Amid a once-in-a-century pandemic, with new Covid cases surging to a third US peak, the Biden campaign has entered the final stretch of the presidential election with tailwinds at its back and a war chest flush with cash. With less than two weeks to go, polls point to a Biden win, but the ghosts of 2016 polling errors haunt those predicting this year’s outcome – handicapping what looks on paper like a high chance of a Biden victory.

Yet the chance that we will not know the winner on election night is likely overweighted. Florida counts ballots in advance and is used to mail-in voting, making a counting delay unlikely. Given that Biden has a slim, but consistent lead in Florida, he could carry the state, and if he does, we will know the result on election night. Without Florida, Trump’s path to victory is all but impossible.

Beyond election night, this is what investors should know about the strategic implications of the final results, gleaned from the last three months of our research:

In terms of immediate market reactions: no matter who wins, equity markets will likely rally after the winner is known, just as they have done in every election since World War II. Markets like certainty, whatever the certainty is. In the event of a Trump win, tech stocks will benefit as the only US sector with positive correlation (or co-movement) to Trump’s betting odds in recent weeks. Alongside tech, Chinese stocks prefer a Trump win too but other sectors display a negative correlation. Meanwhile, for investors looking to hedge either the outcome or the transition period before Inauguration Day, equity volatility is too high and fixed income too anchored to provide valuable portfolio hedges. It is FX volatility that still provides value.

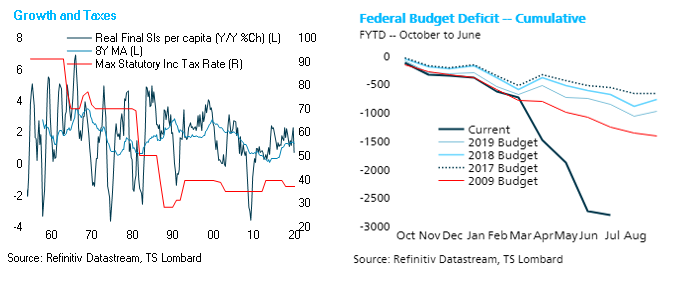

As for the economy as a whole, both Biden and Trump realize that the US needs to spend big in order to achieve pre-2008 levels of growth. However, neither candidate is likely to succeed in moving the US from a cutting to a spending paradigm. Trump was unable to get Republicans to spend during his first two years, when the party controlled the full trifecta of government. If the Senate does not flip to blue, then Biden is also going to fail to increase spending; and even if it does, it will be difficult to move the dial unless the Senate filibuster is first abolished. Republicans tend to rediscover fiscal conservatism during Democratic presidencies at the best of times, but post-pandemic, with the US deficit ballooning (see the chart below right), they will decisively reject fiscal expansion.

As for the vexed question of shale, we find that a Biden win does not pose the risk to shale that some have feared. The effect of Biden’s proposed ban on fracking on federal lands and waters will be cushioned by the fact that only around 11% of fracking takes place on federal land, and of that, much is already covered by firms stockpiling years of federal permits. A Trump victory on the other hand, would be a boon to shale as he pushes on with environmental deregulation, effectively transferring environmental clean-up costs on to state and federal government. The flip side is that this is likely to add to a global supply glut, keeping the S&P energy sector a loser as a result.

On green energy, Biden would be able to accelerate a green boom even if the Senate stays red. Trump has relied so heavily on executive action (like Obama before him) that there is a lot that Biden could do without the Senate, including re-joining the Paris agreement, reversing the rollbacks to more than 100 environmental rules and regulations and potentially imposing some form of carbon border tax. However, even if Biden does not win, we also find that the promise of subsidies is structurally significant. With such an idea now out in the political conversation, the potential returns to lobbying have greatly increased, setting the more money – more lobbying – more money feedback loop into motion. With green energy lobbyists now better energized and funded, green industry subsidies are on their way even under Trump.

On green energy, Biden would be able to accelerate a green boom even if the Senate stays red. Trump has relied so heavily on executive action (like Obama before him) that there is a lot that Biden could do without the Senate, including re-joining the Paris agreement, reversing the rollbacks to more than 100 environmental rules and regulations and potentially imposing some form of carbon border tax. However, even if Biden does not win, we also find that the promise of subsidies is structurally significant. With such an idea now out in the political conversation, the potential returns to lobbying have greatly increased, setting the more money – more lobbying – more money feedback loop into motion. With green energy lobbyists now better energized and funded, green industry subsidies are on their way even under Trump.

Hardly talked about by the candidates – but enormously important for markets – is the future of the US’ trade and tech wars. No matter who wins, the US-China tech war is here to stay in our view and Beijing’s recently launched “dual-circulation strategy” will continue the de-Americanization of Chinese supply chains – helping Taiwan and Korea in the tech space, while also offering a near-term boost for exporters in Europe and Asia. Under Biden’s more multilateral approach, though, the odds of an all-out global trade war would be reduced, yielding benefits for US exporters. Under Trump, it is an open question whether the WTO would exist in 2024.

Finally, as long-term EM specialists, we have to note that China is not the only EM with a stake in this election. Other key EMs – notably Brazil, India, Russia and Mexico – would also see fresh opportunities and new risks from a Biden win, as the structure of geopolitical risk premiums is recalibrated under a new President. Although all these countries (even Russia, paradoxically) would see benefits from Biden’s more predictable rules-based style of governance, ESG risks would also rise for both Brazil and Mexico, while India could see more friction on human rights.

Client Login

Client Login Contact

Contact