Konstantinos Venetis

Recent Posts

Commodities: burden of proof is with the bulls

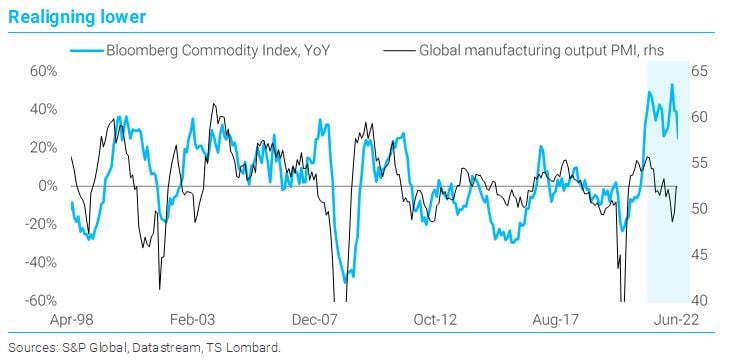

07 Jul 2022 - Konstantinos VenetisThe breadth of the commodity rally started narrowing in early March, when the dust from Russia-Ukraine shock began to settle. Industrial metals topped out first and rolled over decisively in April – around the same time.

#Federal Reserve #China #CommoditiesThe year of the payback

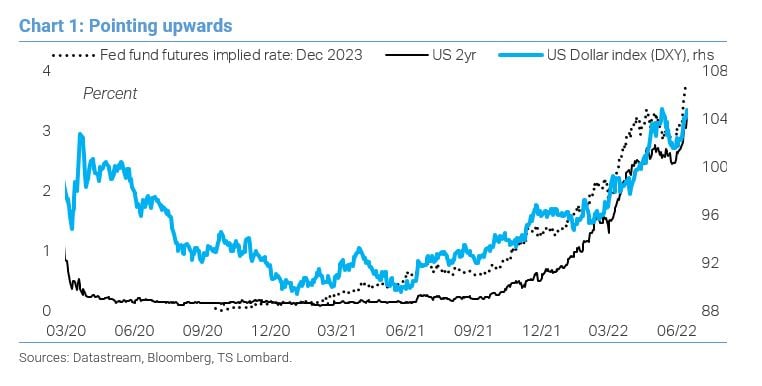

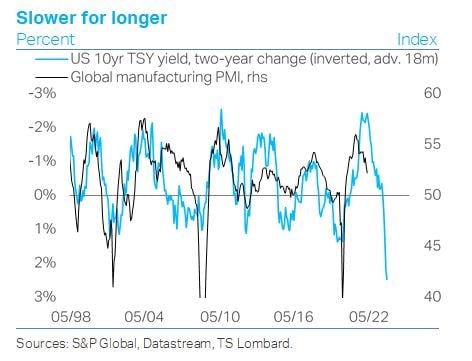

20 Jun 2022 - Konstantinos VenetisThe markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time.

#Federal Reserve #Monetary Policy #Inflation #China #OPECAll eyes on oil as the commodity rally narrows

13 Jun 2022 - Konstantinos VenetisCommodity prices continue to trend higher but the breadth of the rally has narrowed: industrial metals have corrected lower in 2022 Q2, leaving energy prices to pull the cart. Where do we go from here? The case for a.

#Federal Reserve #OPEC #Commodities #OilThe cycle starts to bite

11 May 2022 - Konstantinos VenetisThe macro story of 2022 is “higher-for-longer inflation” that is forcing central bankers across the major DMs, led by the Fed, to tighten into slowing growth. Going into this year, a slew of high-frequency indicators.

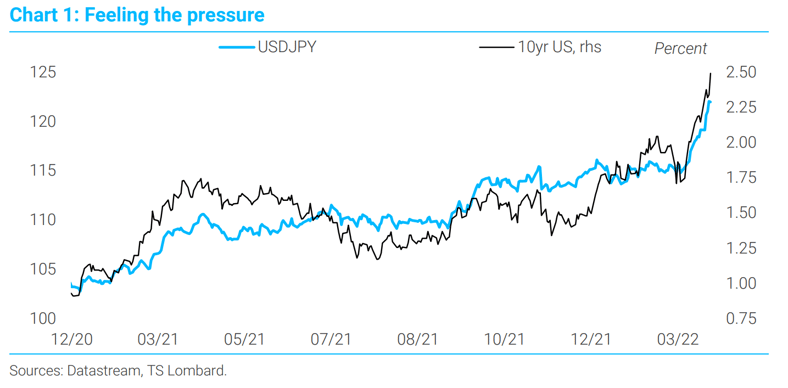

#Federal Reserve #Inflation #China #Bond marketsYEN MOVES AND THE BOJ ‘TAPER’

29 Mar 2022 - Konstantinos VenetisPronounced widening in JGB interest rate differentials, particularly versus US Treasuries, catalysed accelerated yen depreciation in March. Chances are that we are getting closer to a “taper” of Japanese monetary.

