Commodities: burden of proof is with the bulls

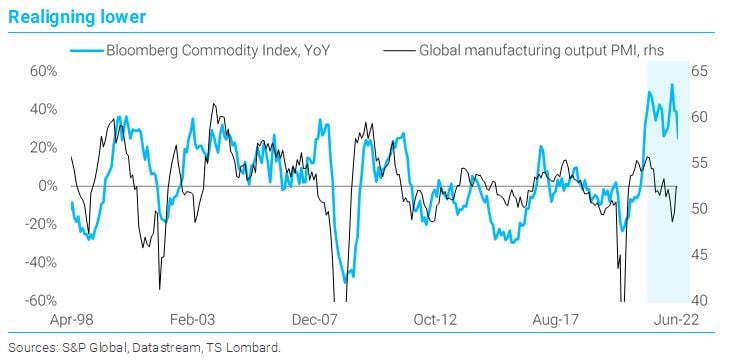

07 Jul 2022 - Konstantinos VenetisThe breadth of the commodity rally started narrowing in early March, when the dust from Russia-Ukraine shock began to settle. Industrial metals topped out first and rolled over decisively in April – around the same time.

#Federal Reserve #China #CommoditiesThe year of the payback

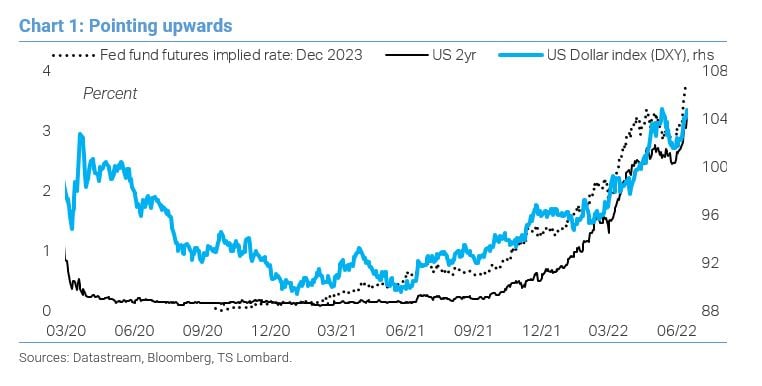

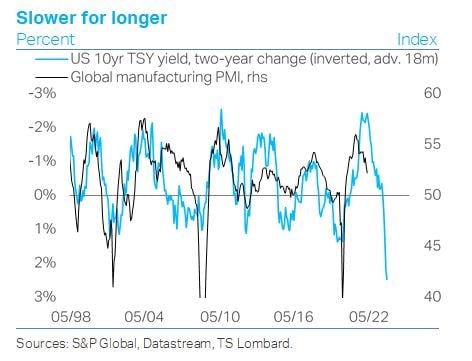

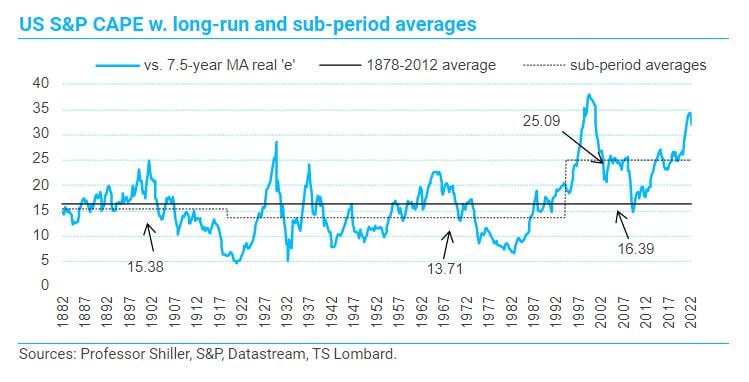

20 Jun 2022 - Konstantinos VenetisThe markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time.

#Federal Reserve #Monetary Policy #Inflation #China #OPECThe cycle starts to bite

11 May 2022 - Konstantinos VenetisThe macro story of 2022 is “higher-for-longer inflation” that is forcing central bankers across the major DMs, led by the Fed, to tighten into slowing growth. Going into this year, a slew of high-frequency indicators.

#Federal Reserve #Inflation #China #Bond marketsGet ready for the super-charging of US-China decoupling

21 Apr 2022 - Grace FanNearly two months into the Russia-Ukraine war, US policymakers – troubled by Beijing’s pro-Kremlin rhetoric – are forging ahead with robust plans to accelerate US-China decoupling. Of the five major decoupling pathways.

#Equities #China #Technology #DecarbonomicsEvergrande China growth contagion

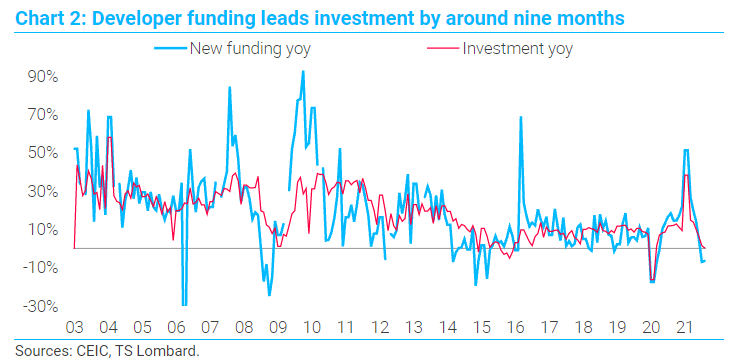

27 Sep 2021 - Rory GreenEvergrande is collapsing. China’s second-largest developer by sales and largest in terms of total debt and liabilities is no longer a viable business. The extent of the macro and market spill-overs both on the Mainland.

