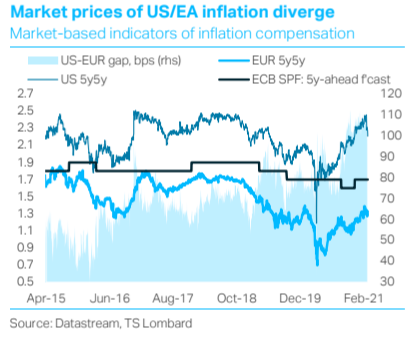

ECB Yield Curve Control?

09 Mar 2021 - Davide OnegliaThe US bond sell-off last week sent waves through global bond markets causing Euro Area(EA) risk-free and sovereign debt curves to steepen at rapid pace, as investors offloaded long-term paper. ECB officials were fast.

#Eurozone #Yield curve #Fiscal PolicyThe Fed hits a wall

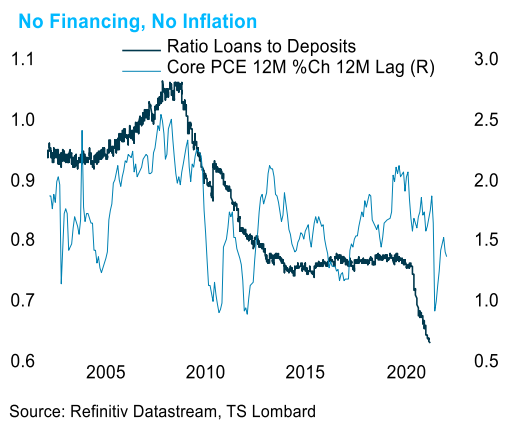

29 Jan 2021 - Steven BlitzThe Fed may not be out of ammo, but the ammo they have may be futile in curtailing the financial instability that policy is creating. Bitcoin, call-option vigilantes, SPACs and market hype generally were topics the FOMC.

#Federal Reserve #Inflation #US Economy #Yield curve #BubbleFed policy pivots to the 10 year

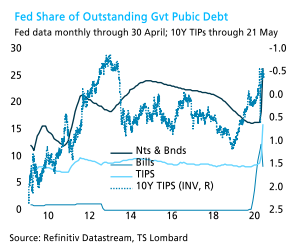

22 May 2020 - Steven BlitzOnce the Fed started buying mass sums to support markets, we began writing that policy was locked into using the balance sheet to manage rates and the yield curve. Reading the April FOMC minutes, we see that this has.

#Federal Reserve #Balance Sheet #FOMC #Yield curveBuyside bust & the dollar crunch

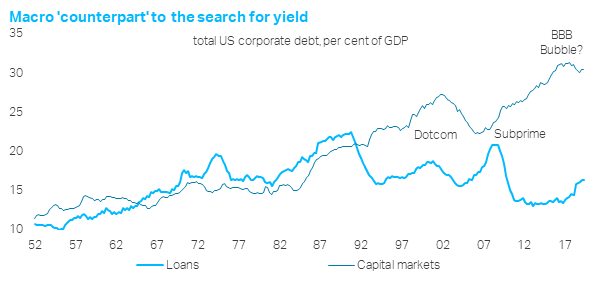

14 Apr 2020 - Dario PerkinsDespite my best efforts, the phrase Buyside Bubble has never really caught on as a description of post-2008 financial markets. Perhaps this is because, what it gained in clever alliteration (or so I like to think…), it.

#Interest Rates #Yield curve #BubbleCredit Risk

20 Dec 2019 - Dario PerkinsBack in 2018, we warned about what we called the ‘Buy-side Bubble’. To the extent we could identify vulnerabilities in global markets, the clearest danger involved a powerful search for yield. Investors had naturally.

#Equities #Yield curve #Stimulus #Capital Markets #Bubble Client Login

Client Login Contact

Contact