Covid: Omicron variant - first take

26 Nov 2021 - Andrea CicioneThese are our initial thoughts on the new Covid variant: We don’t know enough about the B.1.1.529 variant to draw any specific conclusions at this stage. We know that it has many mutations on the protein spike, which.

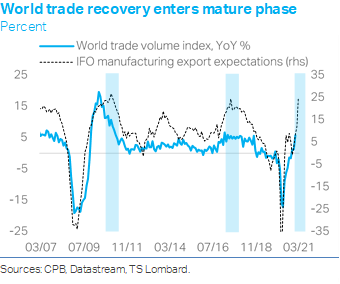

#Liquidity #Equities #Covid19 #Stock MarketWhen the V starts to fade

17 Sep 2021 - Konstantinos VenetisThe looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the.

#Monetary Policy #Inflation #Equities #Stock Market #VolatilityBond market takes a breather

14 Apr 2021 - Konstantinos VenetisIf there is one theme that marked the first quarter of 2021, it is the upturn in bond yields. February saw real interest rates take up the baton from inflation expectations as the primary force behind rising long US.

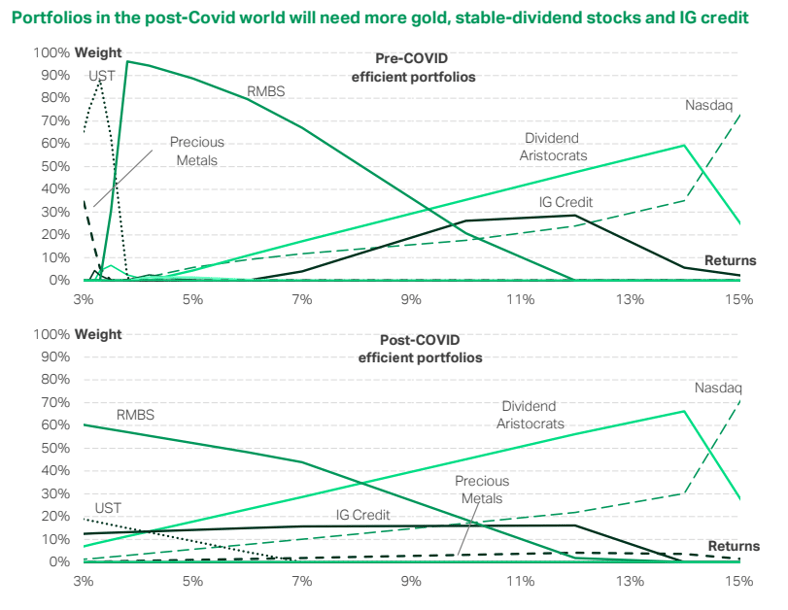

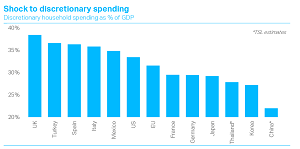

#Liquidity #Stimulus #Stock MarketPortfolios in the post-Covid world

16 Oct 2020 - Andrea CicioneIf the Global Financial Crisis ushered in the era of zero yields, the Covid pandemic has made it a semi-permanent affair. We have looked at how lower bond returns have changed asset allocation choices faced by.

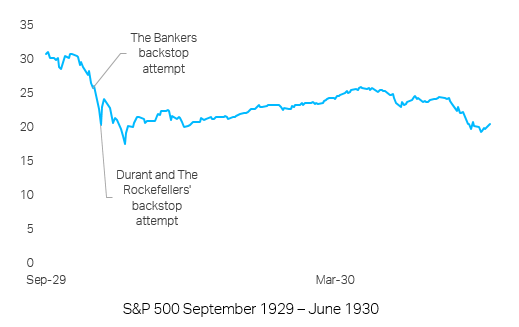

#Equities #Stock Market #Asset Allocation #Gold #Commodities #Dividend AristocratsIf the Fed buys stocks? Then sell

05 Aug 2020 - Charles DumasOctober 1929 – the Wall Street Crash is gathering frightening momentum. Several leading Wall Street bankers get together and decide to backstop the stock market, they come out swinging, placing a bid to purchase a large.

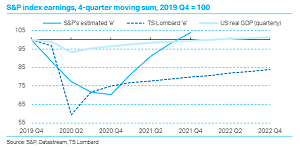

#Federal Reserve #Recession #Stock MarketWhy we remain bears

23 Jun 2020 - Charles DumasThis blog summarises our View on our bearish views about US stock prices. Steve Blitz’s analysis of the US economy in 2020-21 shows the policy context for the November elections. But our pessimism about stock-market.

#US Economy #Covid19 #Stock Market #Bear MarketThe bear and fear stalk the world

10 Mar 2020 - Charles DumasGlobal spread of the Covid-19 virus looks likely to cause a worldwide recession and bear market in stocks. Nobody knows how serious the disease is likely to be. But The Brookings Institution’s estimates suggest a.

#Equities #Recession #Covid19 #Stock Market #Bear MarketThree reasons markets were ignoring the coronavirus

14 Feb 2020 - Dario PerkinsThe contrast between the awful humanitarian crisis in China and the euphoria in global stock markets had been bordering on the surreal. Every night (London time) the Chinese authorities updated their count of the number.

#China #Covid19 #Stock Market Client Login

Client Login Contact

Contact