Commodities: burden of proof is with the bulls

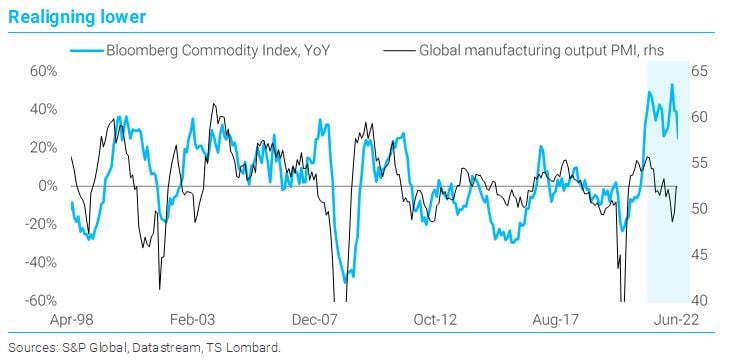

07 Jul 2022 - Konstantinos VenetisThe breadth of the commodity rally started narrowing in early March, when the dust from Russia-Ukraine shock began to settle. Industrial metals topped out first and rolled over decisively in April – around the same time.

#Federal Reserve #China #CommoditiesAll eyes on oil as the commodity rally narrows

13 Jun 2022 - Konstantinos VenetisCommodity prices continue to trend higher but the breadth of the rally has narrowed: industrial metals have corrected lower in 2022 Q2, leaving energy prices to pull the cart. Where do we go from here? The case for a.

#Federal Reserve #OPEC #Commodities #OilUS inflation to set a new course

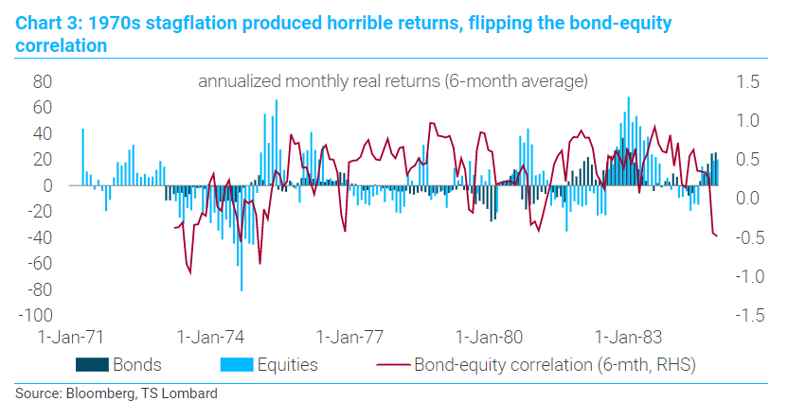

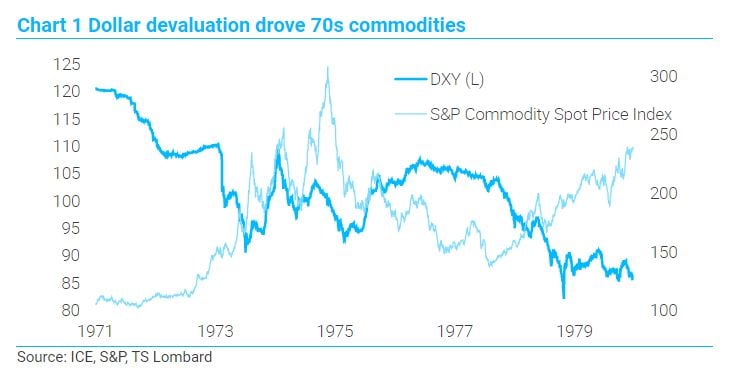

14 Mar 2022 - Steven BlitzThe historic analogue for current inflation does not lie in the 1970s, and the Fed’s on-again off-again response. Inflation in the 1960s eventually strained the Bretton Woods fixed-currency system to the point where it.

#Federal Reserve #Inflation #Commodities #StagflationRussia-Ukraine war: Initial market take

25 Feb 2022 - Andrea CicioneMarkets normally react negatively to geopolitical risks but soon lose interest. The North Korea crisis of 2017-18 is a prime example of this: since it’s impossible to put a price on a nuclear war, markets simply decided.

#Federal Reserve #Oil & Gas #Oil Price #Russia #Commodities #Ukraine #War"Late cycle" comes early

18 Feb 2022 - Konstantinos VenetisWhether one views the last couple of years as a break in the business cycle or the beginning of a new cycle, the bigger point is this has been a cycle on steroids: in terms of its amplitude, the speed of maturity and.

#Federal Reserve #Monetary Policy #Inflation #CommoditiesEvergrande China growth contagion

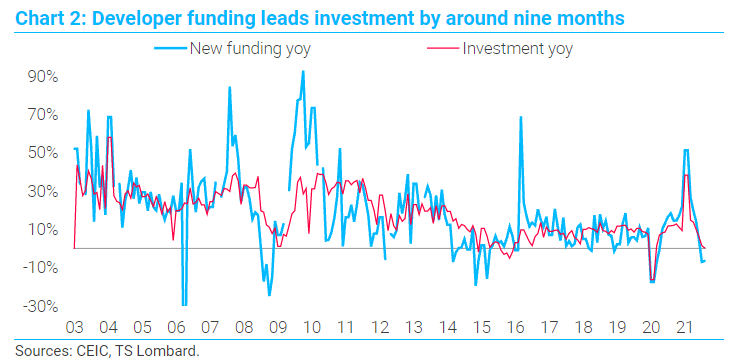

27 Sep 2021 - Rory GreenEvergrande is collapsing. China’s second-largest developer by sales and largest in terms of total debt and liabilities is no longer a viable business. The extent of the macro and market spill-overs both on the Mainland.

