FOMC Minutes + Retail Sales + Industrial Prod. = 50BP in March

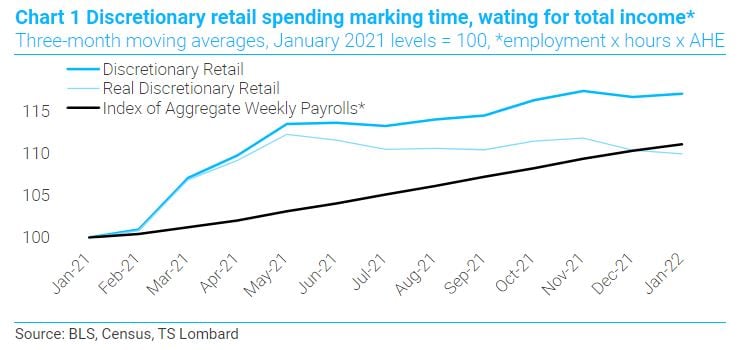

21 Feb 2022 - Steven BlitzMarkets are 60/40 favouring a 25bp rate hike in March vs 50bp. I was similarly positioned until January retail sales, industrial production, and the FOMC minutes were released. January retail sales more than reversed.

#Federal Reserve #Employment #RecoveryPowell lowers the strike price on the Fed's put

27 Jan 2022 - Steven BlitzAIT was the promise that the Fed would chase inflation rather than be pre-emptive and here we are, promise kept. Powell now promises the chase to be executed, using a combination of rate hikes and balance sheet.

#Federal Reserve #Monetary Policy #Inflation #RecoveryUS inflation - It's not about the rent

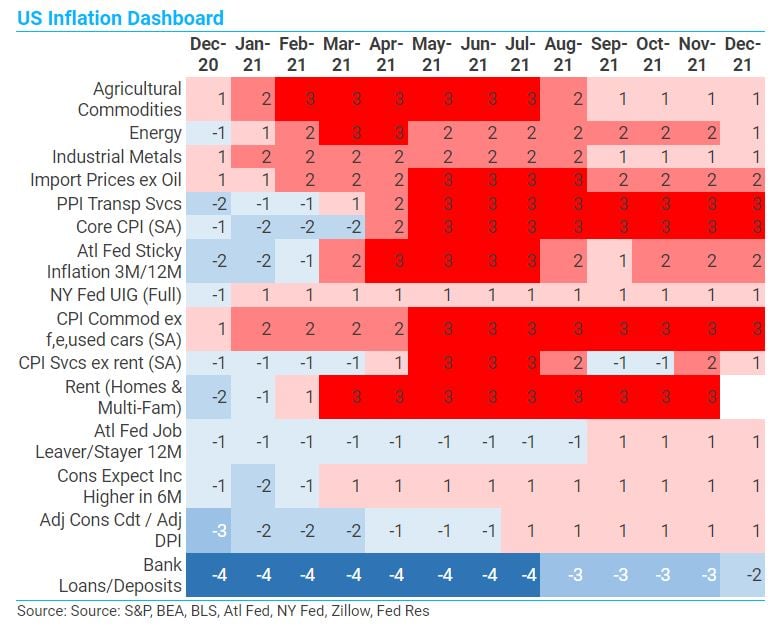

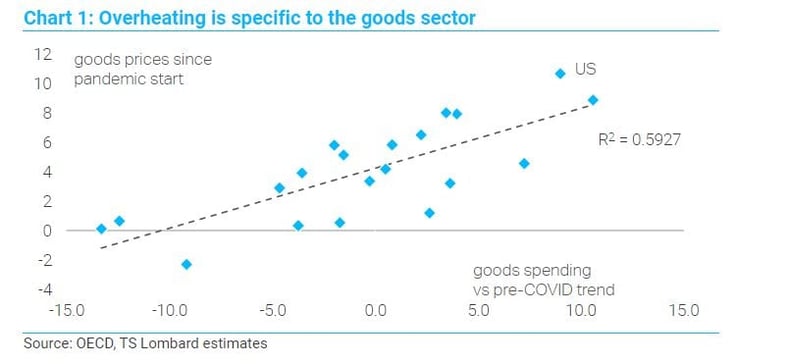

18 Jan 2022 - Steven BlitzThe inflation problem for the US is not rent, but the loss of zero inflation in goods prices as an offset, and this offset is unlikely to return in the coming cycle. One can say current goods price inflation is the.

#Federal Reserve #Inflation #RecoveryDon't extrapolate from this fake business cycle

13 Jan 2022 - Dario PerkinsEdgar Fiedler, who served as Assistant Secretary of the Treasury in the Richard Nixon and Gerald Ford administrations, famously joked: “Ask five economists a question and you'll get five different answers – six, if one.

