On the road in India with protesting farmers

29 Jan 2021 - Amitabh DubeyThe farmers remain determined despite protracted protests. At the farmers’ protest site at Ghazipur on Delhi’s eastern border with Uttar Pradesh, the atmosphere had been determined and upbeat when I visited 2 weeks ago..

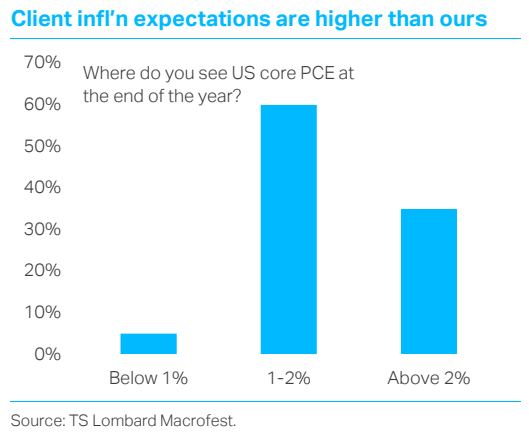

#Emerging Markets #IndiaWhat is normal anyway? Our clients respond

22 Jan 2021 - Oliver BrennanAt our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the.

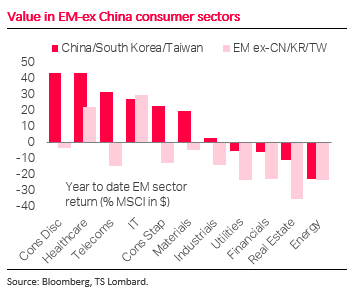

#Inflation #Eurozone #Emerging Markets #Covid19 #Currencies #USD #VaccineEM: Vaccine rotation impact

17 Nov 2020 - Jon HarrisonThe prospect of a vaccine will drive a rotation to underperforming EM assets at the expense of outperformers. EM exporters will benefit from rising global growth, while growing inflationary pressures will shift the.

#Emerging Markets #VaccineEmerging Markets in 6 Charts

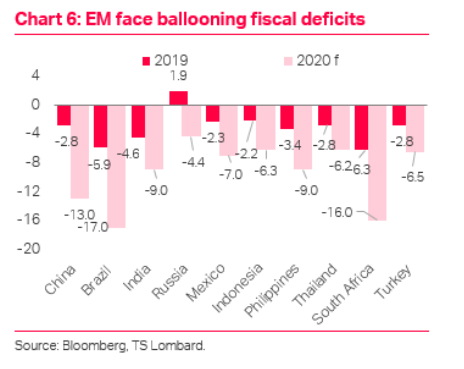

09 Nov 2020 - Jon HarrisonThe outcome of the US election is important for EM economies, but domestic policy challenges in EM themselves will continue to dominate. Secular trends will remain in place, including: US-China tensions, decline of.

#Trade War #Emerging Markets #Fiscal PolicyChina outperformance to continue

08 Oct 2020 - Lawrence BrainardEquites are volatile globally but China is a big outperformer. Looking at rising equity volatilities, we conclude that markets are not ignoring downside risks; the point is that right now, the upside potential and.

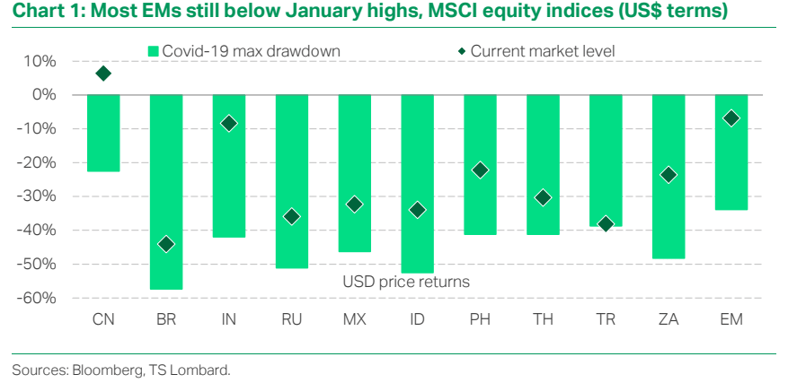

#Equities #China #Emerging Markets #MSCIAmid US election chaos and second wave fears, it’s time for caution

06 Oct 2020 - Lawrence BrainardMost EM equity markets are trading well below their January highs, which suggests recovery potential, but we believe that now is not the time to increase exposures. Our reasons do not reflect a strong conviction that EM.

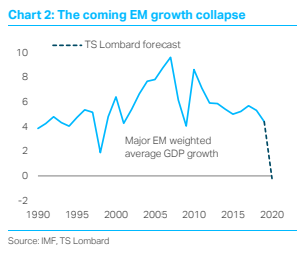

#Emerging MarketsEmerging Markets: The coming growth collapse

28 Apr 2020 - Jon HarrisonSome EM lockdowns are starting to ease. Many EM economies are now 3-4 weeks into restrictive measures and progress is seemingly being made on flattening the curve. Thoughts are turning to the exit strategy. India and.

#Emerging Markets #Covid19 Client Login

Client Login Contact

Contact