#Monetary Policy #Bond markets #Bank of Japan #FX Market"Late cycle" comes early

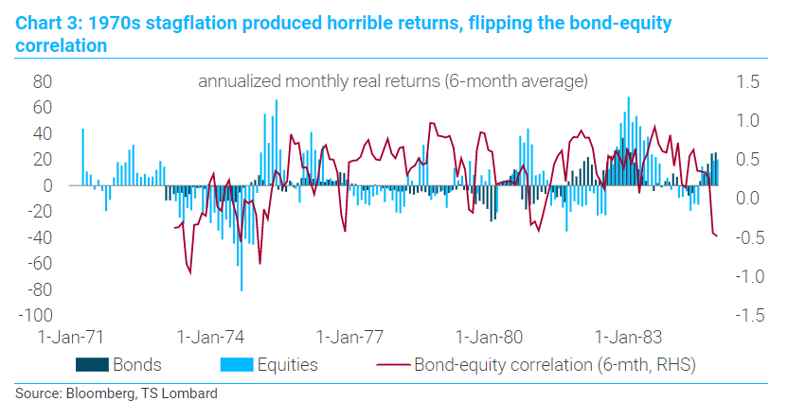

18 Feb 2022 - Konstantinos VenetisWhether one views the last couple of years as a break in the business cycle or the beginning of a new cycle, the bigger point is this has been a cycle on steroids: in terms of its amplitude, the speed of maturity and.

#Federal Reserve #Monetary Policy #Inflation #CommoditiesHawkish Bank of England plays ‘catch-up’ with the cycle

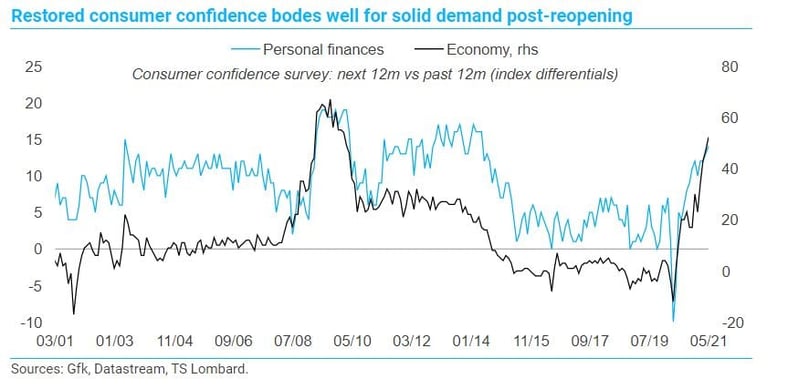

04 Feb 2022 - Konstantinos VenetisA 25bp hike was already in the price ahead of February’s meeting and the MPC did not disappoint, paving the way for ‘passive QT’ as the policy rate has now reached the 0.50% threshold for allowing maturing gilts to roll.

#Monetary Policy #Inflation #Bank Of England‘Undecided’ bond market has made up its mind – at least for now

13 Jan 2022 - Konstantinos VenetisTime to play catch-up. Policymakers have finally dropped the “transitory” narrative and are playing catch-up, rushing to normalize monetary settings closer in line with last year’s sharp positive macro turnaround. While.

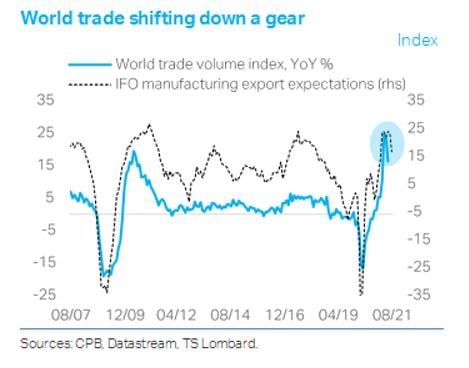

#Central Banks #Federal Reserve #Monetary Policy #Inflation #Bond marketsWhen the V starts to fade

17 Sep 2021 - Konstantinos VenetisThe looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the.

#Monetary Policy #Inflation #Equities #Stock Market #VolatilityThe Bank of England’s monetary ‘put’ need not imply static policy

28 Jun 2021 - Konstantinos VenetisJune’s MPC meeting delivered no surprises, but the debate within the Committee is becoming more nuanced. A closer look at the minutes reveals early signs of a rift between 1) those members on alert for imminent signs of.

#Inflation #Interest Rates #Bank Of England #Quantitative Easing Client Login

Client Login Contact

Contact