The €750bn Next Generation EU Fund (NGEU, aka EU Recovery Fund) has been launched to prevent the asymmetric impact of the pandemic from exacerbating existing growth divergence across member states and to lift long-term growth (esp. in the Euro Area [EA] periphery). Italy and Spain – the greatest recipients of EU funds in the EA – are in line for disbursements (grants + loans) worth €209bn and €140bn, respectively, over six years. A big chunk of that (€45bn for Italy and €43bn for Spain) will be paid out as grants in 2021-22. This is no pocket money: mapping the sectors where the funds are going is key for investors.

The EU Commission requires member states to allocate a minimum of 37% of funds to climate-related policies and 20% to the digital transition, but a review of national recovery plans gives a (still vague) sense of the NGEU spending distribution at sector level. Italy and Spain – the top beneficiaries– are the obvious starting point. With a few assumptions on expenditure reclassification, public investment will concentrate on:

- upgrading digital telecommunication networks and digitising the public administration;

- upgrading the energy grid with sizable investment in renewables and accelerating large-scale deployment of electric vehicle (EV) charging infrastructure –a boost for the EA/German car industry;

- upgrading the transport infrastructure, with a focus on railways and intermodal transport for freights;

- retrofitting public and residential buildings to enhance energy efficiency;

- building and preserving human capital through education and vocational training to upskill/reskill; and

- upgrading technological capabilities via R&D.

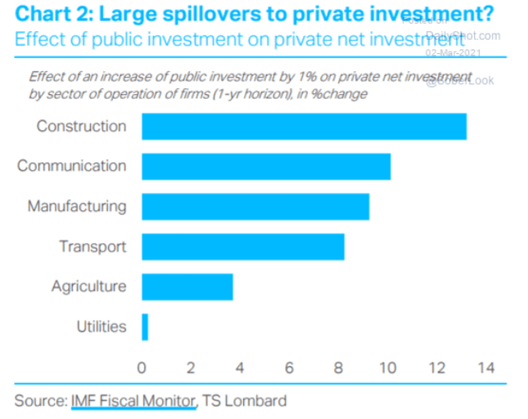

The size of fiscal multipliers is a controversial topic in macro, but recent studies suggest three factors can boost spill overs from NGEU. First, spending multipliers can be, persistently larger than 1.0 during slumps. Second, faced with uncertainty around the shape of the post-pandemic economy, firms can react more forcefully to an increase in public investment, as government commitments raise confidence about future growth unlocking new hiring and investment – a “crowding-in” effect. Third, the sectors that benefit most from NGEU, such as communications, transport and construction, are also those where the sensitivity of net private investment to a change in public investment is highest.

Client Login

Client Login Contact

Contact