It has been a little over a year since commodity prices bottomed out, marking the start of a powerful rally that is reminiscent of those in 1993-95, 2005-07 and 2009-10. With the global economic recovery set to gather pace and demand for real assets on the rise, the macro backdrop implies further upside. But as we roll into a mid-cycle environment, it also means that the easy, early-cycle gains are behind us.

First, the yawning gap that developed between gold and industrial commodities in 2020 H1 has closed via a sharp rebound in the latter, signalling the transition from reflation hopes to the reality of policy stimulus gaining traction. While the gold/CRB ratio probably has further to fall – not least as the balance of risks for long US Treasury yields looks skewed to the upside – it is now much closer to its long-term trend.

Second, the CRB index tends to move in lockstep with market-implied US inflation expectations (10yr TIPS breakevens). Although these could have further to rise, the bulk of the adjustment from the 2020 lows looks more or less complete.

Third, while liquidity is bound to remain very loose, at the margin it is set to cool as policy starts to (slowly) follow global growth turning the corner. Moreover, major economies’ reopening means a larger share of liquidity can be expected to make its way from financial markets to real activity – a boon for commodities from a fundamental standpoint but a potential headwind from a risk-asset angle.

The relationship between oil and industrial metals also seems to suggest that the ‘reopening trade’ has largely been priced in by investors, consistent with the message from other markets. Oil started to outpace copper when news of effective vaccines broke in early November, but this run came to an end in March –about the same time that US long real yields’ advance stalled and US small-cap stocks started to lag the S&P 500.

The long-term fundamental outlook for base metals remains bullish – not least for copper, where a secular rise in demand combined with tight supply and low inventories has already propelled prices to their highest since 2011. To be sure, as Chinese credit growth slows further and the yuan is likely to soften versus the dollar, the price action could become more two-way going into 2021 H2 – a period in which global growth leadership is expected to shift from China to the rest of the world. Our strategists still view current levels as an attractive entry point for long positions in copper futures and mining stocks.

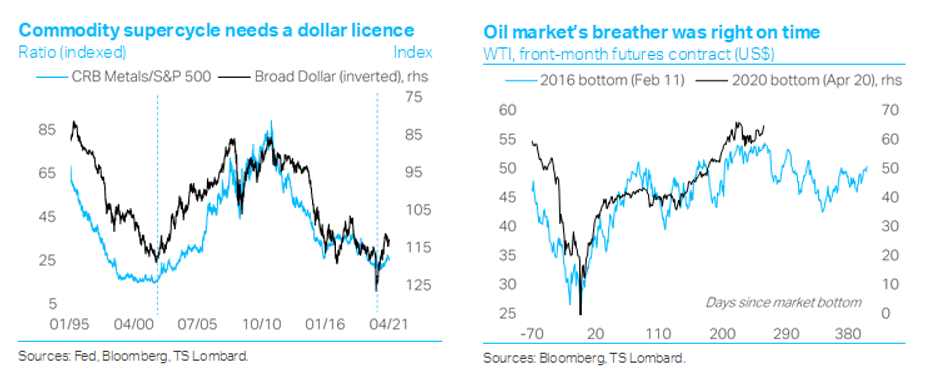

Oil prices have cooled in line with our expectations as the pattern of this rally continues to track the rebound from the February 2016 bottom. This points to a period of range-bound prices ahead, reflecting the combination of recovering demand with OPEC+ discipline (controlled taper of output cuts) and what has so far been a timid supply response from US shale (rig count 50% below March 2020 levels), which should keep inventories drawing. Positive summer demand surprises may well push prices to new highs, but the big picture remains one in which the global drive towards renewables translates into a secular decline in oil demand.

Decarbonization implies, too, that the epicentre of upward price pressures in what is shaping up to be the next major commodity upcycle will not be oil but industrial metals. Whether this will be a supercycle is largely a question of semantics. Our definition encompasses multi-year outperformance versus equities, and history suggests this is likely to go hand in hand with a dollar bear market. The dollar has come off the highs of 2020 but remains remarkably resilient given the extraordinary amounts of central bank liquidity created. We believe this is rooted in the combination of US macro outperformance and strong US domestic demand for dollar liquidity. Both factors are likely to dissipate over the coming quarters as US real activity gathers pace while Europe and major EMs play catch-up. Until then, the dollar is unlikely to weaken significantly, allowing commodity prices to continue rising but keeping the reins on the next supercycle.

Client Login

Client Login Contact

Contact