Optimism: Mild US recession followed by a recovery and 2% inflation

18 Jul 2022 - Steven BlitzThe story of this cycle does not end when recession begins, the story, in fact, begins with the direction Fed policy takes once unemployment starts to rise. Recession of some sort was always inevitable to curb.

#Federal Reserve #Monetary Policy #Inflation #US EconomyThe year of the payback

20 Jun 2022 - Konstantinos VenetisThe markets remain caught in the pincer movement between a hawkish Fed and slowing world growth: 2022 is “payback year” following the outsized gains of 2021. Inflation looks like it is about to peak but at the same time.

#Federal Reserve #Monetary Policy #Inflation #China #OPECA recession to tame inflation?

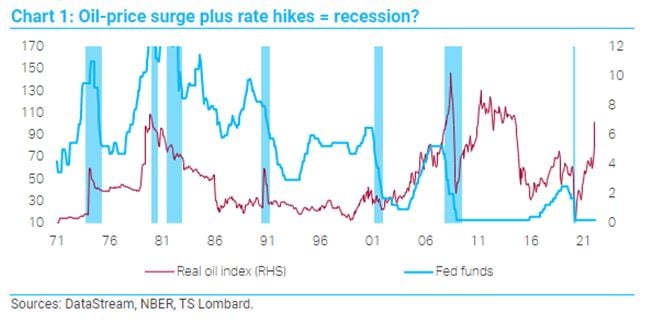

19 May 2022 - Dario PerkinsThere is currently a big debate about whether central banks will need to generate a recession in order to force inflation lower. For the doves, such action is not necessary – because the “cure for high prices is high.

#Central Banks #Inflation #Eurozone #RecessionFed funds target rate is >4%, if...

18 May 2022 - Steven BlitzThe shock of 2021, friction in global sourcing of capital and labour, brings back the output gap as a determinant of inflation and thus returns some slope to the Phillips Curve. This makes the “is inflation peaking”.

