Short shortages - in charts

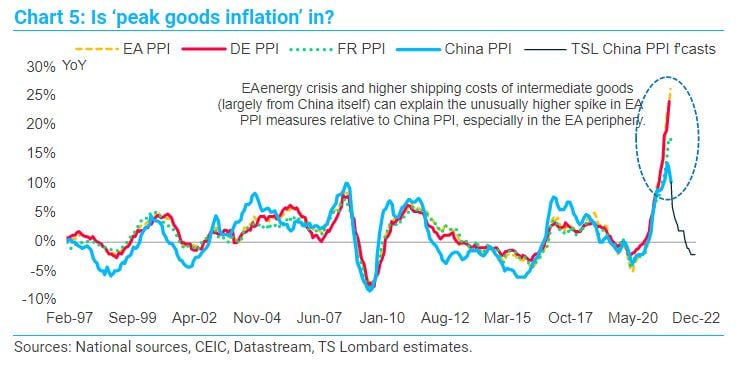

10 Feb 2022 - Rory GreenThe pandemic demand shift and supply mismatch catalysed a surge in global goods inflation. The supply side is improving to meet the new Covid-19 demand reality just as DM consumers transition to services spending..

#Central Banks #Inflation #Eurozone #Fiscal Policy #SemiconductorsEvergrande China growth contagion

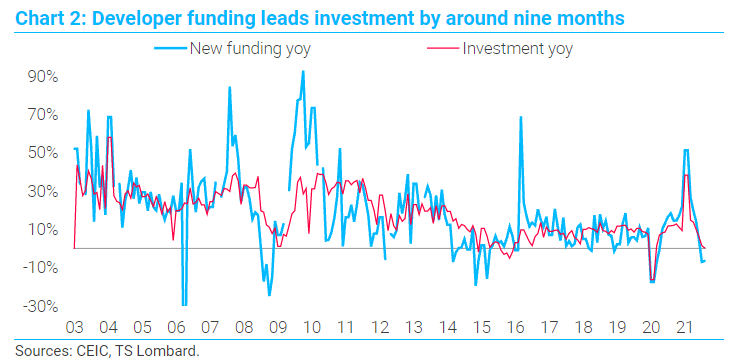

27 Sep 2021 - Rory GreenEvergrande is collapsing. China’s second-largest developer by sales and largest in terms of total debt and liabilities is no longer a viable business. The extent of the macro and market spill-overs both on the Mainland.

#China #Fiscal Policy #Commodities #EvergrandeUS recession is over - Backwards won't be the way forward

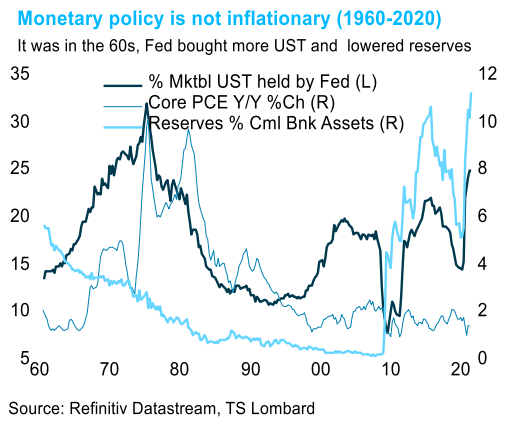

26 Mar 2021 - Steven BlitzThe “non-Covid” recession ended late summer, timed, in part, by the November peak for the number of unemployed not on temporary layoff. What we call the non-Covid recession is simply the downturn that created job losses.

#Federal Reserve #Recession #US Economy #Fiscal Policy #Employment #RecoveryECB Yield Curve Control?

