There are two questions that the current debate on the commodity cycle tends to conflate. Does the rally that kicked off in spring 2020 have further to go? And are we in the early stages of a so-called “supercycle”, i.e., a strong multiyear upswing in the price of key commodities?

The narrowing of the wide divergence between gold (up) and other major commodities (down) that developed in 2020 Q1 is now largely complete, marking the transition from an Asia-centric, uneven global recovery to a broader synchronized cyclical upswing. The CRB-to-gold ratio is up by around 50% since its summer trough but could carry on rising as the major advanced economies reopen, i.e., the upward drift in Treasury yields could keep gold in check while industrial commodities continue their advance as a greater share of global liquidity makes its way from financial assets to the real economy.

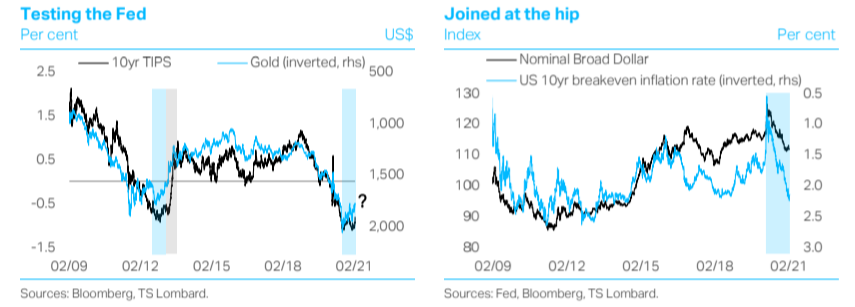

Gold has trended lower over the last six months, however; and given its historical tendency to lead moves in other commodities, it is worth thinking about whether this is likely to prove a temporary correction or the prelude to a longer descent, like the one that started in September 2011, gathered pace in 2012 Q4 and did not reverse until late 2015. For clues to the answer, we focus on US interest rates, inflation breakevens, the dollar and Fed policy. Looking at the charts, one cannot help noticing that the period since gold’s top in August 2020 is reminiscent of 2012, when gold’s retreat following a period of strong gains foreshadowed the trough in real Treasury yields. With the 10yr TIPS yield forming a double bottom earlier this month, a repeat of history would imply that the next big move is “yields up, gold down”, raising a yellow flag for commodity prices more broadly.

Not so fast. Back in 2013, the turnaround in Treasuries was turbocharged by remarks from Ben Bernanke about a possible reduction in the pace of the Fed’s asset purchases. Long real yields rallied hard in 2013 Q2/Q3 and stayed elevated (and positive) until 2014 Q1, weighing on gold and capping gains in most other commodities. The dollar bull run then gathered pace in mid-2014, starting from relatively cheap levels. This kept gold on the back foot for another year-and-a-half even as real yields stayed range-bound; and it took a progressively heavier toll on oil and copper prices. Another feature of this period was falling breakeven inflation rates, which underscored their tight correlation with industrial commodities.

Lessons have been learned, and Jay Powell’s Fed has made clear that it will take great pains to prevent another “taper tantrum”. If (and this is a big “if”) the Fed manages to engineer a smooth normalization in Treasury yields, commodities are unlikely to be hampered by a sharp recalibration in interest rates. To be sure, as reflationary forces gather pace, the Fed’s resolve to remain laser-focused on employment, stay reactive on inflation and allow the economy to run hot will be tested, making things increasingly difficult from a communications standpoint. But it is also hard to see the FOMC diverging materially from its ultra-dovish guidance, buttressed by the new “flexible average inflation-targeting” regime anytime soon. The longer the Fed sticks to its guns, the more likely it is that its next policy mistake will be the opposite of the one it made in 2018, i.e., staying too loose for too long, instead of tightening prematurely. Moves in gold are likely to provide an early signal again, as they did back then. The Fed’s stance implies there is scope for inflation expectations to stay elevated and rise further; and for the dollar, which remains above its long-term average, to stay under pressure.

All these are the ingredients of a commodity upcycle, nurtured by expectations of a new economic recovery and policymakers guarding against the risk of winding back stimulus prematurely. Higher physical demand is likely to be complemented by rising investor demand against a backdrop of depressed interest rates and a soft dollar. This is about not just speculative flows but real money looking to reallocate away from the 60/40 model into real assets. Markets look forward, of course, and have already started to price in this positive outlook, so a period of consolidation is likely in the not too distant future – especially if China’s stimulus taper starts to bite going into 2021 H2. But there is nothing to suggest that this commodity cycle is about to turn – quite the contrary.

Whether this is a ‘supercycle’ is largely about semantics. A supercycle is typically demand-driven and characterized by a structural theme, e.g., China’s urbanization push in the 2000s. Besides soaring demand, the hallmarks of that cycle were tight fundamental balances in both oil and copper; lengthy dollar depreciation; and commodities outpacing equities. The most obvious candidate theme to drive the next supercycle is decarbonization, which points to industrial metals as the new epicentre of upward price pressures. The potential is there, but this is still too early to call. Expectations – both on accelerated “green” spending and prolonged dollar weakness – need to start materializing; and commodities need to break their long-term downtrend relative to stocks. So far, this commodity cycle resembles those of 2009-11 and 2016-18, i.e., “normal” cycles marked by a stimulus-sponsored rebound in growth and inflation expectations.

Client Login

Client Login Contact

Contact