#Federal Reserve #Monetary Policy #Inflation #US EconomyThe cycle starts to bite

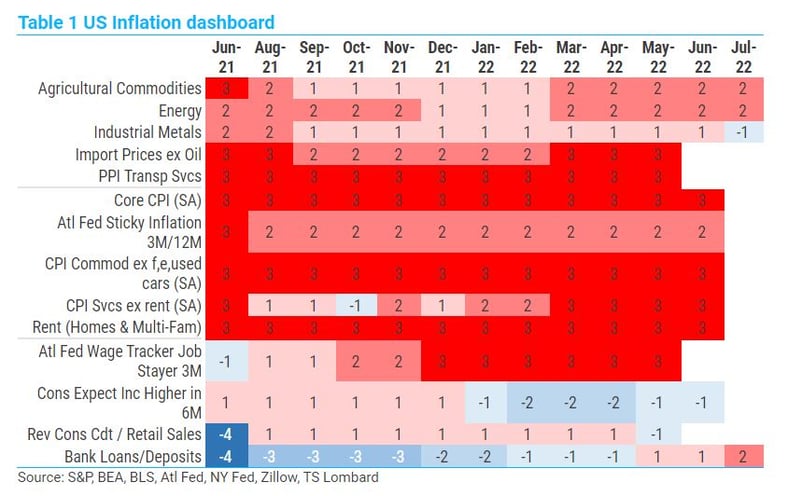

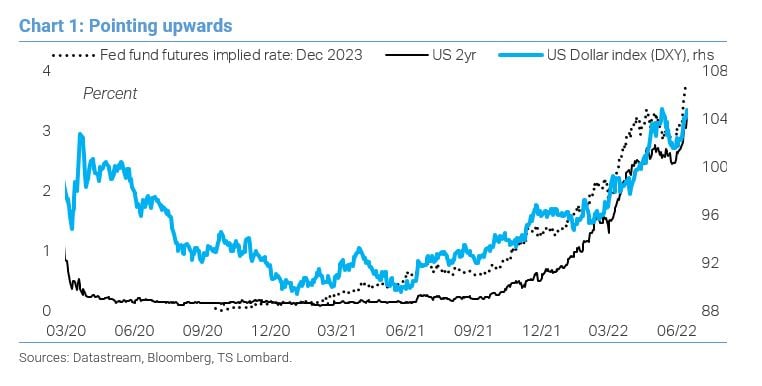

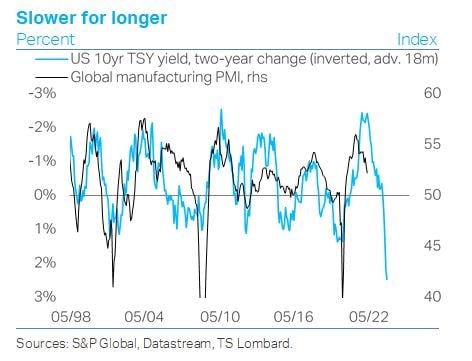

11 May 2022 - Konstantinos VenetisThe macro story of 2022 is “higher-for-longer inflation” that is forcing central bankers across the major DMs, led by the Fed, to tighten into slowing growth. Going into this year, a slew of high-frequency indicators.

#Federal Reserve #Inflation #China #Bond marketsQT's inflationary potential is real

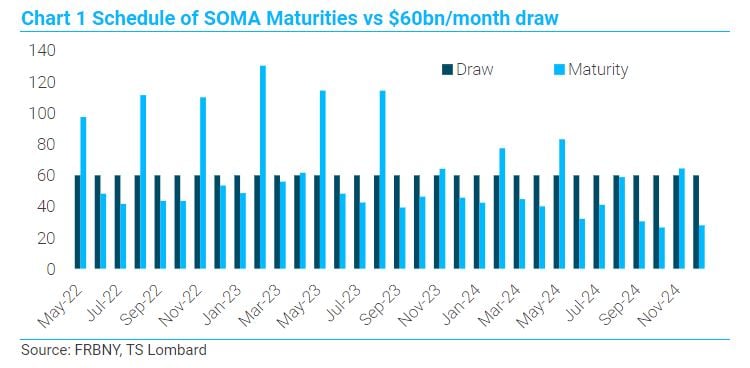

25 Apr 2022 - Steven BlitzMarkets will not truly consider the Fed serious about inflation until policy stresses markets by pulling up real yields to some critical level. The Fed turns serious once they recognize that deteriorating global.

#Federal Reserve #Monetary Policy #Inflation #US EconomyUS CPI - Where to from here is what matters, not the "peak"

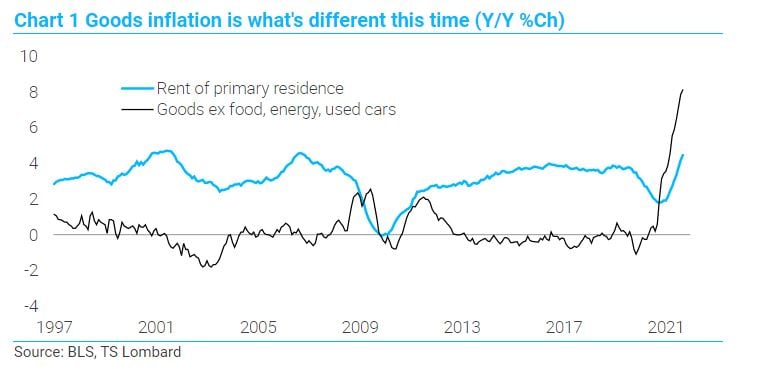

14 Apr 2022 - Steven BlitzMarch CPI data came in as expected, driven up by energy and a smattering of services – but goods prices ex food and energy fell 0.4% m/m, and this is key. The “secret sauce” of low core inflation for a generation has.

#Federal Reserve #Monetary Policy #Inflation #Recession #US EconomyFebruary CPI and bank lending starts to rise