#China #Fiscal Policy #Commodities #EvergrandeCommodity bull moving into mid-cycle

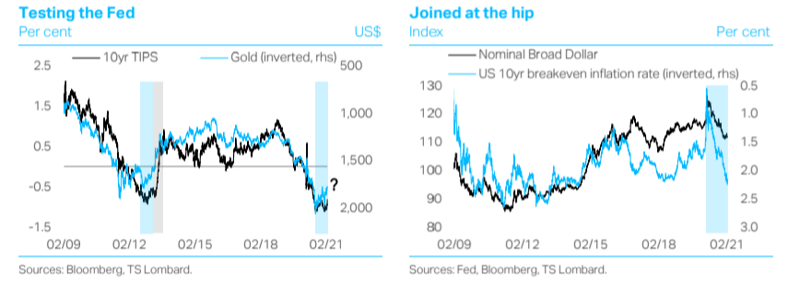

30 Apr 2021 - Konstantinos VenetisIt has been a little over a year since commodity prices bottomed out, marking the start of a powerful rally that is reminiscent of those in 1993-95, 2005-07 and 2009-10. With the global economic recovery set to gather.

#Federal Reserve #Commodities #OilOil: new playbook, same old cycle

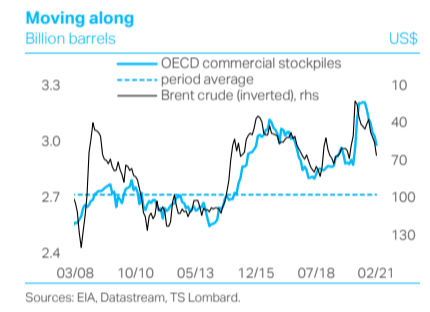

05 Mar 2021 - Konstantinos VenetisWe have often made the argument that although the nature of the Covid shock makes this macro cycle unique, it is important not to lose sight of the fact that this remains a cycle. The same is true of the oil market..

#Inflation #OPEC #Commodities #OilCommodity Supercycle now on? Potential is there

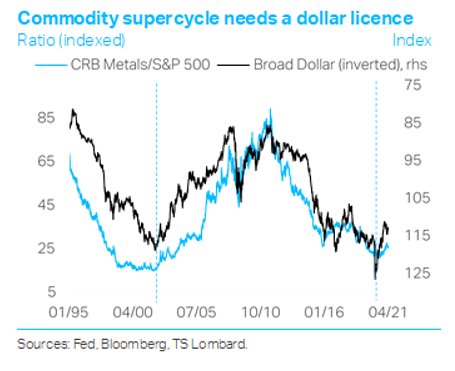

01 Mar 2021 - Konstantinos VenetisThere are two questions that the current debate on the commodity cycle tends to conflate. Does the rally that kicked off in spring 2020 have further to go? And are we in the early stages of a so-called “supercycle”,.

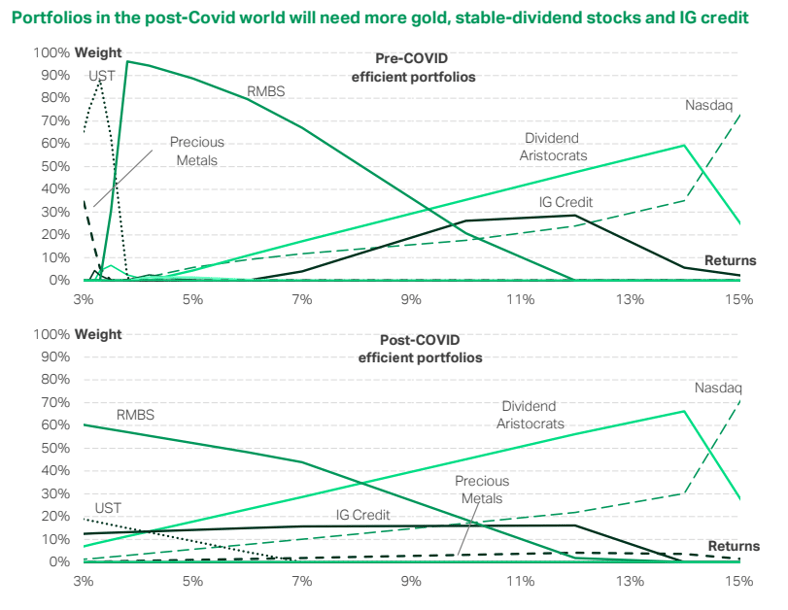

#Federal Reserve #Stimulus #Commodities #OilPortfolios in the post-Covid world

16 Oct 2020 - Andrea CicioneIf the Global Financial Crisis ushered in the era of zero yields, the Covid pandemic has made it a semi-permanent affair. We have looked at how lower bond returns have changed asset allocation choices faced by.

#Equities #Stock Market #Asset Allocation #Gold #Commodities #Dividend Aristocrats Client Login

Client Login Contact

Contact