The outcome of the US election is important for EM economies, but domestic policy challenges in EM themselves will continue to dominate. Secular trends will remain in place, including: US-China tensions, decline of fossil fuel usage and growing focus on ESG themes. A return to a rules based international order under a Biden administration should nonetheless be positive for EM but may not be as positive as some analysts expect. Mexico will almost certainly gain a Biden dividend, but the presidents of Brazil, Turkey and Russia could face pressures, while Southeast Asia could come under pressure on human rights and the environment. We maintain our neutral view of overall EM risk.

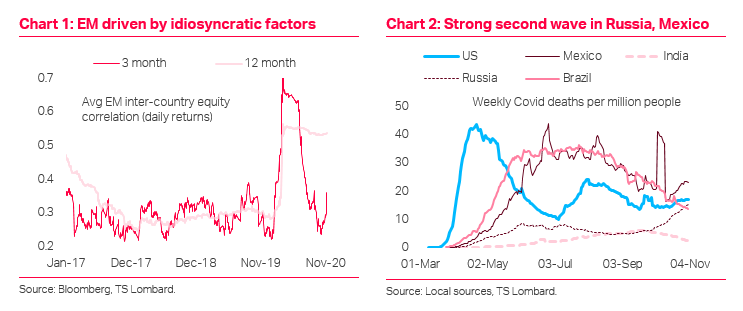

Chart 1: EM assets have responded well to the global risk-on sentiment driven by the US election, but idiosyncratic factors are likely to remain important, leading to uncorrelated outcomes for markets.

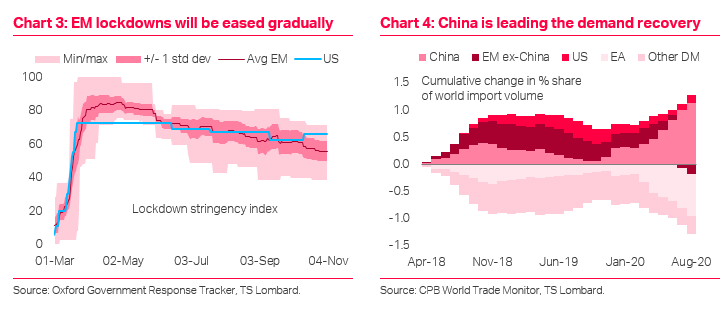

Chart 2: Most EM governments have made progress toward curbing the impact of the pandemic, but a second Covid wave, notably in Russia and Mexico, remains a threat to consumer sentiment and the economic recovery.

Chart 3: Despite the Covid second wave, most EM governments remain reluctant to re-impose severe lockdown restrictions, but full re-opening is likely to proceed only gradually.

Chart 3: Despite the Covid second wave, most EM governments remain reluctant to re-impose severe lockdown restrictions, but full re-opening is likely to proceed only gradually.

Chart 4: China and EM ex-China are gaining a greater share of exports as world trade recovers, but it is demand from China that is driving the recovery. World trade volumes are nonetheless lower than in 2017 and with a double-dip recession likely in Europe, the recovery in the US will be key for EM exporters.

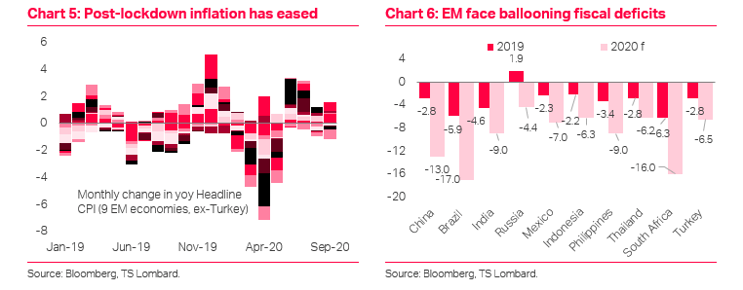

Chart 5: The post-lockdown inflation spike has eased in most EM as disinflationary trends provide a window for fiscal and monetary stimulus. Core inflation is nonetheless above trend in India, Mexico and Russia, likely offset in part by the disinflationary impact of the second wave.

Chart 5: The post-lockdown inflation spike has eased in most EM as disinflationary trends provide a window for fiscal and monetary stimulus. Core inflation is nonetheless above trend in India, Mexico and Russia, likely offset in part by the disinflationary impact of the second wave.

Chart 6: China is delivering fiscal stimulus aimed at generating sustainable economic growth; elsewhere EM governments face an increasingly challenging trade-off of between fiscal choices and financing limitations.

Client Login

Client Login Contact

Contact