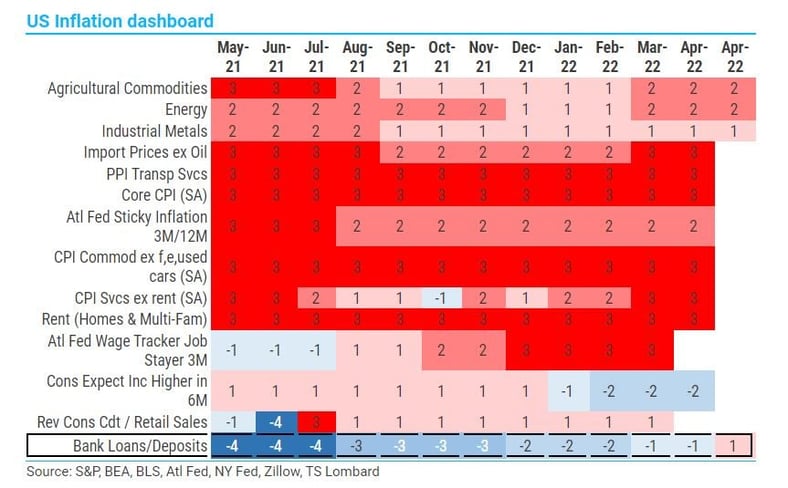

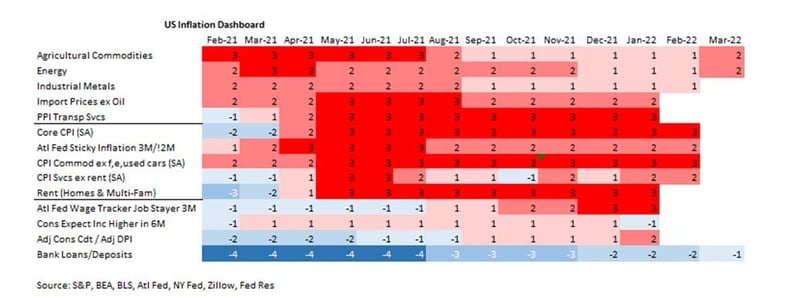

16 Mar 2022 - Steven BlitzThere was little in the Feb CPI report to give the Fed comfort, and the rise in bank lending should be a cause for concern. The “good news” in the Feb CPI report was some deceleration in inflation excluding food,.

#Federal Reserve #Inflation #US EconomyUS inflation to set a new course

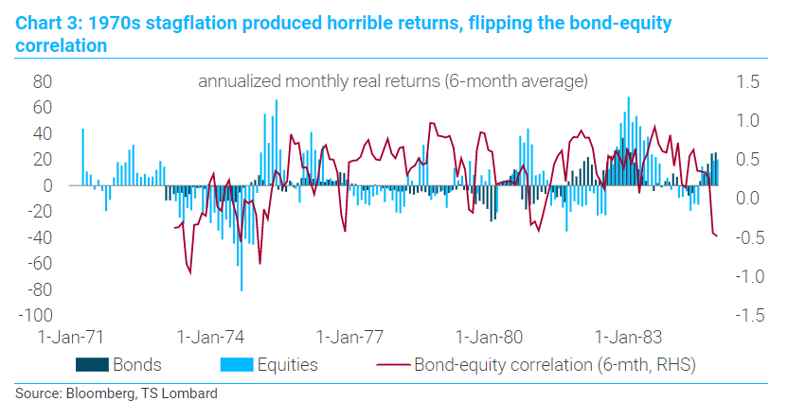

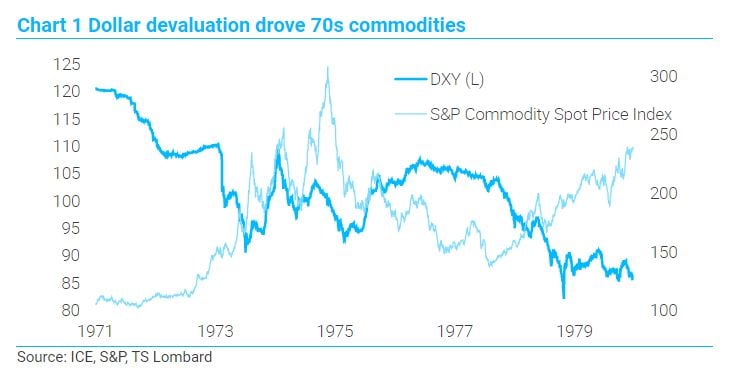

14 Mar 2022 - Steven BlitzThe historic analogue for current inflation does not lie in the 1970s, and the Fed’s on-again off-again response. Inflation in the 1960s eventually strained the Bretton Woods fixed-currency system to the point where it.

#Federal Reserve #Inflation #Commodities #StagflationDon't bet on a soft landing

10 Mar 2022 - Dario PerkinsEvery economist wants to be famous for some great idea they had or to have their name forever linked to an original economic concept or unique thought. We have Keynesian demand-management, Friedman’s monetarism,.

#Central Banks #Monetary Policy #Inflation #Eurozone #Recession Client Login

Client Login Contact

Contact