If there is one theme that marked the first quarter of 2021, it is the upturn in bond yields. February saw real interest rates take up the baton from inflation expectations as the primary force behind rising long US Treasury yields. In effect, this was the bond market playing catch-up, i.e., moving to confirm the reflationary signals sent by equities and commodities over the course of 2020. The US 10yr nominal yield is now hovering at levels last seen in 2020 Q1, yet the failure to break higher during the last couple of weeks suggests that this leg of the advance is mature.

Real advance. Looking ahead, with only around 45bps separating the US 10yr inflation breakeven rate from the highs set in the mid-2000s, any lasting material advance in long nominal yields from here will still need to rely on rising real interest rates. At a negative 70bps, the 10yr TIPS yield remains depressed and as long as the economic recovery stays on track, it should continue to head higher over the coming quarters. This may well be accompanied by an upward drift in inflation expectations, given that the Fed is likely to start showing concern only when these hit 2¾-3% and will otherwise let the economy “run hot” to allow time for the labour market to heal.

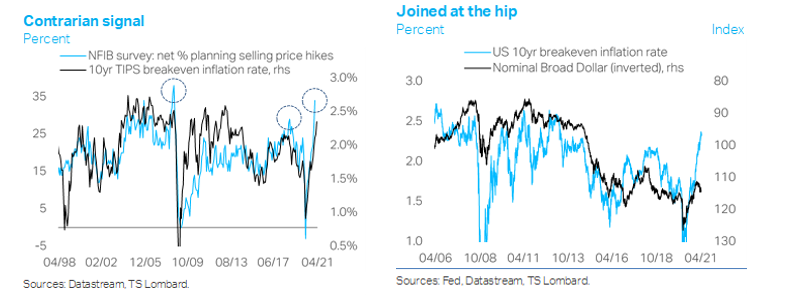

Inverted expectations. That said, the jump in two-year inflation expectations implied by the TIPS market has taken the degree of inversion in the inflation breakeven curve (10s/2s) to historically stretched levels. Our view is that, ultimately, this inversion is more likely to moderate via falling short-term breakeven rates than via rising long-term ones. The NFIB survey suggests that a fair share of US small businesses – the lifeblood of the job market – are planning price increases, but a closer look suggests that spikes in the NFIB series tend to mark turning points in the 10yr breakeven inflation rate.

Commodities are sending a similar message. The 10yr TIPS breakeven rate tends to exhibit a tight correlation with industrial commodity prices. After a 40% advance from the spring 2020 lows, the CRB Industrials index now stands at just around 10% below the record highs set in 2011 Q2. Also, the gold/CRB ratio has reverted lower, close to its long-term trend, suggesting that the “catch-up” rebound in industrial commodity prices is getting long in the tooth – not least as CNY has traded soft over the last couple of months. In short, the bar for a material increase in market-implied US inflation expectations in the foreseeable future looks elevated.

Dollar support. If the bulk of the rebound in TIPS breakevens is indeed behind us, this should translate into near-term support for the dollar: the only period over the past decade when the inverse relationship between the two broke was between 2016 Q4 and 2017 Q1, when the “reflation trade” fuelled by Trump’s victory combined with Fed hikes to boost both inflation breakevens and the dollar. We also reckon that in 2021 H2 the FOMC is likely to announce that it will begin tapering its asset purchases. Coupled with US growth outperformance, this macro mix implies that the dollar is unlikely to resume its decline until there are firm signs of growth reaccelerating in the rest of the world.

Trading places. From a global macro standpoint, 2021 is therefore shaping up to be another year when the US and China – the main locomotives of the world economy – in effect “trade places”. President Biden’s pro-growth fiscal stance means the US is taking up the baton from Beijing as the primary source of global stimulus, just as in 2017 Trump’s tax cuts came on the heels of large-scale Chinese fiscal easing that helped jumpstart the global economy in 2016.

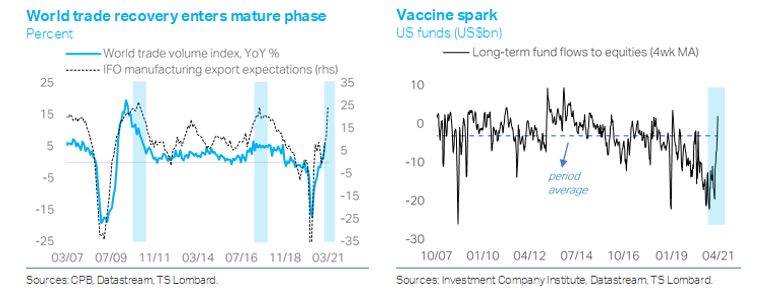

Change of guard. The global trade-manufacturing nexus remains robust. The IFO survey for three-month-ahead manufacturing export expectations surged to a 10-year high in March, boosted by a jump in auto sector sentiment. The latest set of manufacturing PMIs (for March) was solid, too, with rebounding new orders (55.8) lifting the headline index (55.0) to a 10-year high. Still, the degree of strength in the goods side of the world economy that is being signalled by the surveys also raises the bar for material further upside significantly, not least as the reopening of Western economies is bound to benefit the service sector disproportionately.

Defense is the best offense. This positive macro backdrop has helped lift global equities to new highs; yet a closer look shows that over the past month the rally has had a defensive tilt (e.g. Consumer Staples outperforming, EMs lagging), coinciding with the pause in long US yields’ advance and the dollar’s resilience. Earnings revisions ratios for the major equity indices have rolled over after reaching record highs in February; and flow data suggest that US funds’ allocation to global equities has risen significantly over the last five months above long-term averages.

Liquidity sets the tone. In all, the market action suggests there is a rising likelihood that the rally in equities and other risk assets will give way to period of consolidation going into 2021 H2. Global funding conditions are bound to remain very loose for the foreseeable future, underpinned by major central banks’ stated bias to err on the side of easing. This should continue to provide a supportive backdrop for risk assets, particularly if the advance in US long yields proves orderly. At the margin, however, the rate of increase in global liquidity will inevitably cool over the coming quarters – not just owing to base effects but because policy will inevitably start to follow the global economy turning the corner. Moreover, as the major advanced economies reopen, a larger share of global liquidity can be expected to make its way from financial assets to the real economy, exposing pockets of valuation excess. In other words, booming economies do not necessarily imply commensurate strength in risk assets. As power shifts from investors to consumers, equity valuations can be expected sooner or later to start aligning more closely with the fundamentals.

Client Login

Client Login Contact

Contact