Steven Blitz

Recent Posts

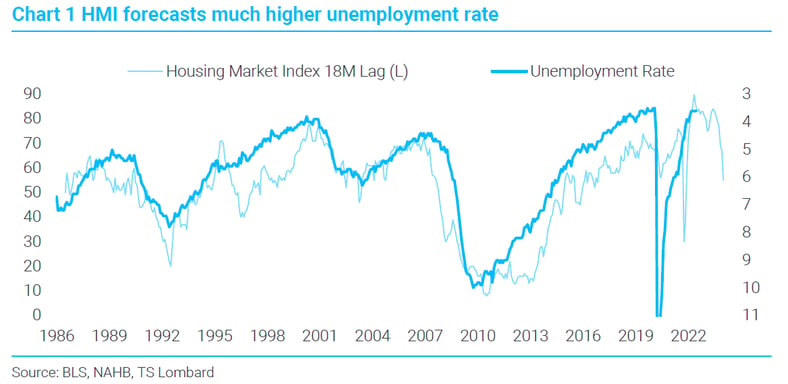

How High for Unemployment in the coming US Recession

26 Jul 2022 - Steven BlitzThere are any number of ways to dissect the spread between the 7% job openings rate and 3.5% unemployment, but the needed drop in demand’s contribution to current inflation occurs when this spread turns negative..

#Federal Reserve #Monetary Policy #Interest Rates #Recession #UnemploymentOptimism: Mild US recession followed by a recovery and 2% inflation

18 Jul 2022 - Steven BlitzThe story of this cycle does not end when recession begins, the story, in fact, begins with the direction Fed policy takes once unemployment starts to rise. Recession of some sort was always inevitable to curb.

#Federal Reserve #Monetary Policy #Inflation #US EconomyFOMC commits to recession - are they late on this too?

16 Jun 2022 - Steven BlitzPowell told us policy is going to create a recession, but soft peddled it enough to leave markets to figure that out for themselves. After all, the FOMC is still very much in the clench of a dance between its objective.

#Federal Reserve #Monetary Policy #Recession #US EconomyFed funds target rate is >4%, if...

18 May 2022 - Steven BlitzThe shock of 2021, friction in global sourcing of capital and labour, brings back the output gap as a determinant of inflation and thus returns some slope to the Phillips Curve. This makes the “is inflation peaking”.

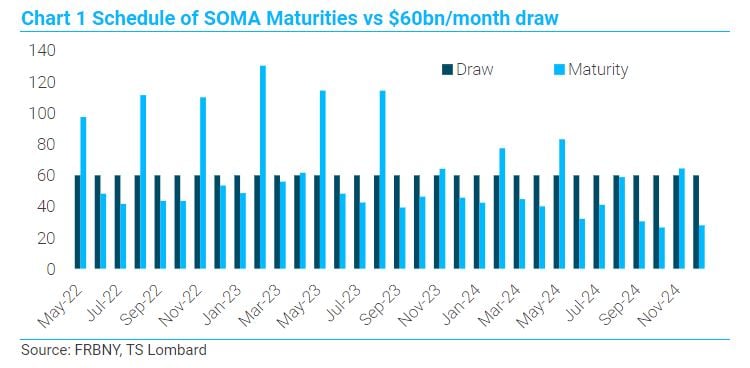

#Federal Reserve #Monetary Policy #Inflation #US EconomyQT's inflationary potential is real

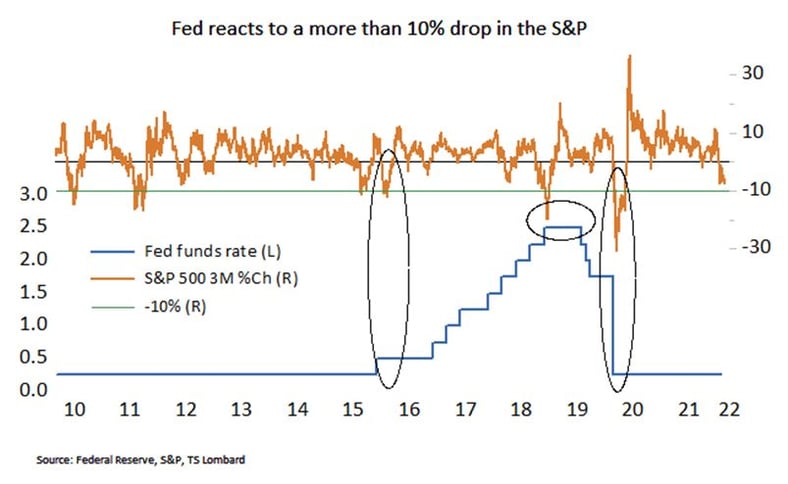

25 Apr 2022 - Steven BlitzMarkets will not truly consider the Fed serious about inflation until policy stresses markets by pulling up real yields to some critical level. The Fed turns serious once they recognize that deteriorating global.