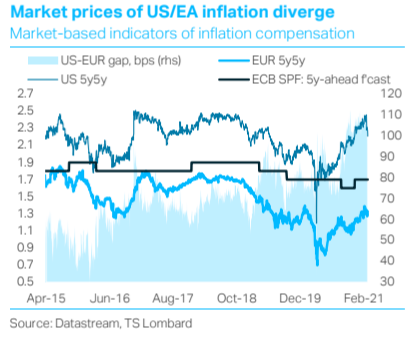

09 Mar 2021 - Davide OnegliaThe US bond sell-off last week sent waves through global bond markets causing Euro Area(EA) risk-free and sovereign debt curves to steepen at rapid pace, as investors offloaded long-term paper. ECB officials were fast.

#Eurozone #Yield curve #Fiscal PolicyEU recovery fund – which sectors get the funds?

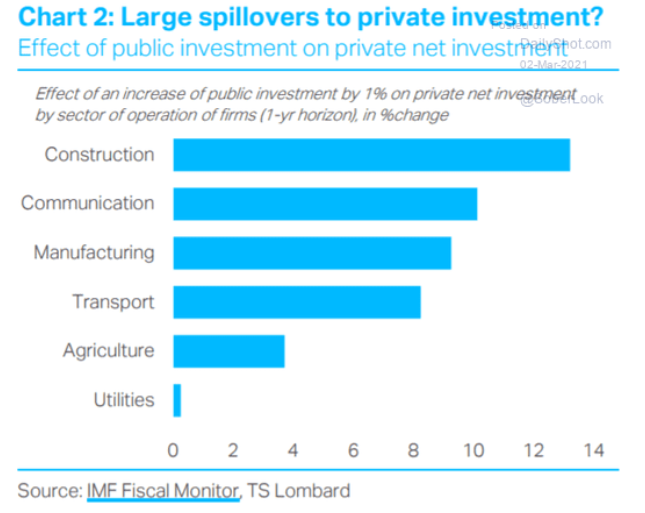

03 Mar 2021 - Davide OnegliaThe €750bn Next Generation EU Fund (NGEU, aka EU Recovery Fund) has been launched to prevent the asymmetric impact of the pandemic from exacerbating existing growth divergence across member states and to lift long-term.

#Eurozone #Fiscal PolicyBioNTech/Pfizer vaccine announcement in a financial market perspective

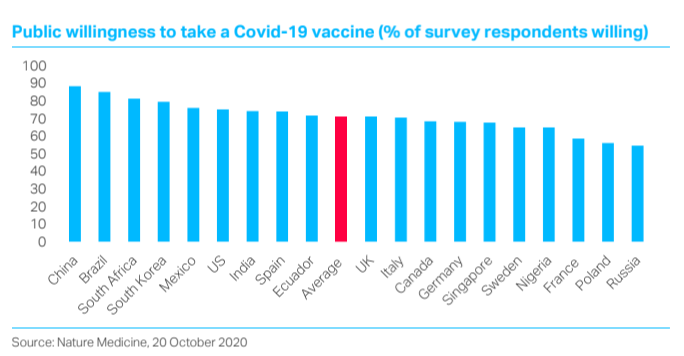

13 Nov 2020 - Christopher Granville“Where might be the catch?” This question about the prospects for the vaccine route to suppressing the pandemic arises naturally from financial markets’ acclamation of last Monday’s Pfizer/BioNTech announcement. Before.

