Once the Fed started buying mass sums to support markets, we began writing that policy was locked into using the balance sheet to manage rates and the yield curve. Reading the April FOMC minutes, we see that this has also dawned on the FOMC (at least publicly). When the discussion turned to future communication of policy’s path, Treasury purchases more specifically, “Several participants remarked that a program of ongoing Treasury securities purchases could be used in the future to keep longer-term yields low.” Further, “a few”, often the influential “few”, noted that the Fed could purchase Treasuries “to keep Treasury yields at short- to medium-term maturities capped at specified levels for a period of time.” The 10-year yield, not the short-end, consequently becomes the centre of policy, and likely will be for a very long time. In truth, the Fed has no choice.

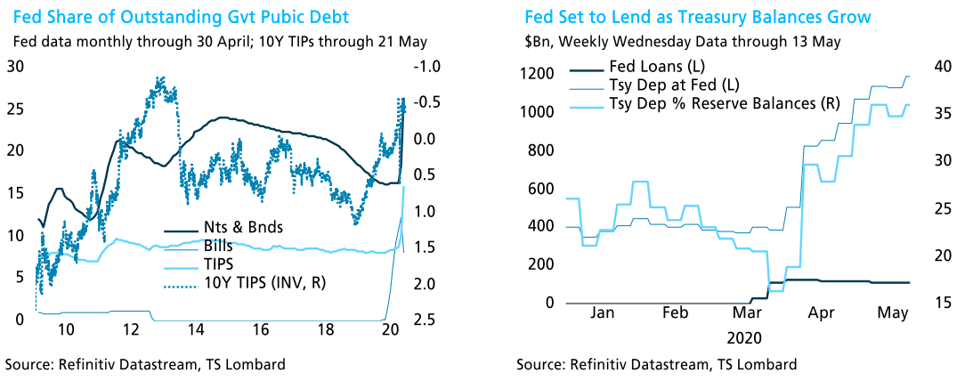

Large Federal deficits and debt, with a large and growing percentage owned by the Fed, means that the central bank must sustain its role in debt financing - lest real rates rise and curb growth as we saw in 2018 (see chart below). The Treasury will raise $3tn in debt this quarter, or 56% of nominal three month GDP – and interest rates, nominal and real, would rise too high for the Fed’s liking if the Fed does not buy. It is true that big deficits have historically not raised yields during a recession because of reduced private credit demands, and, since 1980, the greater willingness of foreign capital to finance the deficit. It is also true that government never asked for quite so much money. The peak WWII deficit, in 1943, was 27% of GDP. At the same time, there was mandated consumer rationing that forced the saving rate up over 24% for three years running (1943-45). The record post-war deficit was 15% of GDP, in 2008:Q4.

No mention of a negative Federal funds rate in the minutes means no negative funds rate as policy. What part of the market does not understand “no”? Apparently, the part still pricing a slight negative funds rate in the second half of 2021 – when stimulus rather than salvaging the economy becomes the more pressing issue. What they and others are missing is that the 10-year yield and lending are the Fed’s proactive tools in their “tool-kit” to boost growth. We have heard as much from Fed Chair Powell, and today as well from Vice-Chair Clarida.Clarida said (bold mine) that the “Federal Reserve will continue to act forcefully, proactively, and aggressively as we deploy our toolkit - including our balance sheet, forward guidance, and lending facilities -....” There is today $1.2trn in Treasury deposits at the Fed (see chart above) and this could finance upwards of $100trn in loans.

The target the Fed uses to communicate policy direction is shifting towards nominal GDP. In the minutes we read (bold mine) “Some participants commented that... forward guidance... could adopt outcome-based forward guidance that would specify macroeconomic outcomes - such as a certain level of the unemployment rate or of the inflation rate... ”. Tiny steps towards GDP targeting in our view, otherwise why we even mention “macroeconomic outcomes” when unemployment and inflation targeting (2%) are already in use.

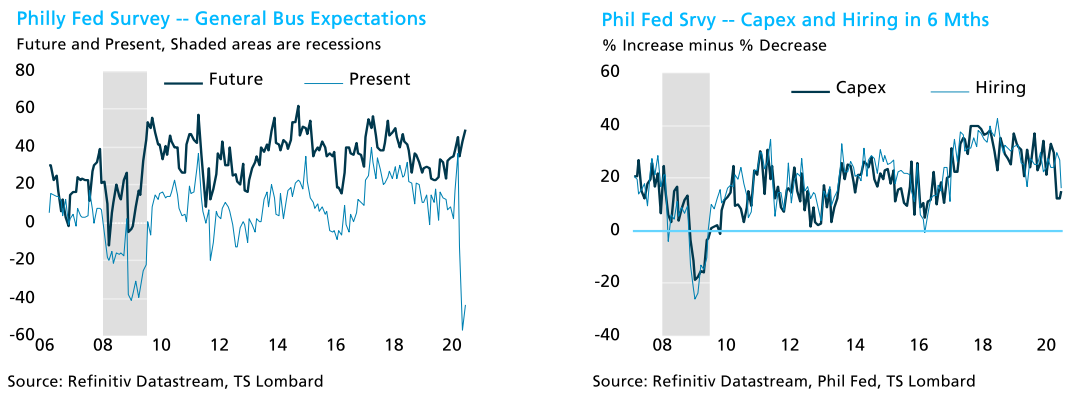

The Fed readies itself to adopt a Japanese style of monetary policy, but surveys remain more upbeat about the future than the Fed. One most unusual aspect of this downturn is that forward sentiment remains upbeat. We see this in the two charts below illustrating some results from the May Philly Fed survey of area manufacturers. Particularly striking is the difference between the respondents’ view of the future versus the present. Further, net future plans for hiring and capex have not even dropped to 2016 lows. This belief that the current downturn is akin to a three-month bank holiday is also helping to fuel the equity market rebound.

Our own view is similar to the Fed’s (not necessarily a comfortable place to be) - that as the economy reopens, sustained deep recessionary levels of activity become more evident. This, in turn, sours forward sentiment, adds to economic weakness, and pulls the stock market down as well. With that, expect the Fed to respond by using its balance sheet to pull down term yields and push out loans.

Client Login

Client Login Contact

Contact