The equity market rallied on a hawkish communication because the FOMC’s rate projections mirrored 2017-18, indicating the return to a strong dollar policy (intentional or not). The FOMC has now shown its hand (broadly hinted at in and around Powell’s Jackson Hole speech) regarding its inflation tolerance – 2.2% by the end of next year is hot enough. Old habits die hard, but this habit of supporting an overvalued dollar boosts foreign earnings and suppresses domestic costs, good enough for the broader equity market. These Fed rate forecasts are remarkably poor and no more likely to become fact than a dart board result. This will be especially true with the coming turnover in FOMC membership (eight members, including regional bank presidents, in the next two years). Our point is that AIT served a purpose, but its promise is not ingrained in Fed decision making. After all, back in March the median projection was for no rate hikes through 2023 (the extent of the forecast) and what has changed since then is the arrival of “transitory” inflation.

We were expecting a soft announcement for tapering (tapering is coming soon, without details) and this is what we got. The drop in hiring due to the delta variant (noted in the statement “The sectors most adversely affected by the pandemic have improved in recent months, but the rise in COVID-19 cases has slowed their recovery”) was enough to scare enough dovish members of the FOMC, and Powell wants a unanimous vote to kick-off tapering. So, he punted for one more meeting –unless there is a sudden collapse in hiring, something the claims data do not suggest. Reading through Powell’s comments in the press conference, it seems to us that a November start date and a June finish means reducing the Fed’s takedown of Treasury securities by $10bn/month and of MBS by $5bn/month. Done by June. The need to taper now was never about the economic data per se, but about the supply/demand imbalance in the Treasury market – too much cash, too few securities.

To support the expansion of reserves on the Fed’s balance sheet, the Fed had to keep other short rates below IOER and the front end of the curve flat – AIT served that purpose. With the end of asset purchases, the need for a flat curve out to three years is finished and so the guessing game for scheduled rate hikes begins. The Fed is coming at this with an economic perspective is like ours – looking past the coming lull in activity, the real expansion takes hold in 2022, but starts out with a higher inflation rate and broad wages set to accelerate. There is no stagflation forming – the economy is naturally slowing as reopening moves into the rear-view mirror and the resulting pull down of inflation, already underway, occurs with a lag. Covid did not change this dynamic.

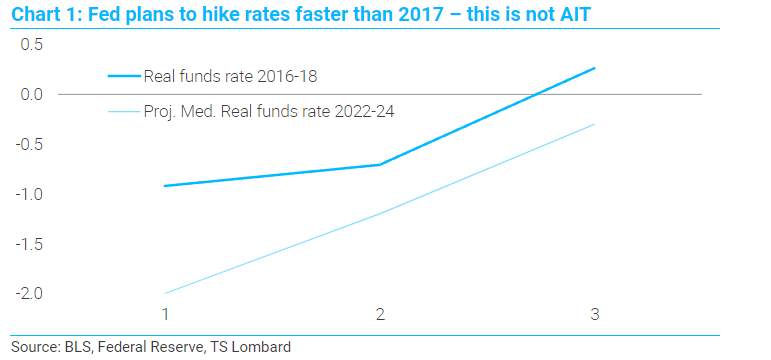

Nevertheless, current inflation levels have unnerved the FOMC’s resolve to run inflation hot (2.5%-3.0%) and this was telegraphed in and around the Jackson Hole speech by Powell and comments by others. Policy projections have consequently morphed into the “same old, same old” pace of tightening in 2022, 23, and 24. We are now up to a split in the FOMC on hikes next year (last November I forecast the first hike in Dec 2022) with 3 voting for two hikes. Everyone is on board, save one, for hikes in 2023, with 10 looking for the year-end funds rate to be 0.875% or higher (3 are at 1.625%). Just how similar their plan looks to 2017-18 actual results, in real terms, is illustrated in Chart 1.

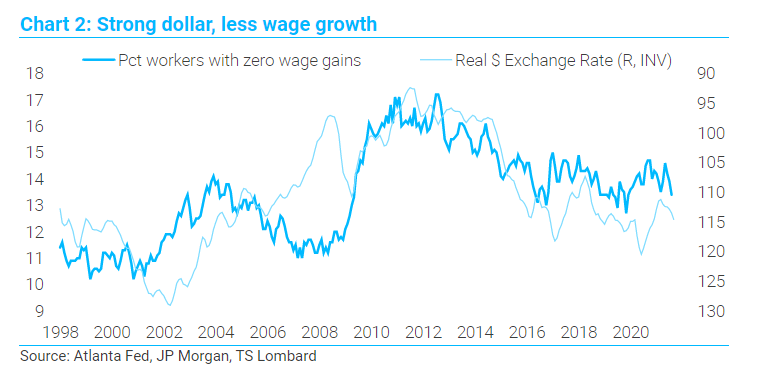

Supressing inflation by hiking rates faster than anyone else in the world comes by boosting the dollar, sustaining the trade deficit, and thereby holding down domestic labour costs. As noted above, this has proven to be a positive for the broad equity market, where foreign earnings are critical to overall revenues. One chart to show is the relation between the percentage of workers receiving no annual raise and versus the real value of the dollar base on CPI, as calculated by JPM.

All of which adds to my point that abandoning AIT’s promise returns an economic environment much like the one that ended – and the Fed is misreading the social tea leaves. The political climate, going back to 2016, tells us that the Fed’s view that this was a great economy because unemployment was so low is incorrect. The downward mobility of the middle is a core issue politically, and returning to a strong dollar policy, explicit or not, exacerbates the problem. This policy does, in fact, run counter what the Trump and Biden Administrations had and have been working to accomplish – resurrect domestic industry and support capital investment.

This projected aggressive pace of tightening in the coming years is still more outlook than fact, the economy’s performance likely veers from the expected outcome. The revelation of the same old, same old, mindset does, however, return to markets a well-known road map – long dollars, supportive of equities and, in the Treasury market, sell the 5-year against the wings. This remains in place until the unexpected arrives, which it always does. As for what the Fed actually does do, assuming the economic outcomes are as expected, that decision falls on the Chair, and I am working on presumption that Powell is appointed. The Fed does what the Chair wants, not the median forecast – and the crew making the current forecasts is going to be quite different by the time 2023 rolls around. It will be interesting to see who is nominated, the subsequent hearings, and who will be newly appointed as presidents of the regional Fed banks – and whether Yellen resets how the Administration sees the dollar’s value.

Client Login

Client Login Contact

Contact