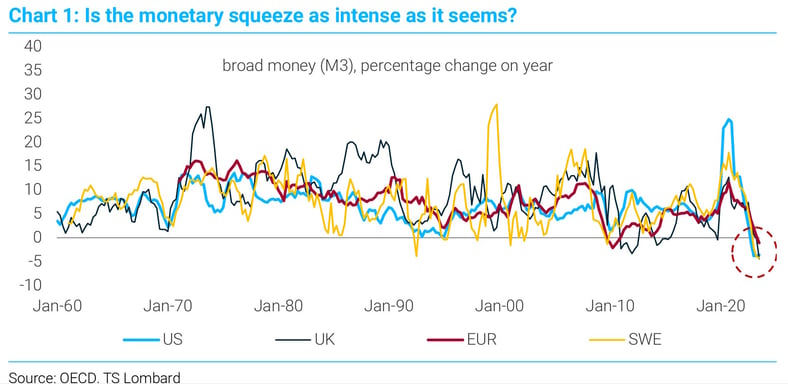

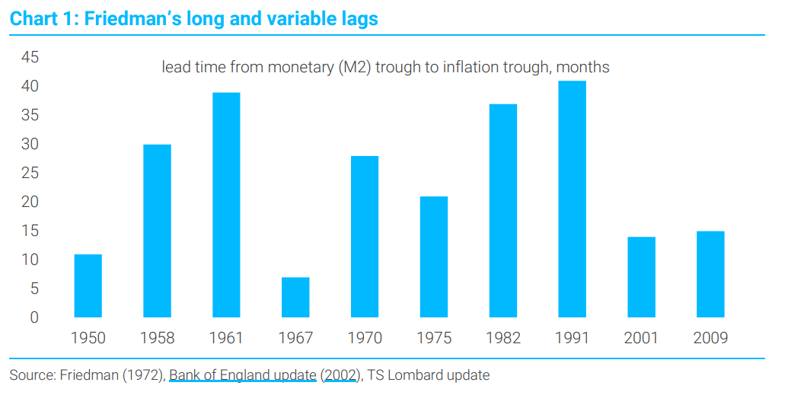

Shorter and Less Variable

02 Feb 2023 - Dario PerkinsThere is a bull market in sellside economists predicting recessions. Ask any of them why they believe 2023 will produce an even worse macro environment than 2022 and you can be sure the words “long and variable lags”.

Things that won't happen in 2023

21 Dec 2022 - Dario PerkinsSince we first published our annual “Things that won’t happen” outlook in 2015, writing outlandish non-forecasts has become considerably more difficult. Back then, nobody would have taken us seriously if we had said.

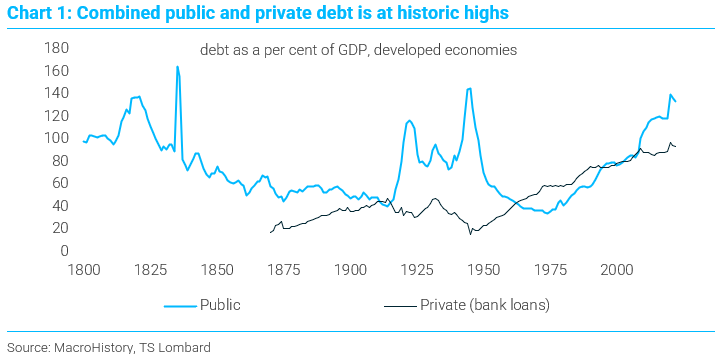

Inflation was always the Endgame

04 Nov 2022 - Dario PerkinsThere is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false..

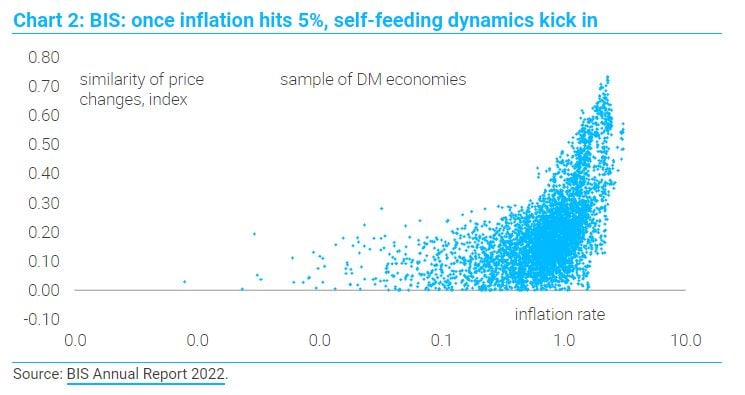

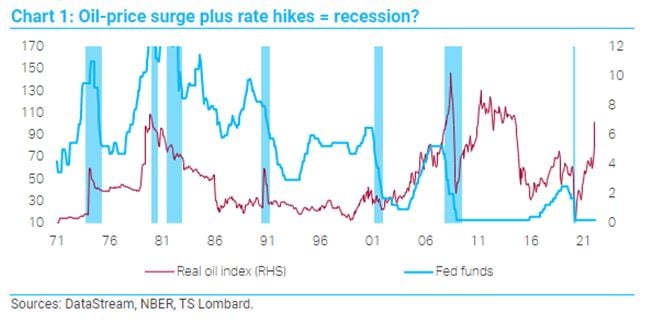

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentThe nightmare scenario for central banks

14 Jul 2022 - Dario PerkinsEvery investor wants to know whether central banks are prepared to cause a recession in order to force inflation down. Surely, officials are bluffing, right? But think about it from the central banker’s perspective..

#Central Banks #Monetary Policy #Eurozone #United KingdomA recession to tame inflation?

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionDon't bet on a soft landing

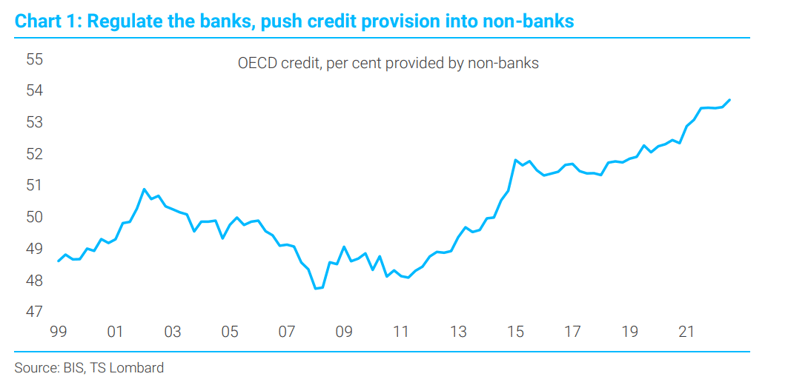

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

#Central Banks #Monetary Policy #Inflation #Eurozone #Recession Client Login

Client Login Contact

Contact