Get ready for the super-charging of US-China decoupling

21 Apr 2022 - Grace FanNearly two months into the Russia-Ukraine war, US policymakers – troubled by Beijing’s pro-Kremlin rhetoric – are forging ahead with robust plans to accelerate US-China decoupling. Of the five major decoupling pathways.

#Equities #China #Technology #DecarbonomicsCovid: Omicron variant - first take

26 Nov 2021 - Andrea CicioneThese are our initial thoughts on the new Covid variant: We don’t know enough about the B.1.1.529 variant to draw any specific conclusions at this stage. We know that it has many mutations on the protein spike, which.

#Liquidity #Equities #Covid19 #Stock MarketFOMC: AIT over before it starts?

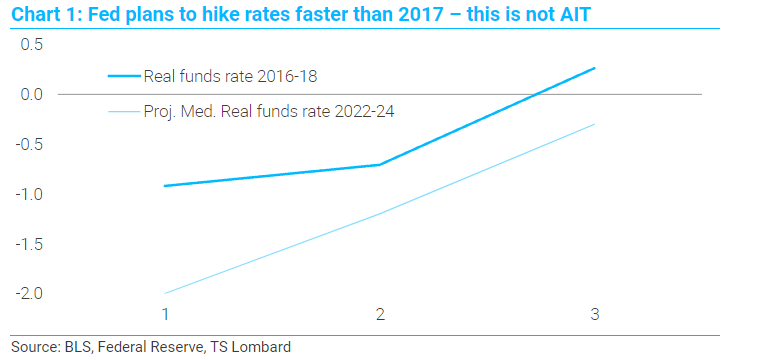

27 Sep 2021 - Steven BlitzThe equity market rallied on a hawkish communication because the FOMC’s rate projections mirrored 2017-18, indicating the return to a strong dollar policy (intentional or not). The FOMC has now shown its hand (broadly.

#Federal Reserve #Equities #US EconomyWhen the V starts to fade

17 Sep 2021 - Konstantinos VenetisThe looming threat to the global growth outlook posed by the Delta variant should not be conflated with what is a natural cyclical downshift in output growth – something that was always on the cards following the.

#Monetary Policy #Inflation #Equities #Stock Market #VolatilityThe Equity Market is now in charge

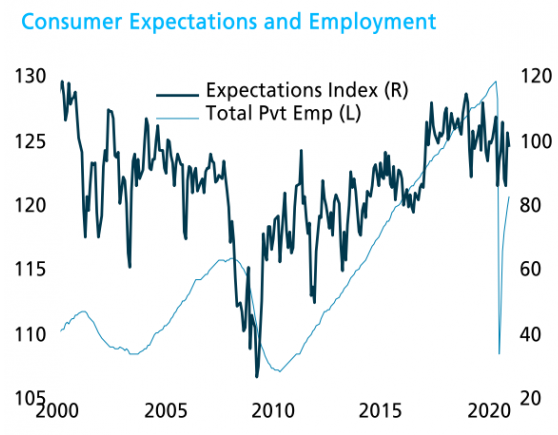

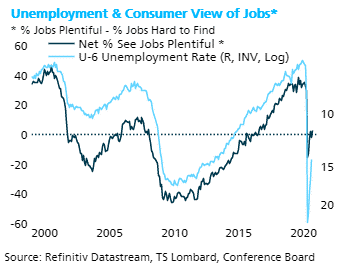

09 Nov 2020 - Steven BlitzBiden won, Trump lost, but lots of Republicans also won, and the October employment data help explain why – the population does not see the economy in crisis. The ongoing recovery in the labour market (906,000 private.

#Federal Reserve #Monetary Policy #Equities #Bond markets #US Economy #US ElectionPerma-frosts and fiery endgames

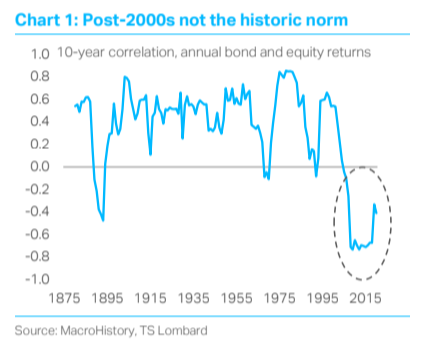

06 Nov 2020 - Dario PerkinsThe bond-equity correlation has gone mainstream in 2020, thanks in part to what happened in March when yields spiked even as equities crumbled (i.e. there was a POSITIVE correlation in returns). While this was.

