There was little in the Feb CPI report to give the Fed comfort, and the rise in bank lending should be a cause for concern.

The “good news” in the Feb CPI report was some deceleration in inflation excluding food, energy, and rent. Goods excluding food and energy were up 0.4% in February, compared to 1% in January, 1.2% in December, 0.9% in November, and 1.1% in October. Services ex rent of shelter was up 0.4% in the month down from 0.9% in January. Good news for one month, not yet a trend.

To the issue of inflation spreading through the economy, the Fed had to find it troubling that the percent of CPI subcategories with three-month rates of change running ahead of their respective 12-month pace jumped up to 51% in February (see chart below).

Inflation of everyday items accelerated in February, thanks to food and energy, to a 17% annualized rate M/M and 10.4% 3M/3M (see chart below).

One could still stretch and make the case for transitory, including the current spike in energy prices. If the oil spike's transitory speed is too slow, then higher energy prices slow growth to some extent, and inflation always follows growth. Food and energy are 10% of household spending, down from 20% during the 1970s. Over time, the drop in relative spending for necessities freed up income for discretionary products and services – the price of which has shot up in the past year. Perhaps as consumers allocate more to food and energy, prices of “want to” items fall in order to sustain demand. Point is, prices rise, there is an income and substitution effect and, over time, a supply response to fill what's short.

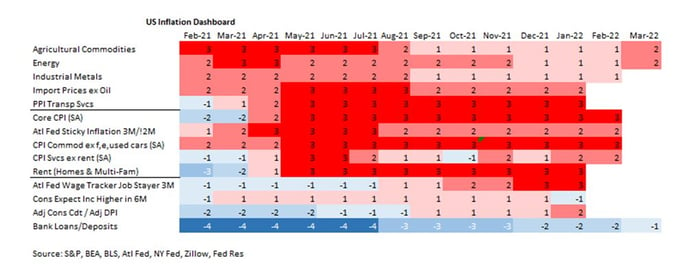

What should be troubling for the Fed is evident in our Dashboard below – the loan/deposit at banks is turning much less cold.

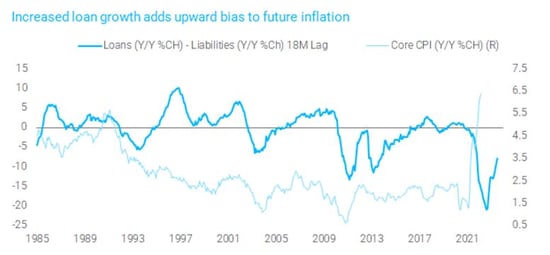

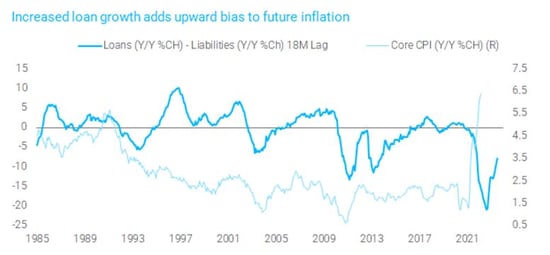

This upturn in bank lending is evident too in the chart below – inflation generally follows bank lending by about an 18-month lag (see chart below).

Inflation is a process that is financed. It was financed last year by massive Federal borrowing that re liquefied household and small business balance sheets and there was no cost – the Fed financed it. Going forward, the question is the extent to which private borrowing offsets the loss of fiscal transfers (it won't but then again it does not have to). As the Fed’s balance sheet begins to shrink, the reserves the Fed created are turned back to the banks, thereby unleashing high-powered money that can be lent. Banks do not have to lend the assets, they can swap returning reserves into T-bills or reverses, but HQLA is so high relative to assets that banks are more likely to lend – if the demand is there along with confidence in the outlook (see chart below).

The Fed, in its infinite wisdom, is trying to engineer a “soft landing” while inflation is far above target and, if successful, could be creating an environment ripe for accelerating demand for loanable funds, the supply is already here. Further, because of the size of the excess, deposits created by these loans will not return to the Fed as reserves. At some point, but the financial system is far from that point.

In the end, the Fed needs to accelerate its pace of tightening lest it allow a borrowing surge to take hold. Data show that lending has turned up. Problem is, the Fed is still reluctant to hike too fast to upset the equity market. Where is the Fed put? One could say around 3,800 on the S&P 500, based on pre-Covid ratios to GDP. But engineering a slower equity market is also a matter of maintaining an orderly market. In other words, a too fast pace would have the Fed stepping in before 3,800 – only a guess.

Client Login

Client Login Contact

Contact