Evergrande is collapsing. China’s second-largest developer by sales and largest in terms of total debt and liabilities is no longer a viable business. The extent of the macro and market spill-overs both on the Mainland and offshore depends on the degree of central government intervention. Whatever happens to Evergrande, the event likely marks the start of a new development model for the property sector, one featuring greater state involvement, lower investment and entailing slower economic activity.

Beijing has the tools and incentives to limit Evergrande risk. Central authorities engineered the current sector-specific credit crunch by introducing tougher rules on developer leverage – and bank lending to developers and mortgage buyers. Evergrande itself is a well-known grey rhino (a difficult to resolve risk but one that can be seen from some way off). Authorities have been aware of the dangers associated with the company for a number of years. Our contacts in Beijing report that restructuring discussions took place with government officials in early 2021.

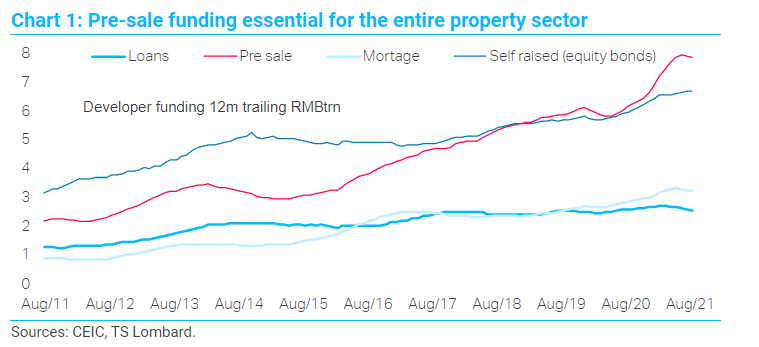

We see three core reasons for China to intervene. First, the risk to household wealth and social security from an uncontrolled default is too high. Falling real-estate prices and the destruction of household wealth would trigger mass protests and raise serious questions about the Party’s legitimacy. Second, unless Evergrande is ring-fenced and its pre-sale model partly backstopped, the entire property sector – which accounts for 25% of China GDP – would face a severe credit crunch. Chart 1 above highlights the stark reliance of the entire industry on the pre-sales funding model. Third, the 20th Party Congress in Q4/22, at which Xi Jinping will start his third “term” as leader, is likely to embed the “common prosperity” shift within the Party-political canon. Stability – economic, social and financial – is always at a premium around big Party set-piece events, and the upcoming Congress is the most important in the last 10 years.

A high pain threshold when hunting for grey rhinos. Since 2016 China has attempted to gradually reduce moral hazard and deleverage. The goal of financial discipline remains paramount and has been reinforced by the emerging shift towards “common prosperity”. Beijing clearly wishes to deliver the message that it remains serious about removing moral hazard. Ultimately, a pain threshold will have to be crossed, when downside financial, economic and social stability risks outweigh de-risking efforts. Reports today suggesting officials may wait to the “last minute” to intervene raise the risk of a disorderly outcome.

Beijing is mobilizing resources. There are signs of increased government intervention. In the past twenty four hours nominally private Mainland media have featured quotes by “official sources” on a restructuring of Evergrande into subsidiary companies and regional property offices. Official state media featured editorials on wider property market reform, including the importance of the sector to the economy. Additionally, a number of banks announced they are working with local governments to “guarantee delivery” of pre-sale properties. Beijing is moving to backstop liabilities to households. The fate of offshore debt holders is less clear, we expect large haircuts. The next step to watch is central government confirmation of support for restructuring efforts.

