Covid: Omicron variant - first take

26 Nov 2021 - Andrea CicioneThese are our initial thoughts on the new Covid variant: We don’t know enough about the B.1.1.529 variant to draw any specific conclusions at this stage. We know that it has many mutations on the protein spike, which.

#Liquidity #Equities #Covid19 #Stock MarketBond market takes a breather

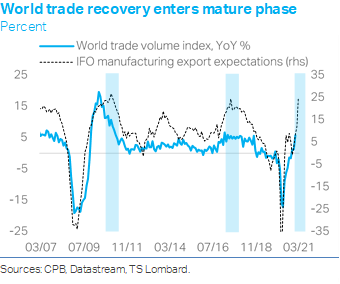

14 Apr 2021 - Konstantinos VenetisIf there is one theme that marked the first quarter of 2021, it is the upturn in bond yields. February saw real interest rates take up the baton from inflation expectations as the primary force behind rising long US.

#Liquidity #Stimulus #Stock MarketQE Nuclear Options

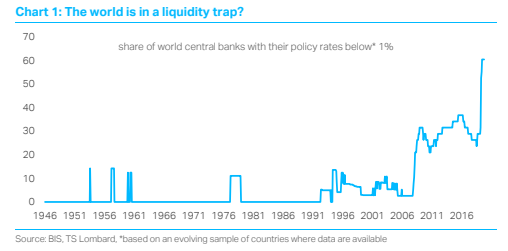

19 Nov 2020 - Dario PerkinsAn effective COVID-19 vaccine is great news because it will save lives and means we might still escape from the current economic crisis with minimal long-term scarring. Yet, the global economy faces a difficult winter,.

#Central Banks #Liquidity #International Monetary Fund #Macro PictureInvestors can’t rely on central banks

24 Jun 2020 - Dario PerkinsThe bounce in global stock markets since March has been both spectacular and a bit puzzling. Despite widespread gloom among institutional investors about ‘fundamentals’ – concerning both the macro outlook and the.

#Central Banks #Federal Reserve #Liquidity #Equities #Fiscal Policy #Covid19 #Bear MarketThe rules to being a sellside economist

21 Jan 2020 - Dario Perkins1) Economic forecasts: Forecasting GDP is basically a waste of time - no investor actually cares what this backward-looking gauge of the economy is doing. But getting it "right" is one of the few (though dubious) ways.

#Central Banks #Liquidity #GDP #Recession Client Login

Client Login Contact

Contact