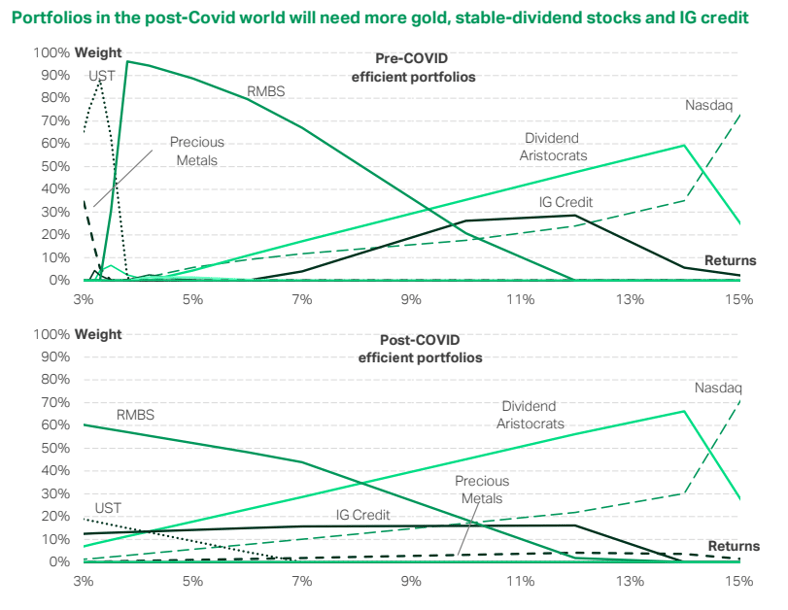

#Central Banks #Equities #Bond marketsPortfolios in the post-Covid world

16 Oct 2020 - Andrea CicioneIf the Global Financial Crisis ushered in the era of zero yields, the Covid pandemic has made it a semi-permanent affair. We have looked at how lower bond returns have changed asset allocation choices faced by.

#Equities #Stock Market #Asset Allocation #Gold #Commodities #Dividend AristocratsChina outperformance to continue

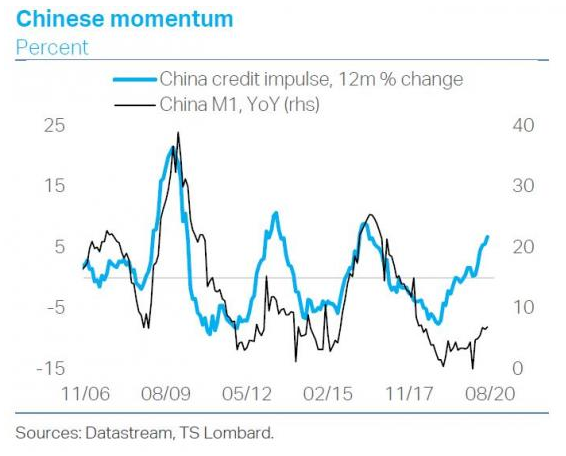

08 Oct 2020 - Lawrence BrainardEquites are volatile globally but China is a big outperformer. Looking at rising equity volatilities, we conclude that markets are not ignoring downside risks; the point is that right now, the upside potential and.

#Equities #China #Emerging Markets #MSCIWorld Trade momentum

06 Oct 2020 - Konstantinos VenetisMacro momentum is easing but remains positive. Our Global Leading Indicator remains consistent with improving macro momentum, in line with the message from other widely followed high-frequency series like the OECD.

#Equities #China #Bond markets #Commodities #USDConsumer Confidence Rebound Confounds the Economic Narrative

30 Sep 2020 - Steven BlitzThe rebound in consumer confidence is just one more indication that the usual narrative from high unemployment fails. To be sure, the confidence levels from the summer still project a loss for Trump (as it would for any.

#Equities #Recession #US Economy #Unemployment #Labour Market Client Login

Client Login Contact

Contact