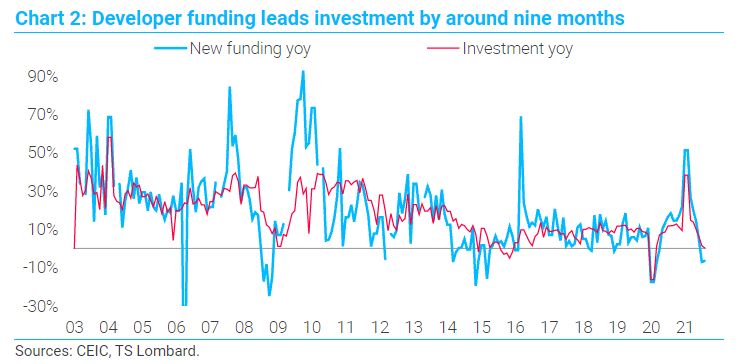

Evergrande is far from an isolated case; and even with a managed default, a slowdown in property investment is unavoidable. In China, developer funding leads property investment by around nine months. Since the announcement of the “three red lines” policy, we have been calling a property investment slump in H2/21. As Chart 1 shows, all avenues of funding have been under pressure since December 2020. Regardless of how Evergrande is resolved, funding will remain tight, while incentives for pre-sales, collateral for loans and yields on bonds must all increase. The other leading indicator of property investment – land sales (no new builds if there is no land) – has fallen consistently over the past six months. Taken together, a real estate investment slump is already baked in (chart 2 above). We expect property FAI to fall to record low growth rates of 2-5% yoy over the next nine months.

China growth downgrade. The direct growth impact from lower property investment, which accounts for 17% of GDP, is significant. Second-order effects via household confidence and wealth effect, lower land sales revenue for local government spending and less credit owing to higher bank NPLs all add to the downside. Taken together Evergrande disruption could lower 2022 GDP growth by 1-4 ppt, depending on the extent of government involvement in restructuring. We downgrade China growth from 8.5% yoy to 8.2% yoy in 2021 and from 5.5% yoy to 5.3% in 2022. Risks are to the downside.

Fiscal stimulus coming slowly. The July Politburo meeting explicitly called for accelerated local-government bond issuance and spending. We expect an increase in local government spending and infrastructure FAI in Q4/21. Policymakers’ frequent references to “cross-cycle management” suggest that Beijing is targeting stability in 2022 ahead of the Party Congress and that the real economic impact of fiscal spending will come in H1/22 rather than the remainder of this year. We expect the budget deficit as a share of GDP to fall back towards 5% over the next six months from 4% now as fiscal activity takes the strain of a weaker economy.

The PBoC is managing interbank rates and liquidity. The bank has set an implied TSF growth target of 11% yoy for H2/21. We do not expect a policy rate cut, but we think a 50 bps RRR reduction is likely by mid-November. And we also reckon that authorities will make greater use of OMO and targeted relending programs to smaller banks.

Property investment and wider growth deceleration is the likeliest channel for global contagion: onshore falling residential prices pose the largest risk to our outlook – not even an authoritarian government cannot force people to buy houses. A shift in sentiment and falling prices in tier 3 cities and below, which account for 70% of property sales by volume, would put the pre-sales model under much greater pressure and significantly increase the hit to consumption via the wealth effect. There are already signs of weakness in tier 3 cities: local authorities have begun to loosen purchase restrictions to provide support to the market.

Beijing’s tough stance, the sheer size of Evergrande, its hidden debt and the importance of property to the Chinese economy all mean that a misstep is possible – which would have grave consequences for China and global growth. The longer central authorities refrain from backstopping Evergrande’s pre-sales, the greater the probability of damage to the real economy and financial spill-overs.

This is only the beginning of the property sector crackdown. The shift towards “common prosperity” marks the start of change in China’s politic economic objectives. The Party is focused on delivering slower, sustainable and more equitable growth while lowering carbon emissions, upgrading manufacturing and tech and reducing financial risks. The disordered credit-intensive growth evident in the property sector runs counter to all major government objectives. In the past nine months, China has begun important reforms to property tax and land sales revenue collection and introduced strict regulation of urban development. The property sector share of China credit and growth is in terminal decline.

Client Login

Client Login Contact

Contact