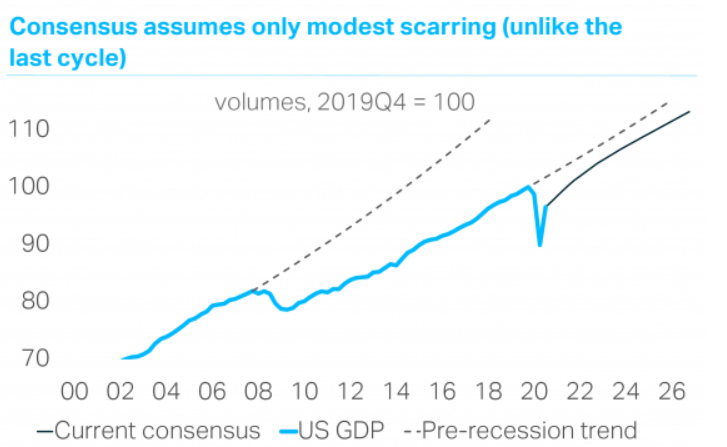

#Fiscal Policy #Stimulus #VaccineCovid Scarring. Impact in 12 charts

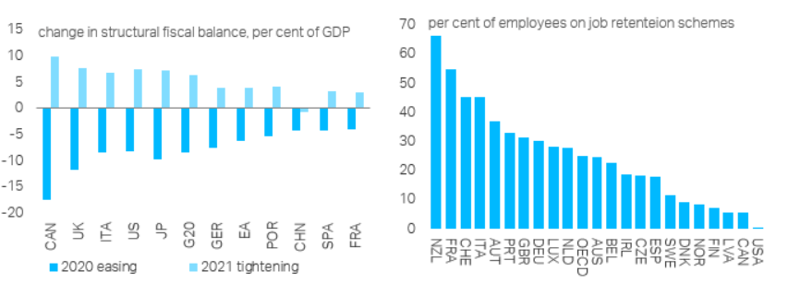

09 Nov 2020 - Dario PerkinsCovid economic scarring is not inevitable, but it is becoming likelier with a second wave of the virus and “fiscal fatigue” setting in. Central banks are determined to ensure scarring does not materialise, but fiscal.

#Fiscal Policy #Covid19Emerging Markets in 6 Charts

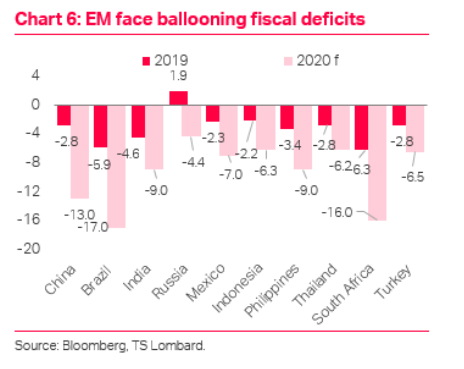

09 Nov 2020 - Jon HarrisonThe outcome of the US election is important for EM economies, but domestic policy challenges in EM themselves will continue to dominate. Secular trends will remain in place, including: US-China tensions, decline of.

#Trade War #Emerging Markets #Fiscal PolicyLong covid

06 Nov 2020 - Dario PerkinsThe authorities’ attempt to reopen their economies has caused a sharp acceleration in COVID cases across Europe and the US, the (entirely predictable) “second wave” of the pandemic. While the health authorities are.

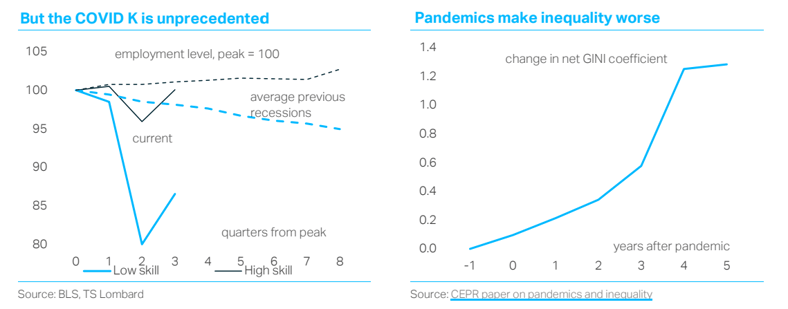

#Recession #Fiscal Policy #Covid19K-runch Time

12 Oct 2020 - Dario PerkinsData for other countries confirms the tendency for inequality to widen during recessions, though the picture is more mixed than the US experience – because it depends, in part, on the policy response. UK disparities,.

#Monetary Policy #Fiscal Policy #Inequality #K Recovery Client Login

Client Login Contact

Contact