Despite my best efforts, the phrase Buyside Bubble has never really caught on as a description of post-2008 financial markets. Perhaps this is because, what it gained in clever alliteration (or so I like to think…), it lost in terms of precision. Some clients liked to point out, for example, that institutional investors were merely the ‘agents’ of this bubble rather than its main ‘principle’. Yet my fondness for this phrase was never intended as a way to assign blame. Instead it was a way to differentiate the market trends of the past decade with the subprime era. Above all, it emphasized the non-involvement of global banks – the ‘sellside’ protagonists of the previous boom-bust cycle. Still, I was excited (it’s a low hurdle in lockdown) to receive an email from the Financial Times asking to ‘discuss the Buyside Bubble’. The expression may not be mainstream, but at least people now understand what it means.

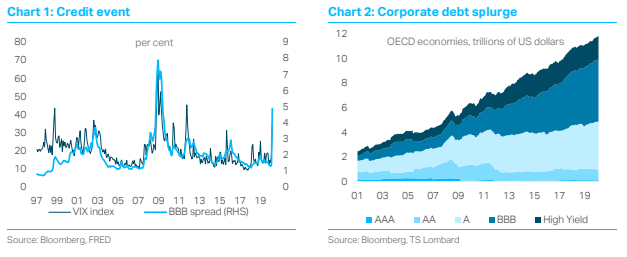

If you want a less controversial name, we can call the BB bubble the ‘post-2008 carry trade’. The basic idea goes like this – investors everywhere struggled to make a decent return in an era of interest rates at 700-year lows. This was especially problematic in jurisdictions with negative nominal yields such as Japan, Europe and Scandinavia. So they rotated towards the United States (the developed economy with the highest interest rates) and the Emerging Markets. But switching currency wasn’t enough, investors also moved along the credit spectrum, into riskier and less-liquid securities. This insatiable search for yield wasn’t just a financial story – it also created clear macroeconomic vulnerabilities, especially in the form of record corporate leverage. US and EM companies took advantage of cheap borrowing costs to stay afloat in a world of low margins, or to engage in financial engineering (stock buybacks, M&A and leveraged buyouts). Corporate debt surged, particularly at the lower end of the investment grade (which was especially appealing to institutional investors) but also in high-yield and leveraged loans.

The Buyside Bubble also had an important impact on the dollar exchange rate, not just its level – which rose to the highest levels since the 1980s – but also in a persistent ‘dollar shortage' Institutional Investors had obligations in euros and Yen but an increasing share of USD assets, which they needed to hedge. Since banks were no longer able to provide hedging services (new Basel III regulations restricted their balance sheets), investors relied on FX swap markets (around 65% of foreigners’ bond purchases were hedged like this), which caused periodic strains in the system – especially when traditional lenders (banks) had to ‘window-dress’ their exposures,

cutting USD lending at the end of every quarter. Dollar funding stress – which has intensified in recent weeks – provided a regular reminder of what had gone wrong in 2008. During the most acute phase of the subprime crash, European banks had struggled to secure dollar funding, having been playing their own carry trade in the early 2000s. This was the infamous ‘investment banking glut’, where European banks had been borrowing in US money markets to fund their purchases of asset-backed securities. When those securities turned toxic they suffered a ‘run’.

.

The pre-2008 carry trade unwound in spectacular fashion, leaving banks – especially in Europe – holding highly illiquid assets (plus a seriously over-leveraged US consumer). This time, the players are different. European banks have scaled down their USD exposure, replaced by institutional investors (including from Asia, such as Taiwan’s massive life insurance companies). But Japanese banks have also been involved in this carry trade and on some metrics look to be as vulnerable as the big euro banks in 2008. Of course, the dollar assets these institutions are holding are more ‘vanilla’ than what had been going on in the subprime years. Here we are talking

mainly about BBB-rated corporate paper. But on the fringes, we have a bunch of dodgier assets, including leveraged loans that were packaged into CLOs. And given the scale of the corporate debt problem and the likely depth/duration of the COVID-19 recession, even traditional borrowers could be in serious trouble. The behaviour of institutional investors could amplify the downswing, with large-scale fund redemptions and mass fallen angels causing asset firesales.

When we warned about these dangers last autumn, we couldn’t have imagined a ‘trigger’ as powerful as COVID-19, which has basically shut down 50% of global GDP. The policy response has also been impressive. The Federal Reserve, in particular, has been doing all the right things – slashing interest rates, restarting large QE, offering to buy corporate debt (with a joint operation involving the Treasury) and rapidly expanding (plus incentivising) dollar swap lines. This last move was particularly important in the context of the dollar shortage and trying to avoid the strains of 2008. The question is whether the Fed’s new USD liquidity injections will find their way to where they are most needed – institutional investors and non-financial corporates (rather than banks). The latest initiative, which will allow foreign central banks to repo their dollar assets (such as FX reserves) rather than have to sell those securities (which might cause further stress on global funding markets) is another important step. But while all this firefighting is necessary, it can only prevent the short-term amplification of a ‘reset’ that might be inevitable anyway. Unfortunately, the authorities cannot contain the fallout of a recession that looks set to be much deeper and longer lasting than the consensus realizes - despite the market’s latest attempt at optimism.

Client Login

Client Login Contact

Contact