The nightmare scenario for central banks

14 Jul 2022 - Dario PerkinsEvery investor wants to know whether central banks are prepared to cause a recession in order to force inflation down. Surely, officials are bluffing, right? But think about it from the central banker’s perspective..

#Central Banks #Monetary Policy #Eurozone #United KingdomA recession to tame inflation?

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionDon't bet on a soft landing

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

#Central Banks #Monetary Policy #Inflation #Eurozone #RecessionShort shortages - in charts

10 Feb 2022 - Rory GreenThe pandemic demand shift and supply mismatch catalysed a surge in global goods inflation. The supply side is improving to meet the new Covid-19 demand reality just as DM consumers transition to services spending..

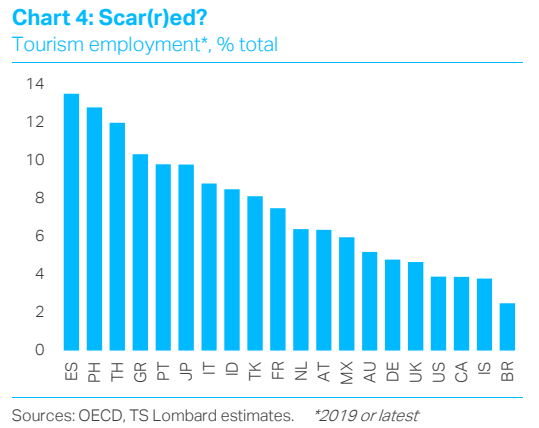

#Central Banks #Inflation #Eurozone #Fiscal Policy #SemiconductorsGlobal Tourism: EU & China risk

29 Mar 2021 - Davide OnegliaOne year into the pandemic, still enduring tough restrictions on social life, entertainment activities, and leisure travel, we bet most people crave a long holiday. With the acceleration in the vaccine rollout,.

#Eurozone #China #TourismECB Yield Curve Control?

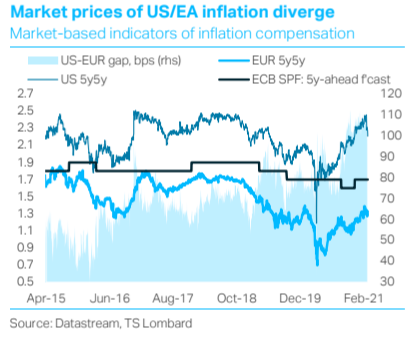

09 Mar 2021 - Davide OnegliaThe US bond sell-off last week sent waves through global bond markets causing Euro Area(EA) risk-free and sovereign debt curves to steepen at rapid pace, as investors offloaded long-term paper. ECB officials were fast.

#Eurozone #Yield curve #Fiscal PolicyEU recovery fund – which sectors get the funds?

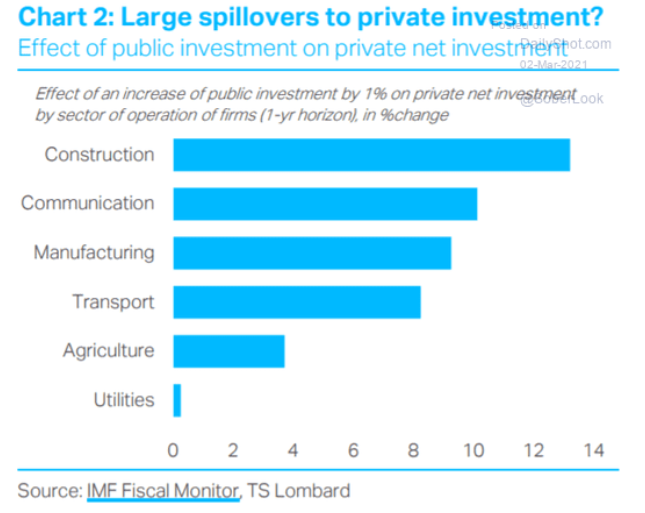

03 Mar 2021 - Davide OnegliaThe €750bn Next Generation EU Fund (NGEU, aka EU Recovery Fund) has been launched to prevent the asymmetric impact of the pandemic from exacerbating existing growth divergence across member states and to lift long-term.