#China #Fiscal Policy #Commodities #EvergrandeDelta blues

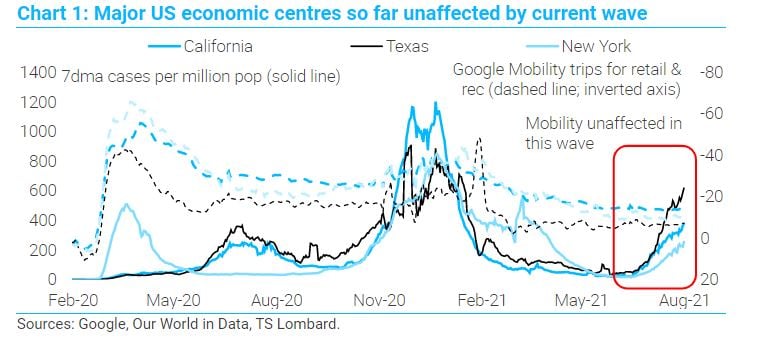

27 Aug 2021 - Oliver BrennanThe US state of Mississippi is in the midst of its worst wave of Covid infections. Ditto Arkansas and Louisiana. But it’s not just the Mississippi Delta feeling the Delta blues. Cases in Florida are second only to.

#China #Covid19 #Recovery #Delta variantGlobal Tourism: EU & China risk

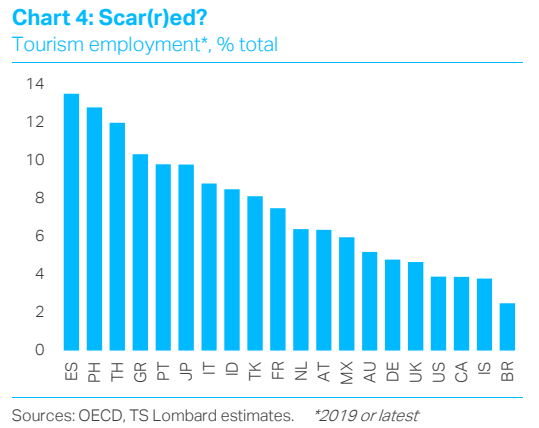

29 Mar 2021 - Davide OnegliaOne year into the pandemic, still enduring tough restrictions on social life, entertainment activities, and leisure travel, we bet most people crave a long holiday. With the acceleration in the vaccine rollout,.

#Eurozone #China #TourismChip Famine and the new OPEC

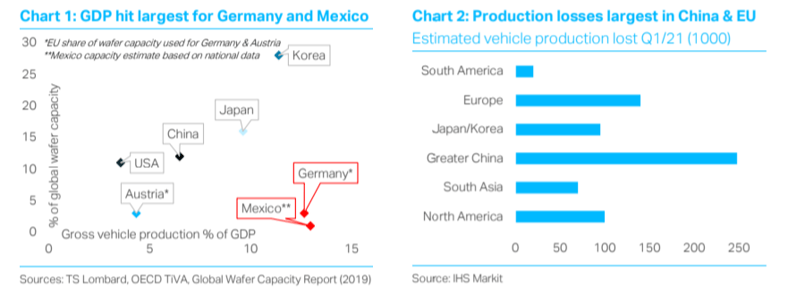

19 Feb 2021 - Rory GreenSurging demand for semiconductors is putting pressure on vehicle production and US-China relations. Taiwan and Korea are the prime beneficiaries, insatiable demand for their exports and rising prices adds conviction to.

#Trade War #China #Technology #OPEC #Semiconductors #GeopoliticsGeopolitical Spotlight shifts to semiconductors - the new oil

10 Feb 2021 - Rory GreenThe structural shift in demand for semiconductors moves the focus of global geopolitics and finance from the Persian Gulf to the South China Sea. The rapid acceleration of the “internet of things”, to-date and to-come,.

#China #Oil & Gas #OPEC #Semiconductors #GeopoliticsChina's green revolution

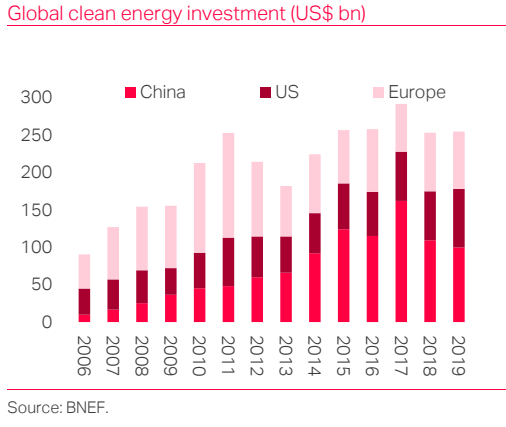

08 Feb 2021 - Eleanor OlcottThe expansion in coal power production towards the end of last year cast doubts on Xi Jinping’s pledge made at a UN summit in September for China to achieve carbon neutrality by 2060. The PRC’s overreliance on coal is.

#China #Decarbonomics #Climate Change Client Login

Client Login Contact

Contact