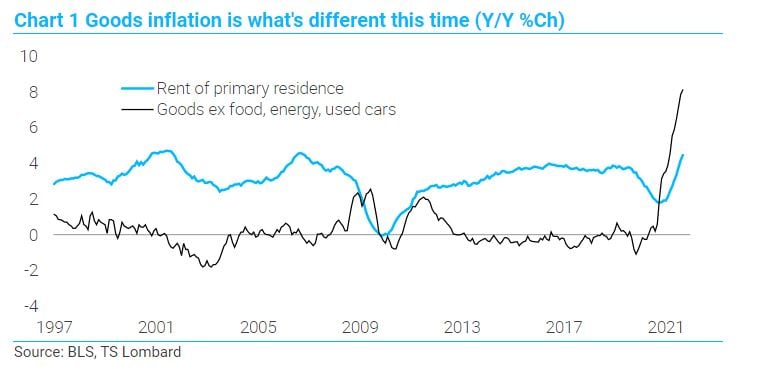

#Federal Reserve #Monetary Policy #Inflation #US EconomyUS CPI - Where to from here is what matters, not the "peak"

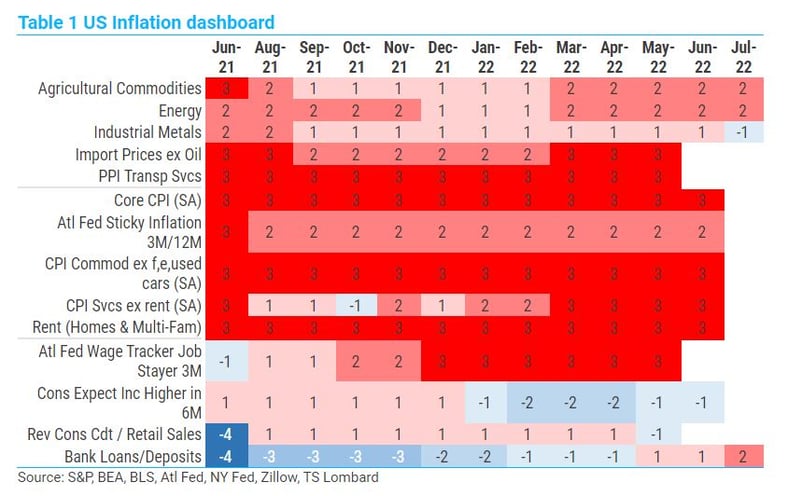

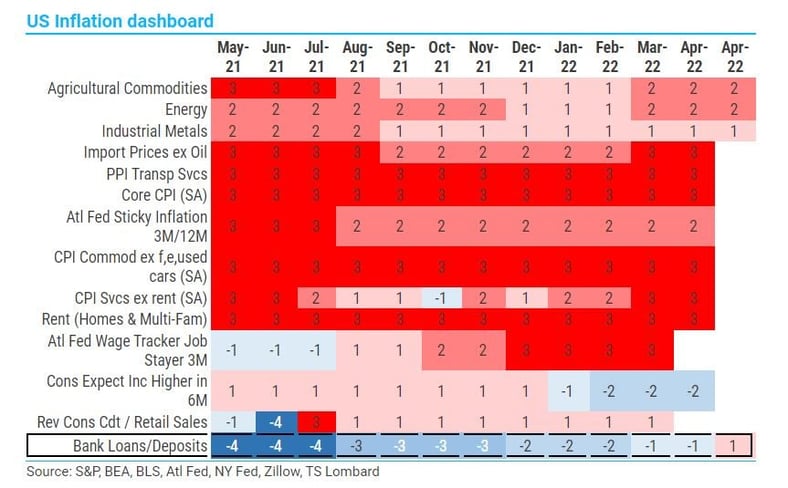

14 Apr 2022 - Steven BlitzMarch CPI data came in as expected, driven up by energy and a smattering of services – but goods prices ex food and energy fell 0.4% m/m, and this is key. The “secret sauce” of low core inflation for a generation has.