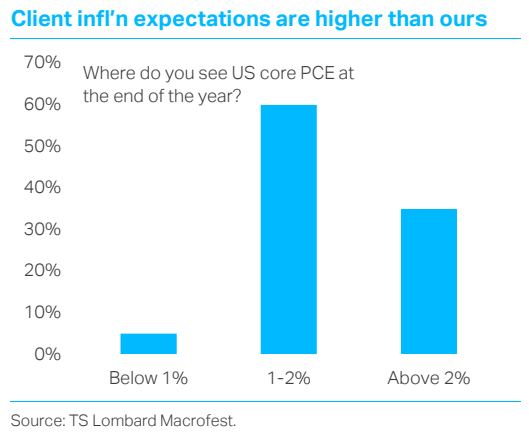

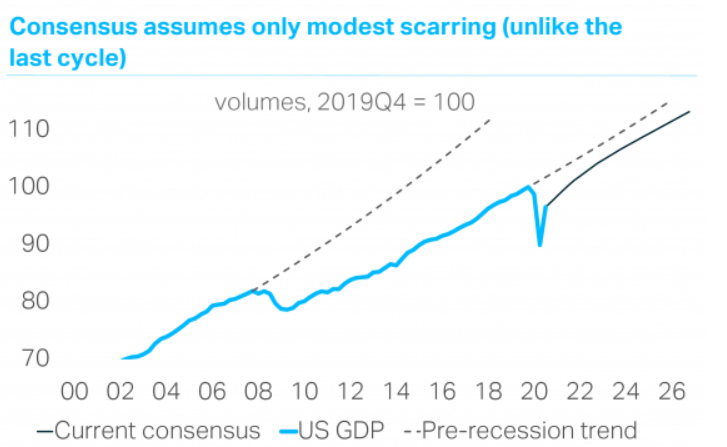

#Eurozone #Fiscal PolicyWhat is normal anyway? Our clients respond

22 Jan 2021 - Oliver BrennanAt our MacroFest virtual event on 12th and 13th January, we discussed the outlook for global growth, global markets, energy, deglobalization and, of course, COVID-19, among many other topics. As a follow-up to the.

#Inflation #Eurozone #Emerging Markets #Covid19 #Currencies #USD #VaccineThe Vaccine Matrix: Winners and Losers

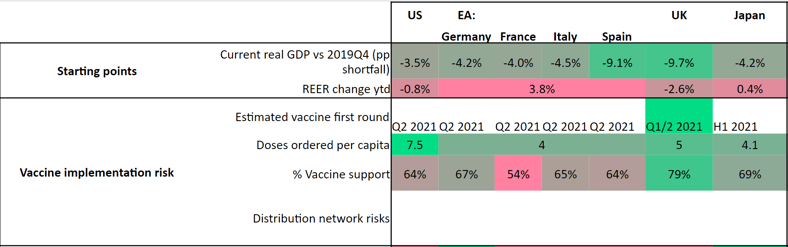

30 Nov 2020 - Oliver BrennanFill in the form below to download the full report - The Vaccine Matrix: Winners and Losers, by Oliver Brennan, Managing Director, Macro Strategy. What does the great rotation mean for countries’ economies? Is it simply.

#Eurozone #China #Vaccine #RecoveryDouble-Dip Recession on the way?

24 Nov 2020 - Davide OnegliaA virulent second wave of the Covid-19 pandemic is underway. We do a back-of-the-envelope calculation to estimate relative declines in domestic demand in what we think is a ‘credible’ worst case scenario. We compare the.

#Eurozone #GDP #Recession #Covid19 Client Login

Client Login Contact

Contact