#Central Banks #Monetary Policy #Inflation #Recession #RecoveryDelta blues

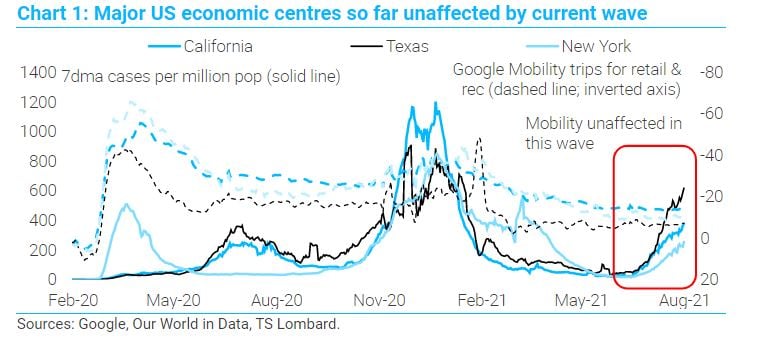

27 Aug 2021 - Oliver BrennanThe US state of Mississippi is in the midst of its worst wave of Covid infections. Ditto Arkansas and Louisiana. But it’s not just the Mississippi Delta feeling the Delta blues. Cases in Florida are second only to.

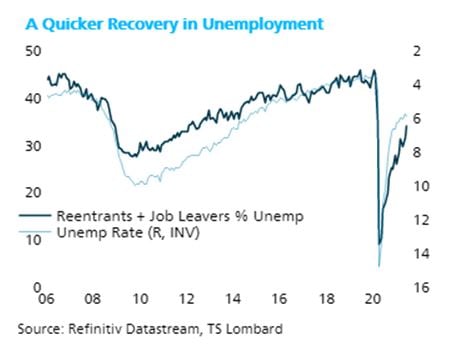

#China #Covid19 #Recovery #Delta variantReading through US unemployment

05 Jul 2021 - Steven BlitzThis was a healthy jobs report by most measures, and a read through of the unemployment data indicates the same. All of the increase in unemployment (household survey) came from a rise in people quitting their jobs and.

#Federal Reserve #Unemployment #RecoveryFed resets the betting table

21 Jun 2021 - Steven BlitzAt Wednesday 16th June’s meeting, the FOMC moved closer to my long-held view that the rate hike first comes at the end of 2022, with two hikes completed by the end of 2023. It was not a unanimous decision, but the.

#Federal Reserve #Unemployment #RecoveryBonds are saying the market needs a new catalyst

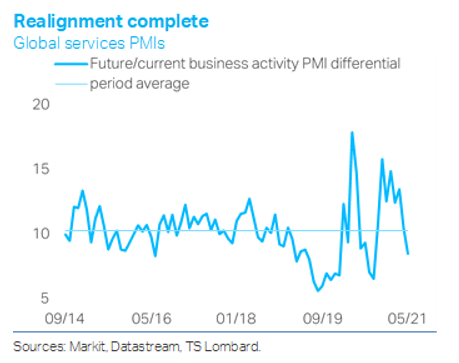

15 Jun 2021 - Konstantinos VenetisThe second quarter of 2021 is set to mark the peak in quarterly GDP growth for most of the major economies, which will give way to a still solid but slower pace of expansion as the transition from an early to a.

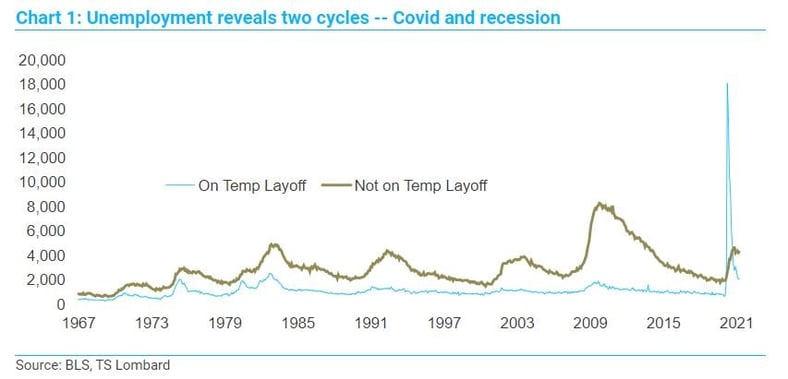

#Federal Reserve #Inflation #Bond markets #RecoveryUS recession is over - Backwards won't be the way forward

26 Mar 2021 - Steven BlitzThe “non-Covid” recession ended late summer, timed, in part, by the November peak for the number of unemployed not on temporary layoff. What we call the non-Covid recession is simply the downturn that created job losses.

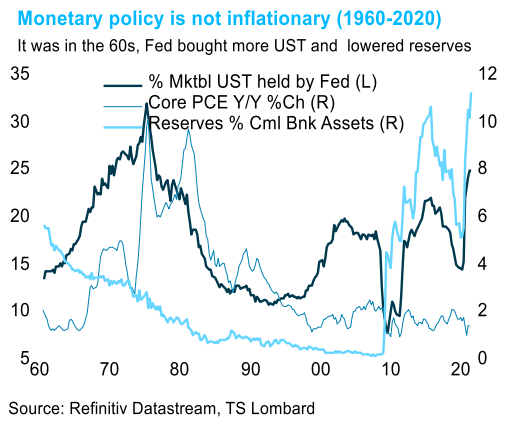

#Federal Reserve #Recession #US Economy #Fiscal Policy #Employment #RecoveryU.S. inflation has to wait

12 Mar 2021 - Steven BlitzAny inflationary process must wait for short rates to drift above what the Fed pays for bank reserves, until then its price changes inside a post-recession disinflationary trend. February CPI data underscore the.

#Inflation #Quantitative Easing #Recovery Client Login

Client Login Contact

Contact