Some EM lockdowns are starting to ease. Many EM economies are now 3-4 weeks into restrictive measures and progress is seemingly being made on flattening the curve. Thoughts are turning to the exit strategy. India and South Africa, which had imposed two of the most severe lockdowns among EM, have partially eased measures. In Mexico, Turkey and Indonesia, however, which we previously identified as most at risk of a deeper public health crisis, lockdown measures are at last being tightened. In Brazil, the lockdowns imposed by regional authorities face a growing backlash joined by President Bolsonaro himself.

But EM are far from defeating the virus. Official statistics on the rate of infection likely reflect testing capacity, while reported deaths probably underestimate reality. There is nonetheless some improvement on these flawed measures. Total reported deaths in major EM ex-China, are now increasing at around 50% per week, down from 100% before the start of lockdowns.

China’s Q1 GDP shows what is in store for wider EM. China’s GDP contracted by 6.8% in Q1/20 reflecting the economic devastation of the lockdown. An infrastructure-led recovery will start in Q2, but we expect growth to reach only 2% YoY in 2020.

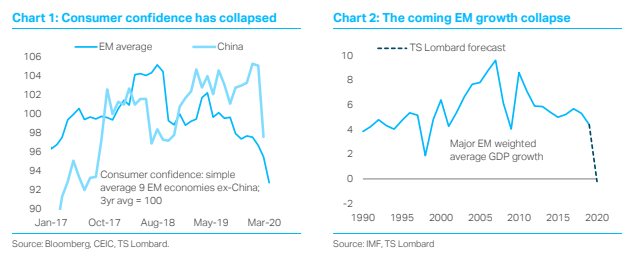

In China and elsewhere in EM, consumer confidence is unlikely to recover quickly (see Chart 1).

The collapse of EM growth will likely be the greatest in 30 years (see Chart 2). The GFC and Dot-com crises were primarily driven by DM economies during which China provided support for EM, while in the EM collapse of 1998, the large economies of both China and India escaped relatively unscathed. This time, we expect only China and the usually fast growing low income economies of India and Indonesia to register growth above zero, while most EM are likely to contract by around 5% or more (see Chart 3). Domestic demand and private investment will be worst hit, while falling trade weighs on EM exports.

The collapse of EM growth will likely be the greatest in 30 years (see Chart 2). The GFC and Dot-com crises were primarily driven by DM economies during which China provided support for EM, while in the EM collapse of 1998, the large economies of both China and India escaped relatively unscathed. This time, we expect only China and the usually fast growing low income economies of India and Indonesia to register growth above zero, while most EM are likely to contract by around 5% or more (see Chart 3). Domestic demand and private investment will be worst hit, while falling trade weighs on EM exports.Forecasting GDP growth at this time is even more problematic than usual. There is massive uncertainty in the trajectory of the US economy and in the other external drivers of EM growth, while we continue to expect a renewed downturn in global markets. Equally as important, each EM must first defeat the virus before its economic recovery can start to take shape, while the evolving fiscal response of governments to the crisis offers the possibility to reduce some of the more severe negative growth impact.

The deep contraction in EM will have negative feedback to the global economy. Emerging and developing countries account for around 60% of global GDP in PPP terms. China accounts for 20%, while the nine EM economies we cover regularly are a further 20%. The fall in EM growth will weigh on the global economy, while a crisis in one or more important EM could precipitate a systemic acceleration in capital outflows.

Monetary policy is reaching its limit. The collapse in the price of oil will deliver a disinflationary shock of 2-3pp on average across EM, adding to the disinflation caused by loss of demand, while raising risks for oil producers, including Russia, Mexico and Brazil. We expect further rate cuts in Brazil, India, Russia and Mexico, among others, but there is little more that monetary policy can do to stimulate growth.

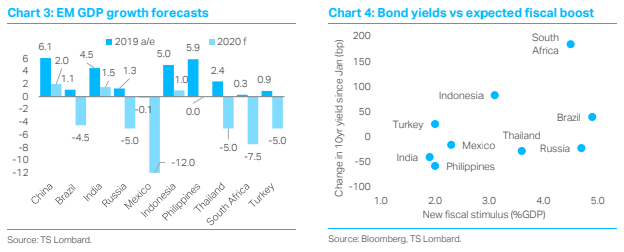

Fixed income markets reflect growing fiscal risks. Fiscal stimulus offers hope to stabilise economies but comes at a cost. Long dated local market yields have adjusted broadly in line with the anticipated fiscal boost (see Chart 4). Curve steepening is exacerbated by the high level of foreign holdings in some markets. Among those EM that have seen the greatest market adjustment, Brazil may be best placed to rein in fiscal slippage once the virus is beaten, while South Africa faces the most challenging task. By contrast, the so far relatively limited fiscal stimulus in Mexico appears unlikely to stabilise growth. GDP contraction and ballooning fiscal deficits spell deteriorating debt to GDP dynamics raising credit risks for EM.

Client Login

Client Login Contact

Contact