#Federal Reserve #Monetary Policy #Inflation #Recession #US EconomyIs the US recession inevitable? Always, but not when real rates are negative

06 Apr 2022 - Steven BlitzToday, in the middle of this cycle, the straight path is lost -- the Fed is hoping for relief from abroad because it fears the chase that inevitably leads to lost jobs and wealth. Seeing the Fed play for time, markets.

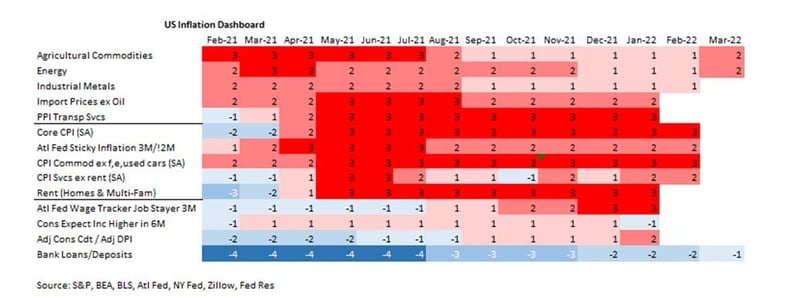

#Federal Reserve #Monetary Policy #Recession #US EconomyFebruary CPI and bank lending starts to rise

16 Mar 2022 - Steven BlitzThere was little in the Feb CPI report to give the Fed comfort, and the rise in bank lending should be a cause for concern. The “good news” in the Feb CPI report was some deceleration in inflation excluding food,.

#Federal Reserve #Inflation #US EconomyUS inflation to set a new course

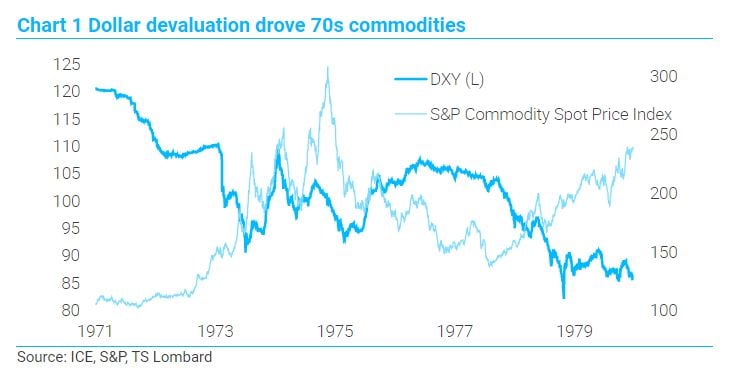

14 Mar 2022 - Steven BlitzThe historic analogue for current inflation does not lie in the 1970s, and the Fed’s on-again off-again response. Inflation in the 1960s eventually strained the Bretton Woods fixed-currency system to the point where it.

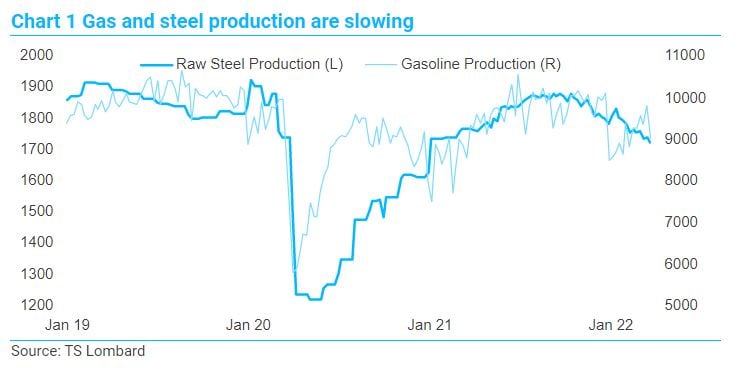

#Federal Reserve #Inflation #Commodities #StagflationUS growth and the Fed - after the Russian invasion

28 Feb 2022 - Steven BlitzThe short-term implications of the Russian invasion of Ukraine pales next to the longer-run consequences, but the world focuses on the short-term and so too does this note (with a coda on the long-run). First off, Biden.

#Federal Reserve #Russia #Geopolitics #Ukraine Client Login

Client Login Contact

Contact