The US state of Mississippi is in the midst of its worst wave of Covid infections. Ditto Arkansas and Louisiana. But it’s not just the Mississippi Delta feeling the Delta blues. Cases in Florida are second only to Mississippi in the US (population-adjusted) and Covid-related deaths in the sunshine state are now running at a higher pace than at any point since the pandemic started. The Olympics and Paralympics in Tokyo are proceeding with no fans, and here in the UK a music festival in Cornwall was a super-spreader event (and the same is inevitable at three huge music festivals in Reading, Leeds and the northwest of England).

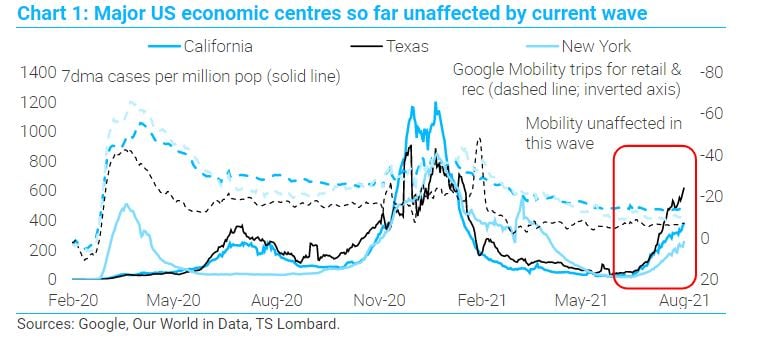

But so far, the recovery remains on track. Our assertion in July that Delta would not derail the recovery was largely based on high vaccination rates and low case counts in the major economic centres of the US (California, Texas and New York). Since then, the pace of new cases has more than trebled in Texas and New York despite the vaccination rollout continuing to progress. However, given that lockdowns remain very unlikely in these centres, we reckon the US recovery is still on track even if the post-Covid rebound is now mostly done.

Do vaccines still work? Israel – which achieved a 50% vaccination rate back in March – is facing another virus surge, with cases at a similar level to the country’s January wave and the fatality rate rising sharply, too. We are not epidemiologists and we will not pretend to offer reasons why the virus appears to have broken through, despite high levels of vaccination. But unfortunate as this is for Israel, the country’s experience serves as a forewarning for the US and European countries: Israel started administering boosters last month and their apparent success means other countries will follow its lead – ideally before the current wave intensifies further. Yes, vaccines still work.

Does a zero-Covid approach work? In our Covid update last month, we spelled out two contrasting paths to tackling the virus. While last month the dichotomy was most evident between the US and China, it is now the case that both Australia and New Zealand are following a similar zero-Covid path to that of China. Any outdoor gathering of more than two people is prohibited in Sydney, and the whole of New Zealand is at “Alert Level 4” (the highest level) – all in an effort to prevent the small number of community cases from spreading more widely among a largely unvaccinated population. Inevitably these restrictions have frozen economic activity and, in New Zealand’s case, prevented at least one central bank rate hike.

And here’s the problem: it is well-nigh impossible to avoid importing the virus, especially when a more virulent strain emerges. Thanks to higher levels of antibodies in some countries with high vaccination rates, the more virulent Delta strain emerged and rapidly spread around the world. For each new wave of infections, countries pursuing a zero-Covid policy must take more and more stringent measures to prevent transmission. Yes, it may work. No, it is not sustainable.

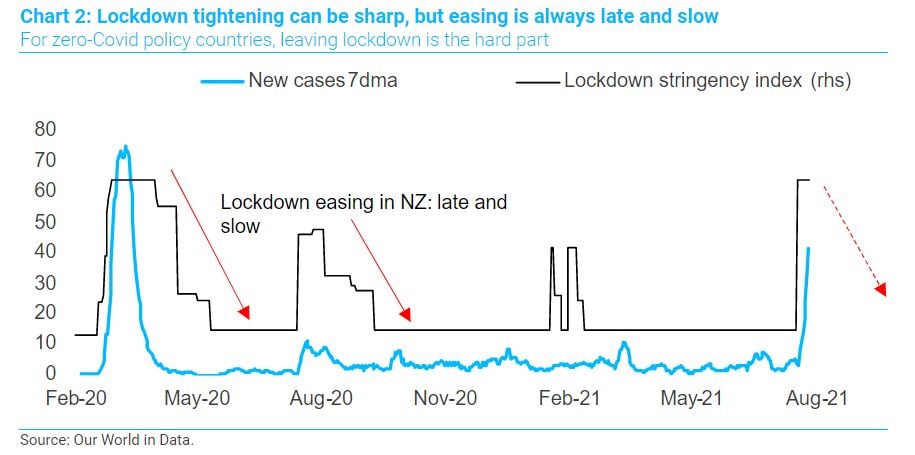

Some may point to China’s relatively high vaccination rate as added protection against virus risks, but as long as the country continues to pursue a zero-Covid policy, the vaccination rate is a lesser consideration: policymakers will always be faced with the dilemma of how rapidly and how broadly to lock down when a new variant hits their shores. Unless the zero-Covid strategy is abandoned, the government will be compelled to enact lockdowns and freeze the economy (in the best case locally, in the worst case nationally) until an outbreak is over. For example, New Zealand entered a three-day lockdown on 17 August. This has now been extended until the end of the month – and beyond in the case of Auckland – but the case count continues to rise sharply. New Zealand eased previous lockdowns only when cases had definitively peaked: the exit from lockdowns is inevitably late and slow.

We reckon China’s zero-Covid policy will be in place until the Beijing Winter Olympics in February next year. And we have already seen the effect of this policy: under the recent lockdowns in Jiangsu and Henan provinces, both consumption (retail sales) and manufacturing (industrial production) activity fell by more than expected. Not only is the implementation of this policy a drag on growth, the threat of a snap lockdown discourages consumer activity: why plan travel or spending if a lockdown is always on the horizon. Owing to the country’s zero-Covid approach, China growth is likely to remain subdued until at least after the Winter Olympics.

Nowhere is safe until everywhere is safe. The Delta variant is threatening the global recovery, but we reckon that the very low probability of further lockdowns in the US together with forthcoming booster shots means it is unlikely to derail growth. However, offering a third vaccine shot to rich Westerners smacks of conspicuous consumption when there is a vaccine dearth in the developing world. Less than 3% of the population of Africa has been fully vaccinated. If the virus has free rein to mutate, the world remains at risk from more virulent variants. So far, we have been lucky as far as the Delta variant is concerned, but the Lambda variant – currently spreading through South America – appears highly infectious and more resistant to vaccines.

The Delta variant is giving growth the blues. But investors’ focus should be on how the various economies respond to virus spread: zero-Covid economies will be hardest hit, with the greatest (global) risk in China. And the next focus should be on the rise of variants. We mentioned Lambda above, but pick a letter of the Greek alphabet and there will be a variant to follow. Covid-19 is going nowhere, and nor should your vigilance.

Client Login

Client Login Contact

Contact