Inflation was always the Endgame

04 Nov 2022 - Dario PerkinsThere is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false..

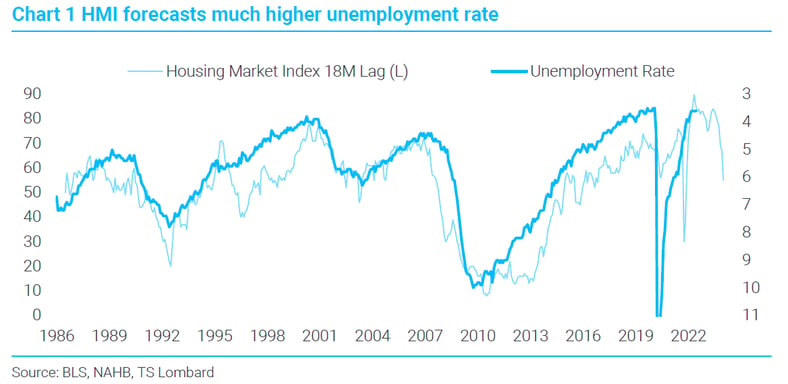

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentHow High for Unemployment in the coming US Recession

26 Jul 2022 - Steven BlitzThere are any number of ways to dissect the spread between the 7% job openings rate and 3.5% unemployment, but the needed drop in demand’s contribution to current inflation occurs when this spread turns negative..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentThe Bank of England’s monetary ‘put’ need not imply static policy

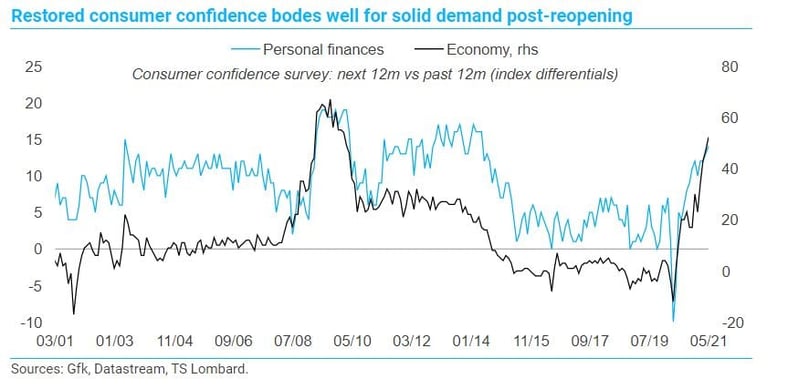

28 Jun 2021 - Konstantinos VenetisJune’s MPC meeting delivered no surprises, but the debate within the Committee is becoming more nuanced. A closer look at the minutes reveals early signs of a rift between 1) those members on alert for imminent signs of.

#Inflation #Interest Rates #Bank Of England #Quantitative EasingPolitics of unemployment to reign

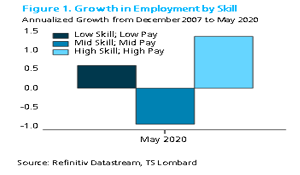

26 Jun 2020 - Steven BlitzAs the economy reopens, the revealed recessionary environment will reflect the imbalance of the expansion just ended – a surplus of service-related workers with no obvious direction in which to go to find re-employment..

#Federal Reserve #Interest Rates #Fiscal Policy #Bear Market #Unemployment #US ElectionBuyside bust & the dollar crunch

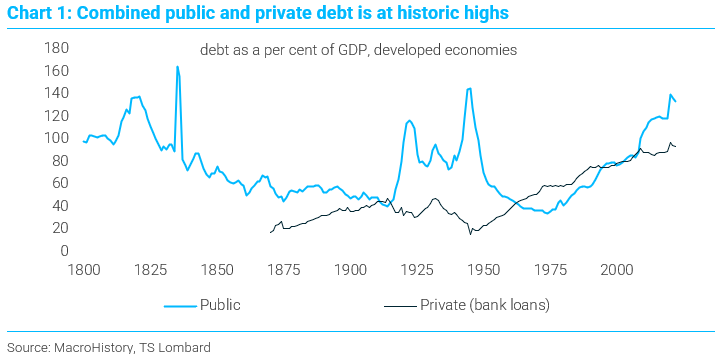

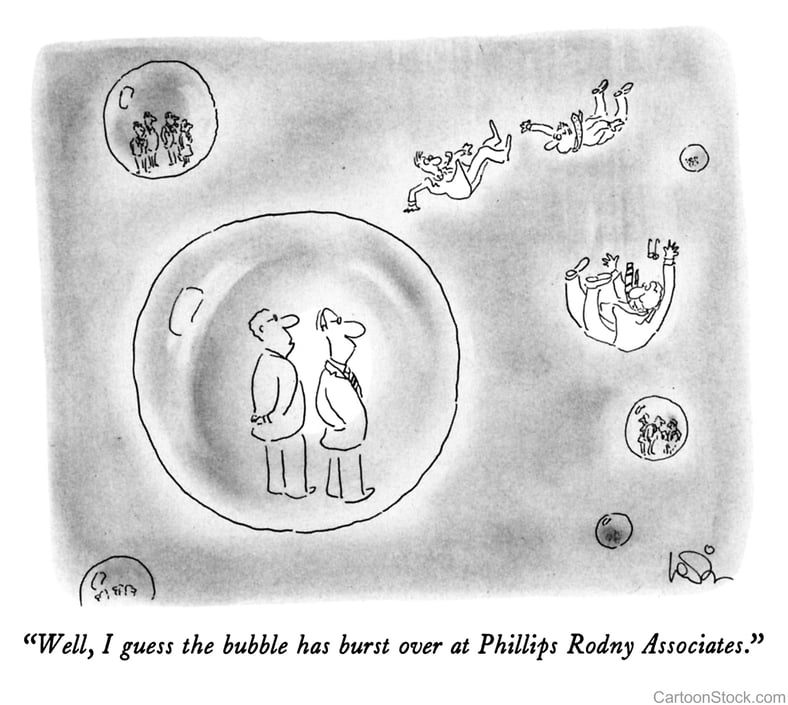

14 Apr 2020 - Dario PerkinsDespite my best efforts, the phrase Buyside Bubble has never really caught on as a description of post-2008 financial markets. Perhaps this is because, what it gained in clever alliteration (or so I like to think…), it.

#Interest Rates #Yield curve #Bubble Client Login

Client Login Contact

Contact