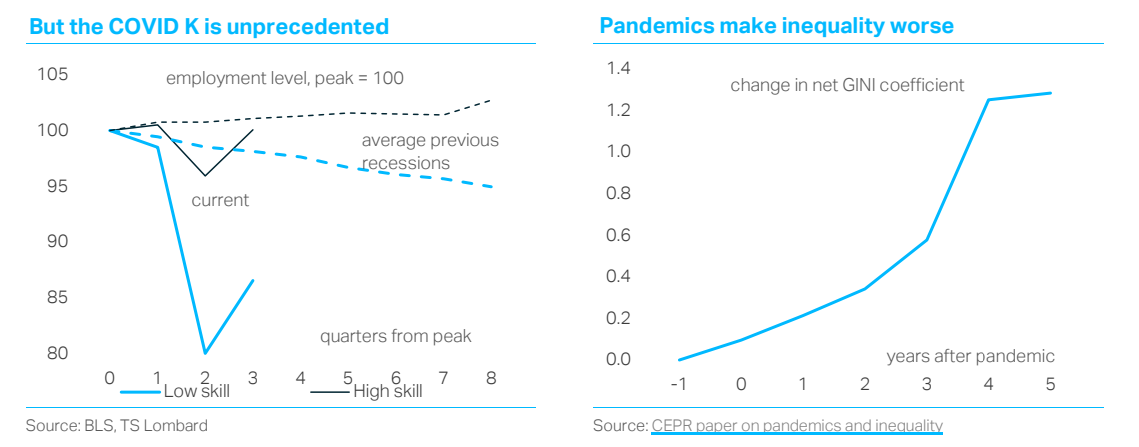

Data for other countries confirms the tendency for inequality to widen during recessions, though the picture is more mixed than the US experience – because it depends, in part, on the policy response. UK disparities, for example, widened sharply during the recessions of the 1980s and1990s, though Britain avoided a similar trend after the global financial crisis. While inequality has remained an important theme in the UK over the past decade, aggregate measures such as the Gini coefficient have been remarkably stable, with regional dispersion (especially between London and the rest of the country) taking over as the main area of controversy. Still, nothing we see in the historical data for OECD countries can compare to what has happened in 2020,where the “K” has widened more dramatically than in any previous global recession (chart on the left).

There are several explanations for the extreme widening in inequality that has taken place in 2020. First, it reflects the underlying cause of the downturn – the health crisis. Historical evidence shows pandemics usually hit the poorest members of society hardest. A recent paper by Furceri, Loungani, Ostry and Pizzuto (2020) analysed the impact of previous epidemics, which while on a smaller scale: (i) caused a marked increase in the Gini coefficient, (ii) raised the income shares of higher income-earners, and (iii) reduced the employment-to-population ratio for those with basic education compared to those with higher education. The chart on the right shows a summary of their findings, with the average pandemic causing a persistent increase in inequality. Five years later, the Gini coefficient was on average around 1.3% above its pre-pandemic trend, which is a significant shift for a statistical series that tends to evolve only slowly over time.

The behaviour of the stock market is another reason the COVID-19 downturn has had wider distributional effects than previous recessions, especially in the United States. Stock-market wealth is particularly concentrated in the top 10%. The resilience of the stock market has widened wealth inequalities, especially compared to the typical recession in which equity values usually suffer a substantial decline. Note also that equity wealth is more unevenly distributed than housing wealth. This is important in the context of “wealth effects” because it means the recent resilience of household balance sheets is less likely to support consumption, providing a limited boost to the economy (so no “trickle down”).

Client Login

Client Login Contact

Contact