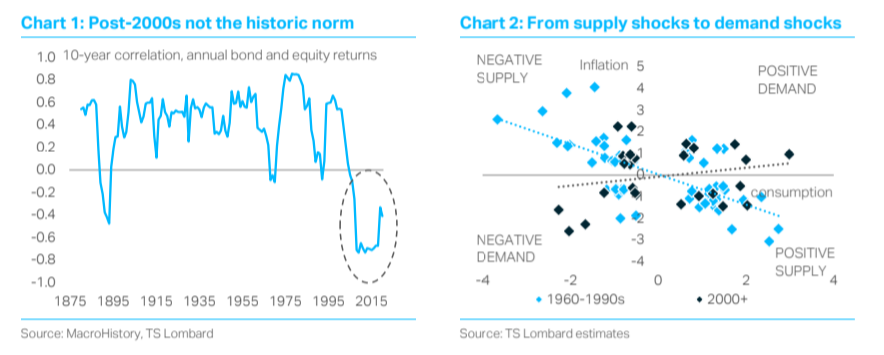

The bond-equity correlation has gone mainstream in 2020, thanks in part to what happened in March when yields spiked even as equities crumbled (i.e. there was a POSITIVE correlation in returns). While this was temporary, the idea bonds might no longer provide sufficient insurance for stock-market exposure is now a widespread concern among clients. Meanwhile, sellside analysts have been lining up to declare the death of the 60-40 portfolio (a possibility we raised in February). When you look at the history of the relationship between bonds and equities, it is easy to understand where these worries are coming from. The negative correlation of the post-2000 era is the exception, rather than the rule. Over time, the relationship has been positive more often than it has been negative, but it is also prone to sudden “breaks”. What determines these interactions and how might they evolve in the 2020s?

Both bond and equity returns have trended higher over the last two decades. Any good statistician knows you have to remove this trend to understand the relationship between these markets at higher frequencies. When we do this, we reveal the negative correlation that has provided the bedrock of modern portfolio theory. Bonds gain when equities lose, which is what gives fixed income its “insurance” properties. This also explains why the term premium has trended lower over time and is now negative – you don’t need to blame central bank QE, rather this is the insurance premium investors are prepared to pay. Until recently, there wasn’t a great deal of research about the bond-equity correlation. Economists assumed the correlation was mostly positive, except during periods of acute panic (the 87 crash, LTCM etc) and didn’t realise it could flip to persistently negative. But the last decade has bought a flurry of research papers in this area, with some important analytical breakthroughs – especially during the last 5 years.

The latest research highlights two underlying macro drivers of the bond-equity correlation: (i) the cyclicality of inflation, which depends on the relative influence of demand and supply shocks, and (ii) the credibility of monetary policy. Inflation was generally countercyclical until the 2000s, but it flipped to becoming pro-cyclical thereafter, the mirror image of the bond-equity link. We had a long sequence of supply shocks, first negative – OPEC oil spikes, a decline in productivity, trade union militancy – followed by a series of positive supply shocks – the collapse of worker power, globalization and the emergence of China. But demand shocks have been more important in the last 20 years, especially various asset-price bubbles. Of course, central banks also like to take credit for the shift in the correlation, since they believe active demand management is only possible if they anchor inflation expectations. According to the Keynesian Phillips curve, pro-cyclical inflation is impossible unless price expectations are locked down. While the authorities tend to exaggerate their role, good policy has interacted with good luck.

The latest research highlights two underlying macro drivers of the bond-equity correlation: (i) the cyclicality of inflation, which depends on the relative influence of demand and supply shocks, and (ii) the credibility of monetary policy. Inflation was generally countercyclical until the 2000s, but it flipped to becoming pro-cyclical thereafter, the mirror image of the bond-equity link. We had a long sequence of supply shocks, first negative – OPEC oil spikes, a decline in productivity, trade union militancy – followed by a series of positive supply shocks – the collapse of worker power, globalization and the emergence of China. But demand shocks have been more important in the last 20 years, especially various asset-price bubbles. Of course, central banks also like to take credit for the shift in the correlation, since they believe active demand management is only possible if they anchor inflation expectations. According to the Keynesian Phillips curve, pro-cyclical inflation is impossible unless price expectations are locked down. While the authorities tend to exaggerate their role, good policy has interacted with good luck.

How could these relationships change in the 2020s? Right now, many investors are thinking about what might happen in a “permazero” macro environment. Implicitly, this is a world where central banks are already losing credibility because investors are assuming even persistent zero interest rates will not be sufficient to reflate the world economy. And if the nominal interest rate is stuck at its lower bound, there is a limit to how much lower bond yields can go. Central banks will not be able to stimulate demand sufficiently, let alone respond to future shocks. So the permazero world is one in which the bond-equity correlation should converge on zero, which means fixed income markets are less useful as part of a 60-40 portfolio. COVID-19 has left a huge disinflationary hole in the world economy, which means the permazero environment is likely to remain the dominant macro regime for the next 18 months. Our strategy team has looked at what this means for asset allocation, arguing that investors should replace fixed-income securities with defensive (especially high dividend) stocks, IG credit and commodities.

While the prospect of permazero rates dominates the short-term outlook, history suggests we can’t rule out a more radical financial regime in the longer term. This would be the “fire scenario”, in which the bond-equity correlation flips back to positive territory. Our analysis of the underlying macro drivers of this relationship can tell us what sort of macro environment is required to produce this outcome. First, we would need supply shocks to become more important relative to demand shocks, which would make inflation persistently countercyclical again. Second, any loss of monetary independence would compound this move. Imagine the 2020s dominated by post-COVID disruption, climate change and deglobalization, where macro policy goes “full MMT” and you have the perfect fiery endgame. After all, there have been two main episodes in the past where the correlation between bonds and equities flipped from negative to positive, (i) the end of the Long Depression in the late 1800s (think deglobalization, populism, the first socialist parties and the start of trade-union power), and (ii) the 1970s (a policy framework MMT inadvertently wants to recreate). Both have lessons for the situation we might eventually face in the 2020s.

Read more blogs by Dario Perkins, Managing Director, Global Macro

Client Login

Client Login Contact

Contact