The US bond sell-off last week sent waves through global bond markets causing Euro Area(EA) risk-free and sovereign debt curves to steepen at rapid pace, as investors offloaded long-term paper. ECB officials were fast to let the markets know they were closely monitoring these unwelcome developments, which, in turn, spread rumours that the ECB may be moving towards yield curve control (YCC). We think a quick rise in long-term yields in the EA is unwarranted, why the ECB won’t adopt explicit YCC and why the introduction of a PEPP forward guidance based on several financing condition indicators to appease Governing Council (GC) hawks trying to rein in stimulus is now actually allowing the ECB to reclaim control over PEPP flexibility.

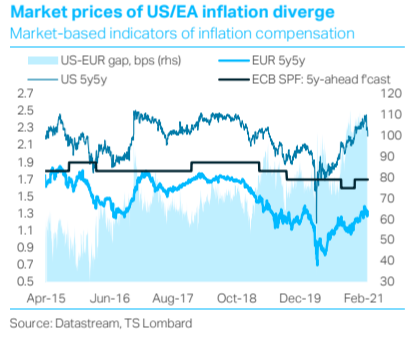

The EA recovery and fiscal policy outlook doesn’t justify a quick rise in term premia. In the US, improving growth expectations are raising the term premium and justifying at least some of the higher pressure on yields. However, the situation in the EA is very different. First, while in the EA new infections are still too high for comfort, the slow pace of vaccinations is forcing governments to keep significant business and mobility restrictions in place. Second, the US has passed a large fiscal stimulus package worth about 7% of GDP, while EA governments struggle to commit to higher spending – both in the short- and in the medium-run. Third, as a result, slack in EA economies is expected to persist at least until mid-2022, in contrast with the US, where it will be reabsorbed by the second half of this year. Fourth, market measures of inflation compensation in the US are improving faster than in the EA thanks to both higher inflation risk premium and inflation expectations.

Client Login

Client Login Contact

Contact